More than a year and a half after its arrival, fintech Jeeves is entering a new expansion phase, with Brazil at the forefront of its priorities.

Backed by major investors such as Tencent, Andreessen Horowitz, Y Combinator, CRV, and GIC, U.S. Fintech entered the South American market to compete in the local market for payment solutions and corporate expense management.

To achieve this, the fintech plans to ‘expand its tentacles’ beyond its most well-known product: cards.

“Our main focus is to accelerate our traction in Brazil by 2024,” said Jeeves’ General Manager for Brazil and Latin America, Brian Siu, in an exclusive interview with Startups.

The new stage is called ‘Jeeves 2.0’ by the fintech itself. According to the executive, it will bring new features crucial for the company’s current customer base, which mainly consists of medium and large enterprises.

“These are companies that have operations in other countries or constantly deal with the need to make transactions with clients or suppliers abroad,” Siu emphasizes.

To achieve this, the new phase involves implementing layers of management and banking functionalities, all from a cross-border perspective, which, according to the CEO, many local fintechs still need to address, and most companies continue to rely on the traditional banking system.

In addition to payments, Jeeves plans to offer the ability to view accounts from different countries in one place through its platform.

“Your company may have an account at Itaú in Brazil and another at Itaú in Miami, but they are different logins. We want to centralize this,” explains the executive.

“Nearshoring and how companies do business today make this solution an important part of their financial processes. Being able to pay suppliers in other countries, in the local currency with a preferential rate, and in less than 24 hours, positions us as leaders in the segment,” Brian asserts.

Although the immediate focus is on the external needs of customers, Brian emphasized that Jeeves is also moving to meet internal demands, including account features and payments through TED, DOC, and Pix.

According to them, these features are in the sights of other foreign players like the Mexican Clara and are essential to compete with native fintechs like Conta Simples or Portão3.

“We want to make the product even more localized. To be a complete solution in Brazil, it must offer Pix, boleto, TED, and DOC. We want to launch all of this in the first quarter of 2024,” reveals Siu.

For this, the company plans to become a regulated entity by the Central Bank. Globally, Jeeves is present in 24 countries and serves approximately 3,000 clients.

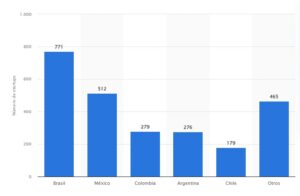

In Latin America, its primary market is Mexico, which it entered in 2021. It has captured a significant portion of the market there, even going head-to-head with local fintechs like Clara.

“Mexico is our main market, but our focus is to put Brazil first, or as close as possible, and we are allocating more resources to grow here,” expresses Brian.

According to the executive, resources will be intensified in the team area, both in product and development, further adapting Jeeves’ solutions.

In 2021, when it arrived in Brazil, the startup had just become a unicorn by raising a Series C round of USD$180 million, led by Tencent. In total, the company has already received over USD$380 million in investments.

With the start of this new stage, the new features, and the arrival of new sources of income, the expectation is to increase revenue with a mix of credit and customer deposit income.