Contxto – With Mexico and Chile as recent case studies, crowdfunding regulations may soon be coming to Peru. This will likely present a new landscape for fintech startups to navigate.

In Summary

In May, president of the Ministry Council Salvador del Solar announced a Congressional bill aiming to regulate crowdfunding, or in other words, participatory financing systems.

Behind this legislation was support from the Superintendency of Banking, Insurance and AFP (SBS), the Superintendence of the Securities Market (SMV), the Central Reserve Bank of Peru (BCRP) and the Ministry of Economy and Finance (MEF).

For better or worse, it would be a milestone if the bill passes. Only Peruvian companies will be able to administer fintech platforms based on the stipulations. Furthermore, fintechs and crowdfunding platforms will need to receive authorization by the SMV.

These terms are to provide certainty to investors and protection to consumers. Ultimately, SMV would also establish minimum capital requirements and require further financial cooperation with the SBS.

This milestone would certainly affect Peruvian fintech and crowdfunding startups in terms of oversight and secondary legislation.

In-Depth

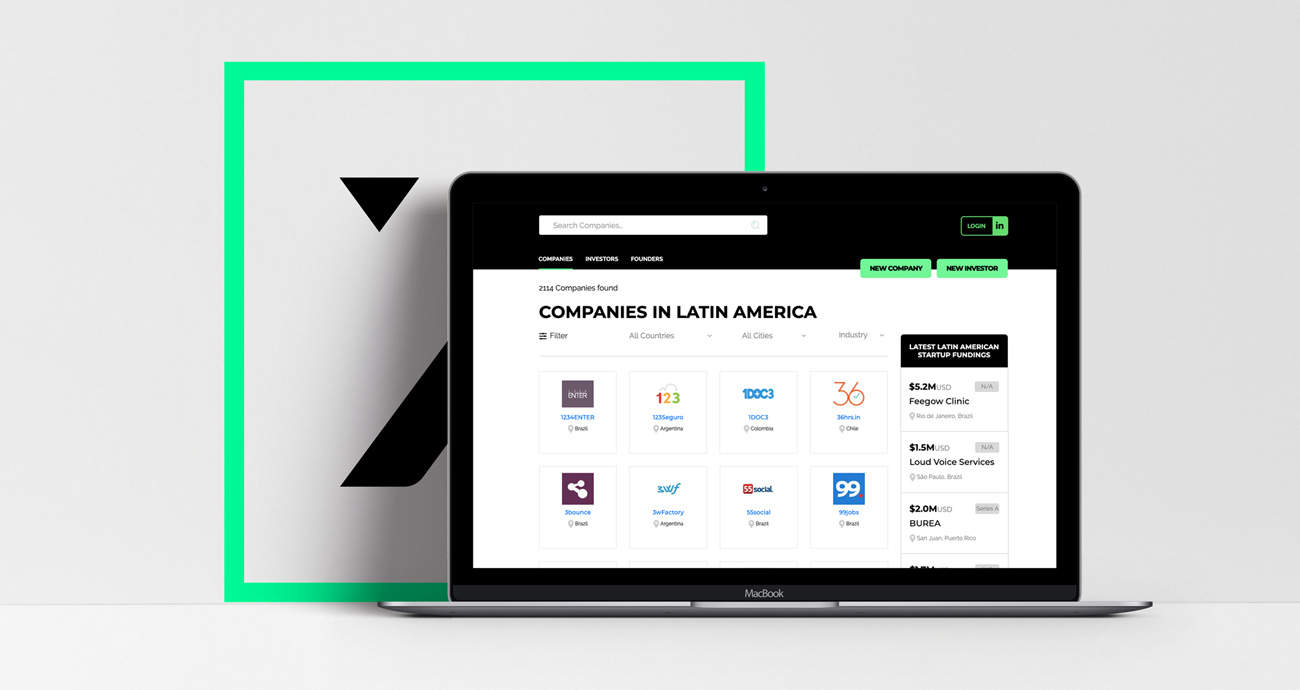

Fintech is still developing in Peru but could potentially be the fintech hub of the Andean region, according to Andres Fontao, co-founder and managing partner of Finnovista.

“We’ve seen strong talent with a mix of technology and industry know-how, and interest from incumbents in collaborating with fintechs,” said Fontao.

In November of last year, Finnovista ranked Peru sixth in the Latin American fintech ecosystem. Ahead were Brazil, Mexico, Colombia, Argentina, and Chile, in this order.

Recently, FinTech Peru released a report asserting that there are currently 130 fintechs in Peru. As a result, these showed signs of maturity within the emerging fintech sector. Accordingly, they represent the following five major business segments:

Payments and remittances (24 percent), alternative financing (20 percent), foreign exchange operations (19 percent), enterprise financial management (9.2 percent), and personal financial management (5.4 percent).

From the same report, there were five crowdfunding platforms in the Peruvian ecosystem. This number will likely increase if the law passes.

Moreover, Peru’s growing fintech sector created over 1,700 jobs between 2016 and 2018. Fintech Peru also shared that people between 20 and 39-years-old held 40 percent of managerial positions. Likewise, women secured 30 percent of management jobs in the industry.

Peruvian development bank Cofide is also reportedly planning to create a seed capital fund worth US$20 million to support fintech creation and growth.

Fintech and crowdfunding policies have been a work in progress in Peru. For example, Lourdes Alcorta Suerto of the Fuerza Popular party has previously advocated for similar measures.

According to her, fintech regulations should be “national priority and of national interest” for Peru. While she says they offer “considerable benefits,” regulations are to reportedly ensure user protection.

Fintech standouts

Kambista is one of Peru’s most successful fintech startups with its U.S. dollars and Peruvian soles currency exchange. Popular among everyday people and SMEs alike, the fintech became Peru’s first digital exchange letting users covert money over mobile devices in 2017.

It has reportedly exchanged a total of US$200 million and made over 100,000 transactions since its founding.

Last month, U.S.money platform for the “Catholic” economy, Cathio, partnered with Kambista to leverage its payment processing technologies in other countries. According to the terms, Cathio will create and experiment with a remittance pilot program alongside Kambista.

Lima Fintech Forum 2019 also happened from May 8 to 9. Professionals from the banking, insurance, regulatory and cybersecurity industries came together to discuss ways to incorporate fintech into their respective markets.

-JA