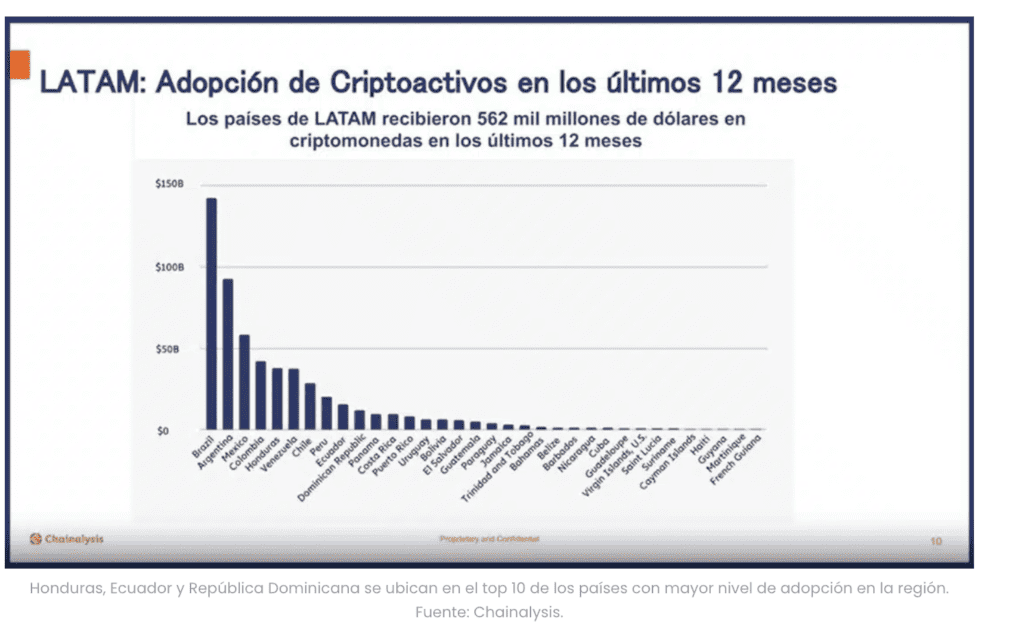

Since the emergence of Bitcoin in 2008, the world of cryptocurrencies has been constantly evolving. Latin America has begun to experience its own “digital gold rush”, reflected in a 40% increase in cryptocurrency investments between July 2021 and June 2022, reaching an amount of USD $562 billion, according to the Latin American and Caribbean Economic System (SELA), as stated here.

Countries like El Salvador have adopted Bitcoin as legal tender, while Mexico is exploring ways to do the same. But to better understand this phenomenon, it’s essential to analyze the context in which these digital currencies emerge. For example, Dogecoin, created in 2013 by Billy Markus and Jackson Palmer as a parody, has gained ground and media attention, opening a window to the universe of cryptocurrencies in the region.

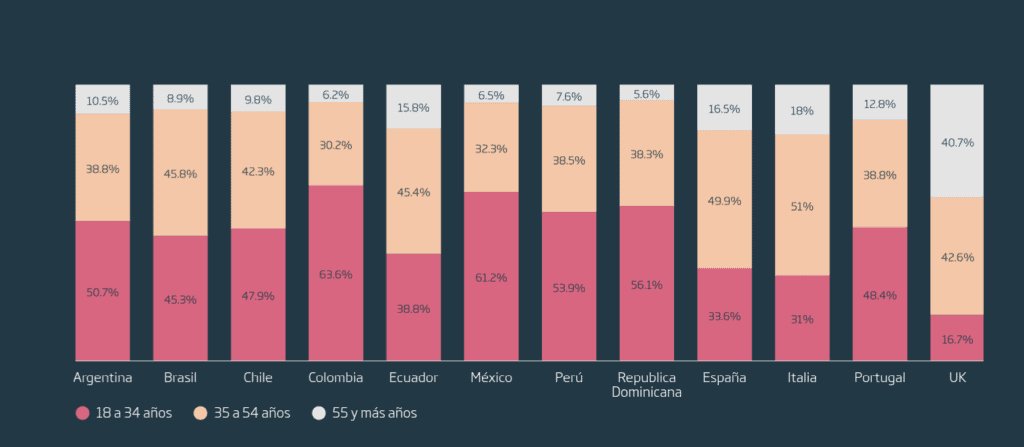

The situation in Latin America is unique because the adoption of cryptocurrencies is driven by a combination of factors: the search for alternative savings options, the need for more efficient remittance sending, and, in some cases, speculative investment. According to data from Minsait Payments, nearly half of the banked Latin Americans are willing to buy Bitcoin and make payments with cryptocurrencies.

The Key Players and Regional Dynamics

Within this [emerging scenario](https://www.criptonoticias.com/comunidad/adopcion/estos-son-10-paises-latinoamerica-mayor-adopcion-criptomonedas/), countries like Brazil and Argentina are taking the lead. Brazil has received investments of more than USD $150 billion in cryptocurrencies, while Argentina has accumulated more than USD $100 billion. Other countries like Colombia, Venezuela, Chile, and Peru are also recording a significant increase in cryptocurrency adoption.

But there are significant contrasts in the way each country approaches this phenomenon. El Salvador, for example, has taken a bold approach by adopting Bitcoin as legal tender. This decision has been controversial and has generated mixed reactions in terms of adoption and financial stability. Meanwhile, in Mexico, Senator Indira Kempis has proposed a similar initiative but has not made significant progress in the Senate.

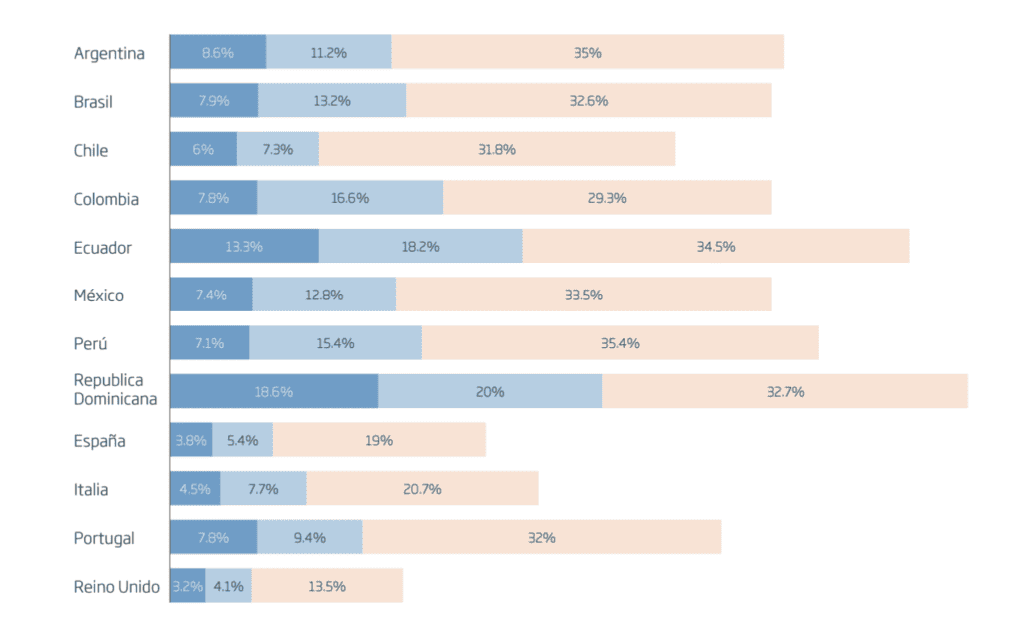

Bitcoin’s dominance is notable throughout the region. According to data from Statista and Finder, in countries like Mexico, Bitcoin accounts for 22.8% of use. This suggests that, while there is growing interest and knowledge about cryptocurrencies, a more sophisticated financial culture is still needed for safer and more widespread adoption. Additionally, the lack of regulation and the need for robust security infrastructures are barriers to mass adoption.

Challenges and Opportunities: The Future of the Crypto Market in LatAm

The future of cryptocurrencies in Latin America is promising but uncertain. While companies like Bitso in Mexico, Mercado Bitcoin in Brazil, and Ripio in Argentina are advancing rapidly in the digital currency exchange sector, there are still significant obstacles.

The first and most obvious challenge is the need for a regulatory framework. Currently, the use of cryptocurrencies in the region is largely unregulated territory, which generates distrust among investors and jeopardizes widespread adoption. Companies and regulators will need to work together to develop policies that foster a secure and reliable ecosystem for cryptocurrency transactions.

The second challenge is educational. Many Latin Americans still lack basic knowledge about what cryptocurrencies are, how they work, and how they can be used safely. Training and financial education will play a crucial role in helping the general public understand and adopt this emerging form of digital economy.

In terms of opportunities, cryptocurrency adoption offers several tangible benefits. In countries with high inflation, such as Venezuela and Argentina, cryptocurrencies can function as a safe haven to preserve the value of money. They also offer a more efficient and less expensive alternative for remittance sending, a crucial aspect for many Latin Americans who depend on these financial flows.

The cryptocurrency market in Latin America is in a stage of rapid growth and evolution. The opportunities are vast, but the challenges are equally significant. The development of regulatory frameworks and financial education will be key factors in determining how cryptocurrencies are adopted and used in the region in the coming years.