Certainly! Below is the translated text, maintaining the WordPress code:

Gianmarco Scarsi has extensive knowledge and experience in the insurance sector. In 2016, he established an insurance brokerage and a consulting firm specialized in cargo insurance in Peru. It was this background that allowed him to identify a prevalent problem and address it with an innovative solution: the development of the first Minimum Viable Product (MVP), consisting of an e-commerce platform designed to facilitate automatic cargo insurance for small and medium-sized enterprises in Peru. This is how Zuru Latam was born: the first insurtech in Latin America with a clear objective to offer protection of goods in transit and logistical risks for SMEs.

The problem arises due to the nonexistent access to innovative insurance solutions for SMEs, resulting in 80% of goods being underinsured or not insured, according to The Logistic World.

“Zuru Latam arises to solve this problem by offering innovative and technological solutions that insure cargoes automatically, especially for SMEs in Peru and Mexico, backed by top-level insurers and reinsurers: Chubb, HDI Global, Lampe & Schwartze,” explains Scarsi, the company’s CEO, to Contxto.

Zuru Latam Technology

Zuru Latam has created a digital platform using Genexus, a low-code platform powered by artificial intelligence. Zuru’s technology is offered through two business divisions; one for SMEs and one for logistics intermediaries (freight agencies, customs agencies, carriers).

The platform for SMEs is an e-commerce site that allows the client to quote and acquire cargo insurance policies by shipment (on-demand) in minutes. Due to the platform’s connection with insurers, it can offer a competitive premium in the market, as it doesn’t maintain the high operating costs that are passed on when the sale is made in a traditional manner.

On the other hand, its platform for logistics intermediaries allows this type of client to distribute and sell cargo insurance to their entire client portfolio, enabling a new revenue line for each policy sold. Thus, “The proposal is unique as it minimizes operating expenses and offers very competitive premiums, thanks to its direct connection with insurers,” explains Gianmarco Scarsi.

Market and Customers

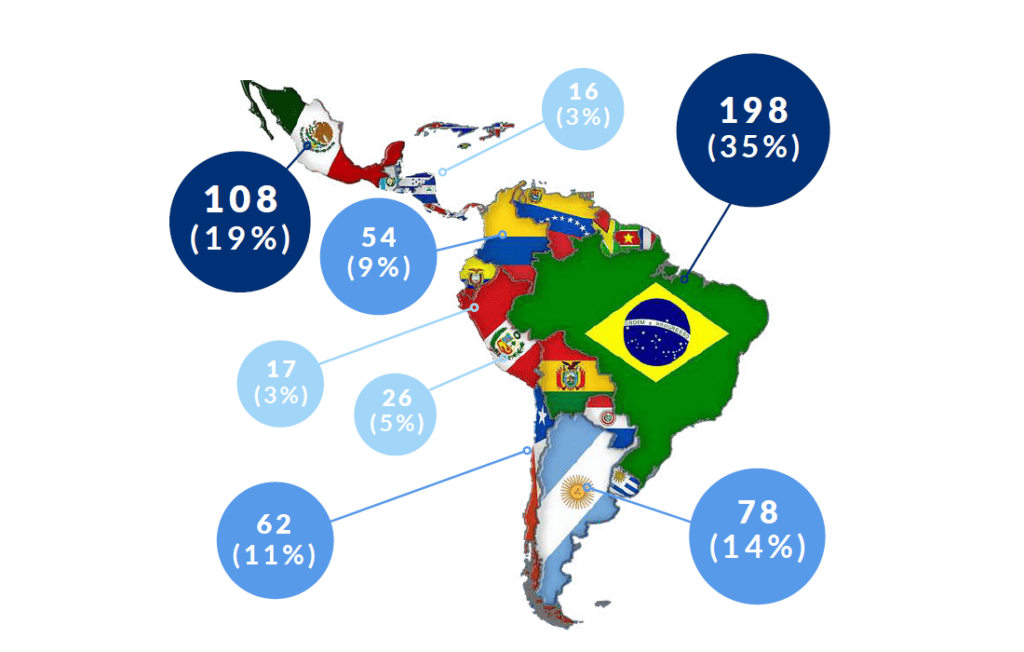

According to the study Latam Insurtech Journey, updated in July of 23 and prepared by Digital Insurance Latam, there are currently 470 insurtechs in Latin America, which represent 7% of the global insurtech ecosystem, but still only account for 2% of total funding. In the first quarter of 2023, only USD $99 million was invested, representing an increase of 178% compared to the last semester of 2022.

In a boiling market, Zuru Latam aims primarily at SMEs and logistics intermediaries, providing solutions tailored to their needs and offering experience, support, and efficiency in technology. The backing of multinational insurance companies and significant penetration in the logistics segment have allowed them to position themselves as a vital digital distribution channel in the region.

The success of Zuru Latam lies in enabling SMEs to acquire “on-demand” logistics insurance, meanwhile reducing by an average of 30%, the operating expenses of insurers in the distribution of the product, thanks to the connections via API with Zuru’s platform.

Expansion Strategy

Zuru Latam has experienced notable growth, especially in Mexico, representing 40% of the revenues, in less than a year and a half since the start of its operations. The company plans to expand in the most important logistics hubs in Mexico, such as Guadalajara and Monterrey, taking advantage of the “momentum” generated by significant investments through “nearshoring.” Additionally, it contemplates future strategic alliances and collaborations with startups: fintech, logtech, TMS, among others, to offer 360 solutions and meet US-MX cross-border needs.

In 2022, they managed to structure their pre-seed round with a valuation of USD$ 4.5 million pre-money and a capture of USD$ 680 thousand dollars, currently, they have launched a new seed round with the aim of accelerating growth in Mexico.

In the short term, they will focus on growth in the Mexican market and offering new products in Peru. In the medium term, they will seek to consolidate in Mexico and expand in Latam through regional clients. In the long term, they aspire to enter the Latin market in the United States, become the reference insurtech of Latam and evolve to an insurance subscription agency (MGA), using artificial intelligence for underwriting based on on-demand shipment data.

Zuru Latam is an example of innovation and adaptation in the insurtech sector, combining advanced technology, solid market strategies, and strategic alliances to solve specific problems and create tangible value for its clients and investors. “The company is not only redefining access and distribution of cargo insurance, but it is also paving the way towards a safer and more efficient future for SMEs and the logistics industry in the Latin America region,” concludes Scarsi.