[wd_hustle id=”InArticleOptin” type=”embedded”/]

Contxto – You know, I’ve been trying to think of an analogy for what I think the Cornershop situation looks like and, I must admit, I have been unable to. When it comes to describing something as absurd as what has been going on, I’m left speechless.

For those of you who haven’t been following every detail of the Cornershop saga, I recommend you read these three articles here:

- Mexican authorities halt Walmart from acquiring Cornershop, developments follow

- Uber to purchase majority stake in Cornershop

- Cornershop’s struggle with Uber acquisition: What’s actually happening

But, hey, here’s a small recap nevertheless:

Cornershop—the Chilean/Mexican delivery startup—is finding itself in a pretty frustrating situation.

Last April, the company announced that it was going to be acquired by Walmart. “Hurray!”, we all thought. But celebrations were cut short six months later after we found out Mexico’s anti-monopoly agency, Cofece, scrapped the deal.

Surprisingly enough, I must admit, these founders dusted themselves off, got to work and, once again, found a pretty decent buyer.

In fact, the new purchaser, Uber, was allegedly going to pay at least four times Walmart’s valuation. Not even Anakin-turned-Vader made for such a badass comeback.

The Hero’s Journey?

As in any good story, there are obviously some challenges our hero must overcome. The problem? The challenges aren’t even difficult, they’re just extremely dull, slow, and incompetent.

Now, the existence of an anti-monopoly agency may be controversial for my libertarian friends out there, but most of us agree it is necessary for a properly functioning economy.

In fact, if you asked me at the time of Walmart’s potential acquisition of Cornershop, I believed that it was, in fact, a dangerous operation for us, consumers. I still do.

But what is going on at this stage is ridiculous. Yes, this is once again part of the process as usual. Yes, government agencies need some time to conduct proper analysis and do due diligence. But no, we can’t accept this level of carelessness.

Initially, the company, being both Mexican and Chilean, found itself in the midst of a multinational fight over who had the say-in on what should happen with the acquisition. But now Mexico can’t even decide who is in charge of deciding whether the acquisition goes forward… internally!

Cofece, and now a new regulator, IFT (Telecommunications Federal Institute), are engaged in a jurisdiction swinging contest to see who gets to decide.

Now enter a third bureaucrat, the Justice Department.

Because these two agencies can’t seem to decide, a jury in Mexico is weighing up which one will get to make the decision. Note, this hasn’t been decided yet and the deal has been left hanging for several months already.

Add to that, the time it will take for the “winning” regulator to finally get to the actual work of deciding whether the deal goes ahead or not.

It will, most likely, kill the company.

Running a last-mile delivery company, like riding a bike

How could this kill the company, you might say?

“Unit economics are the be-all-end-all in a company’s success,” said Deliv’s founder and CEO, Daphne Carmeli, during 2019’s GroceryShop conference in Las Vegas.

The unitary cost of each trip depends on four key factors, more or less related to time as the key driver. Let’s remember that for some of these companies the cost of goods sold could take up to 90 percent of the sale value leaving a very tiny margin for profit and error. McKinsey has stated that profit margins range from 2 to 5 percent.

These four variables include Volume, Distance, Service Level Agreement, and Predictability.

For companies like Cornershop, time literally means money. Opportunity cost is a killer, and spending more time in choosing the right groceries, longer routes, and unforeseen events in the trajectory all take up time, and thus money.

Not only that, but if what you promise the end user isn’t coherent with what you deliver (pun intended), that also costs money.

Offering the freshest groceries in the shortest time possible is challenging and, if you’re not fulfilling your value proposition, the model’s surely gonna backfire.

Groceries, as perishable products, need shorter delivery distances and more realistic user promises. On top of that, as most grocery deliveries are bigger order sizes than, say, a single product or snack, it’s difficult to pool or batch several orders in a simultaneous trip.

Why is this relevant?

Well, because there are two things Cornershop certainly needs not to run out of runway:

- Cashflow, to juggle tiny margin orders and play the volume game

- Exceptional customer service

Both which could be suffering. The former because, well, money is running out, and the second one because of the cost reductions and employee cuts taking place to reduce burn rate. Customer service could suffer also from lack of proper executive attention, due to their focused efforts on lobbying on the regulators.

You’ve been cornershopped!

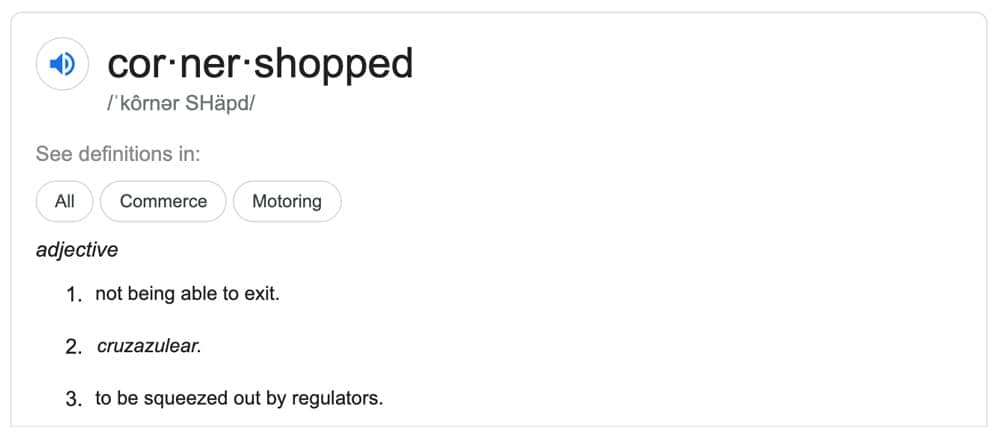

I am afraid to say this just seems like really bad luck. Or what I like to call being “cornershopped”; the inability to exit due to bureaucratic impasse; illiquidity by incompetence; so good that they wouldn’t let you get away with what you wanted.

And for Uber, I assume, time is ticking.

Now, who is better than Dani Undurraga, the co-founder himself, to showcase the frustration this whole affair is causing?:

The ecosystem is outraged. Let’s see if after more than six months of doing nothing, Cofece and IFT deign to do something before the deal expires

Just looking at his Twitter feed is enough for one to share his feelings.

This is a very sad and maddening case.

At the time of writing, Cornershop is number 12 in the iOS App Store’s most downloaded shopping apps. Google Trends’ search frequency has skyrocketed due to Covid-19, and though they would want to capitalize on the opportunity, they most likely can’t. Instead of going in for growth, they must preserve cash to survive.

trends.embed.renderExploreWidget("TIMESERIES", {"comparisonItem":[{"keyword":"cornershop","geo":"","time":"today 5-y"}],"category":0,"property":""}, {"exploreQuery":"date=today%205-y&q=cornershop","guestPath":"https://trends.google.com:443/trends/embed/"});Promising markets. Unpromising governments.

As of 2018, the entire last-mile delivery industry was worth over US$30.2 billion.

Its expected growth between 2019 and 2024 was a compounded annual growth rate (CAGR) of 9.3 percent, reaching a total of US$47 billion by the end of 2024. And honestly, I think with Harvard epidemiologists expecting social distancing to last until 2022, this market may be worth even more.

Along with this, its broader e-commerce industry is now valued at US$3.54 trillion dollars. While Latin America’s, although lesser in comparison to Asia or the US/Canada, it’s still expected to grow to US$82.73 billion by 2020.

My only concern here is the volume of deliverers, which will eventually decrease due to natural contagion. But other than that, an industry that used to be for early adopters and young techies is broadening its scope to older and late-adopter generations.

What’s most disturbing though is that, if the acquisition falls short, lots of jobs and services will be lost. More than 650 executives, according to LinkedIn, and countless deliverers could lose their main or only income stream, leaving them naked and at the mercy of the upcoming economy tsunami.

The world’s economy, and particularly Mexico’s economy, can’t stand massive layoffs for a prolonged period of time. I believe it is crucial that the regulators not only sort the conflict out, but also to approve the acquisition immediately.

Failing to do so will represent a huge mistake and an everlasting scar to the ecosystem and Mexico’s trustworthiness for doing business.

If it was an urgent matter before the pandemic, it is crucial now. For if this continues, the impasse will only go on to prove definitively that the authorities are incapable, or worse, indifferent to the potential short and long-term fallout that the tragedy of Cornershop will cause.

Related articles: Tech and startups from Mexico!

-VC