Gerry Giacomán is not concerned about whether the times in venture capital are good or bad. The CEO of Clara is confident that his fintech can secure investment in any context, even when there are certain obstacles to raising capital in 2023, as he assures that they have a solid business model and one of the best teams in Latin America.

Clara, a fintech unicorn specializing in expense and corporate credit management, raised a $60 million investment round led by GGV Capital in April of this year. “Unlike 2021, when we raised three rounds of capital quickly, raising funds in 2023 required much more attention,” said Giacomán in a video call with Contxto, from his office in Brasilia, the capital of Brazil.

Also read: Clara raises $60 million in a round led by GGV Capital

“It’s true that there is less capital available than in 2021, but for us, it has always been important to make sure that we are well capitalized with funds for the years ahead,” Giacomán assures. His company already has more than 10,000 clients, focusing on medium and large companies in Mexico, Colombia, and Brazil.

For about ten months, there haven’t been any mega venture capital rounds (over $50 million) in Latin America, but in the second quarter of 2023, Mexican fintechs brought them back. In addition to Clara, in May, Kapital raised $65 million (including $20 million in Series A led by Niya Partners and Tribe Capital, and $45 million for debt placements).

Then, in June, it was revealed that Colombian proptech La Haus had raised a Series C of $62 million. However, according to a statement to Reuters by Jerónimo Uribe, co-founder, and CEO of La Haus, the round was closed in 2022 but was not publicly announced.

A source close to the startup told Contxto, “They didn’t want to make noise about it because it could be taken the wrong way,” amid a depressed context for later-stage startups, for whom venture capital had virtually frozen.

The Brazilian company Daki also received a mega round of $50 million in the second quarter of 2023. But these milestones have been scarce compared to what was happening from late 2020 to early 2022.

Inflation and high interest rates: the difference between raising capital in 2021 and 2023

Clara became a unicorn in a prolific 2021 for venture capital investment. The startup co-founded by Giacomán and Diego García received a $3.5 million seed round in March 2021, which significantly boosted its startup. Two months later, it announced the closing of a $30 million Series A financing. It also secured a $50 million revolving credit line.

At that time, Giacomán states, “There was a lot of excitement and enthusiasm about the impact Clara could have in the region.” This led DST Global, General Catalyst, Monashees, and other investors to invest in the fintech.

By December 2021, Clara received a $70 million investment round led by Cotaue, a company that has invested in tech companies like Tik Tok and the Mexican unicorn Bitso. Since then, it has continued to attract venture capital and debt funding from major investors like Goldman Sachs and Axial Capital.

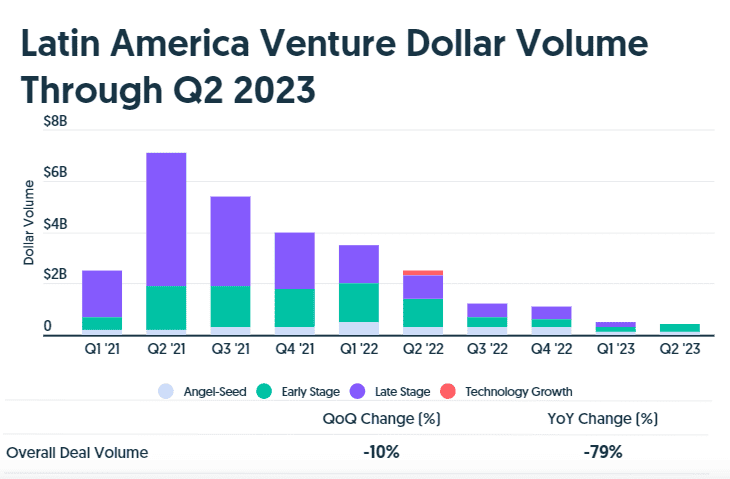

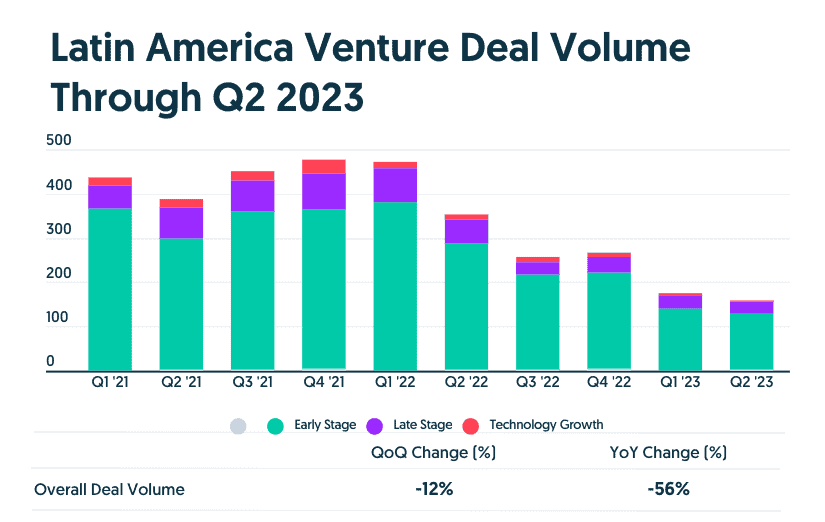

However, after 2021 – a record year for venture capital investment in Latin America, raising $15.9 billion according to the Latin American Private Equity and Venture Capital Association (LAVCA) – there have been some adjustments in valuations, and investors are more cautious about venture capital investments. In 2022, only $7.8 billion was raised, 50.9% less than the previous year.

Startups in Series B and C (and beyond) are the most affected by venture capital caution, “because the prospect of going public or being acquired is severely impacted in terms of valuations,” says Fernando Pontaza, co-founder, and managing general partner of venture capital fund Invariantes, mainly focused on early-stage investments, but also makes follow-up investments for stages after Series A.

Pontaza says that companies at this stage are waiting to survive for a year or two until there is a more relaxed inflationary environment. “The situation is complicated because inflation leads to a perspective adjustment that hasn’t been seen since 2008,” and this is the main obstacle to raising capital in 2023.

This particularly affects tech companies because they have a present value, but their revenues will come from future years, explains the Guatemalan investor.

“The current value of a tech company is the discounted value of its cash flows to the present, and if the discount rate is higher, it penalizes the present value of companies in inflationary environments,” Pontaza details.

Under these conditions, it is no longer as attractive to invest solely in venture capital for a return.

“At least inflation has stalled; it hasn’t gone down, but it’s not growing at the high rate it had been growing, which may be a light at the end of the tunnel.”

A More Stringent Due Diligence to Raise Capital

In addition to inflation and high interest rates, another obstacle to raising capital in 2023 is a due diligence focused on profitability numbers, something that startups find challenging to achieve due to their emergent nature.

Giacomán acknowledges that, unlike raising capital in 2021, there is now “a much deeper diligence” in 2023. During times of abundant venture capital, the most important metric was growth potential, but now it is profitability.

Regarding their latest funding round, Giacomán shares:

“We are pleased that we have completed the audit of our finances since we started operations, something that is not very common among many startups.”

The CEO of Clara boasts of having processes of a fairly sophisticated organization, despite being a company with only a few years of experience. Furthermore, he states that they are getting closer and closer to profitability and to a moment of going public. “There is no sense of urgency that it has to be now, but it’s something that feels closer with time.”

However, not all startups have been able to achieve profitability in such a short time, and they are the ones facing the biggest obstacles to raising capital in 2023.

“Before, capital could be raised with just a PowerPoint presentation, easy,” emphasizes Antonio Nunes, co-founder, and CEO of the Colombian startup Instaleap. A few months ago, this startup, which offers a SaaS to digitize supermarkets, raised a Series A of $5 million led by the funds Redwood Ventures, Pegasus, and Eduardo Castro-Wright, former CEO of Walmart.

The CEO of this startup, which has a team of 170 people and processes over two million transactions per month, will use the resources obtained for the development of their supermarket digitization technology.

Recommended Read: Million-dollar Investment in Habi and Seed Capital for Instaleap and Kala Stand Out Among Recent Financing Rounds in LatAm

Nunes says that “the level of stress placed on the investment case is deeper and more demanding, and the due diligence takes more time” (the Series A diligence took about six months from start to finish).

To raise capital now, Nunes says it requires:

- More preparation in the pitch information

- Being more organized during due diligence

- Building the right relationships with investors

- Being consistent in business execution

- Having a very transparent data room

All of the above helped generate investor confidence in these cautious times of venture capital.

Nunes says he was able to close his Series A because Instaleap has always been very concerned with unit economics and business fundamentals. The fundraising pitch emphasized that they were almost reaching profitability, but also focused on growth, which doubled last year.

Regarding valuations in the SaaS world, Nunes states that “pre-crisis, a year and a half ago, rounds were being done at multiples of 20 times, but now they are in a range between 6 and 8 times.”

Being Profitable Regardless of the Stage

Although investment activity has been quite dynamic for startups in pre-seed or seed stages, and valuations have not been affected in the past year, the pursuit of profitability remains a constant. As the old saying goes: valor is assumed in a bullfighter.

Helle Jeppsson, co-founder of Scape, an on-demand home spa service, received her first venture capital round of $1.3 million in 2023 from investors such as 500 Global, Amplifica Capital, and Angel Ventures.

The key in a cautious environment, says Jeppsson, was that Scape has been in the market for almost three years and “we already had significant revenue and traction” in its operations in Mexico and Colombia.

“I had not raised capital before, but talking to other founders, I realized that I faced a very complex environment, and perhaps doubly so because I am a woman,” Jeppsson shares.

The entrepreneur also affirms that “funds are asking for very different metrics now, they want the unit economics to be sound, they focus a lot on profitability, and they analyze the data extensively. We prepared an extensive data room, as if we were raising a Series A, not a seed round.”

Raising capital in 2023 can be a big challenge in this environment. That’s why Jeppsson advises doing extensive research to see which fund truly has available capital and if the startup fits their investment thesis.

In her case, it was difficult because investing in the wellness industry is not as common in Latin America. “But we became an interesting company because we could show that we are already profitable and generating utility,” Jeppsson affirms.

Rodrigo Kuri, co-founder of Pacto, says that having a short to medium-term profitability horizon enabled them to raise capital. He claims they realized that “the story investors are looking for is very different today from what it was 18 months ago.” In March 2022, Pacto closed a pre-seed round of $2 million.

At the end of March, Pacto, a Mexican startup offering a point-of-sale platform with integrated payments for restaurants and bars, received a $4 million seed round led by Dila Capital.

The environment is very challenging for any investment that is not liquid, so what investors want is a well-grounded business plan with very clear fundamentals and a proven management, explains Kuri, who was Deputy CEO of Citibanamex.

In the case of Pacto, it is a market of 600,000 restaurants in Mexico, representing a significant business opportunity. Currently, they have around 100 businesses as clients.

Additionally, Pacto has a distribution model in collaboration with Santander, which allows them to rapidly grow user acquisition and business signups at a low cost, resulting in a “short-term profitability horizon,” Kuri says.

However, the founders of Pacto made sure “not to promise future capital rounds based on users or growth that does not yield economic benefits. Instead, financial projections are closely aligned with a stable business and distribution model.”

To overcome the obstacles of raising capital in 2023, Gerry Giacomán, whose startup has raised $408.5 million (according to Crunchbase), has advice for entrepreneurs:

“They must find a way to balance growth with other metrics; how easily the product can attract new customers, how easily it can be monetized, and how that creates a numerically sound profitability story on a large scale. Ultimately, it’s all about efficiency in the use of capital.”

Recommended Read: Foodology, the cloud kitchen startup, announces $17 million in funding