Por Jose Pulido

julio 17, 2023

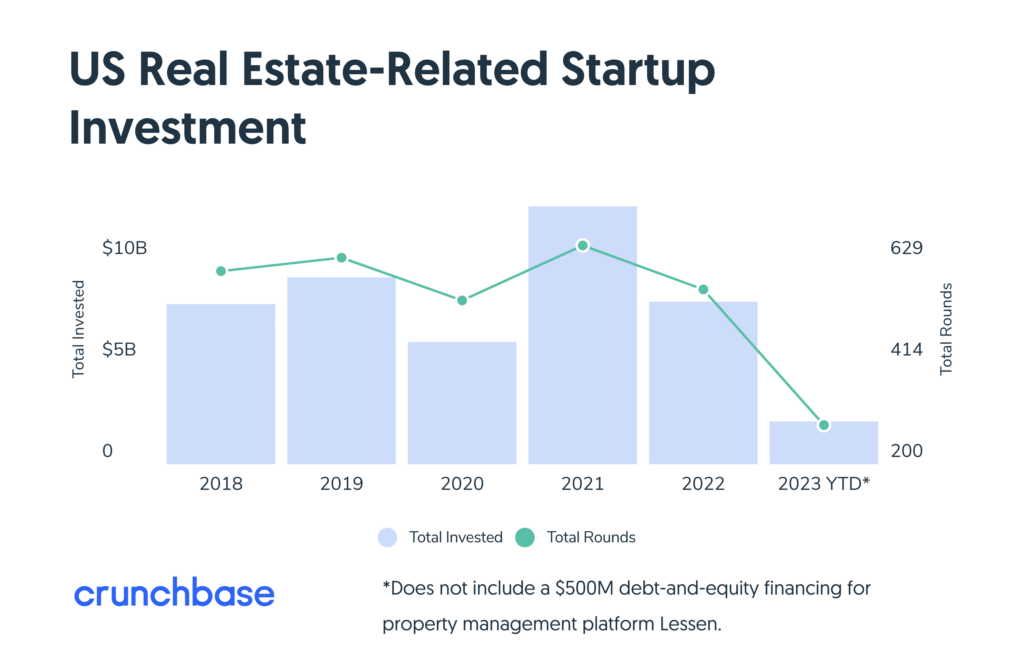

According to a report by Crunchbase, funding for real estate-related startups in the United States is on track to reach its lowest level in at least five years.

The constantly changing market conditions have impacted the real estate startup space. While the growing office vacancies have been widely discussed, the sharp rise in interest rates is likely the most significant disruption for startups. Since late 2021, the typical rate on a U.S. home mortgage has surged from 3% to 7%.

US Real Estate-Related Startup Investment. (Soure: Crunchbase)

The study highlights the absence of major investments from firms like Tiger Global Management and SoftBank Vision Fund, who have not made any deals in real estate categories. Even Andreessen Horowitz, which invested $350 million in WeWork, is noticeably absent.

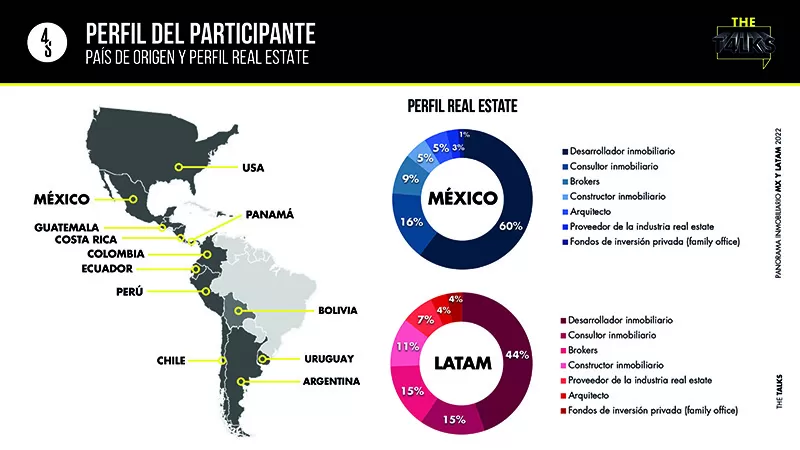

Regarding the region, a report from real estate consulting firm 4S Real Estate indicates that the real estate sector in Mexico experienced a rapid recovery during the first quarter of 2022, despite the challenges posed by the Covid-19 pandemic. This showcases greater stability compared to other Latin American countries, such as Argentina, where over 2,000 real estate agencies closed in the past two years, and Chile, which incurred losses of $600 million due to reorganizations, strategic moves, and bankruptcies of real estate developers.

Currently, proptech startups, which represent innovations and applications of new technologies in the real estate industry, have become a key player in transforming the sector.

Panorama Inmobiliario. (4S Real Estate)

Business Insider reports that venture capital investment in these companies grew by 54% between 2018 and 2020, totaling $571 million, ranking them fourth among sectors that attracted the most capital.

You might be interested in: Monopolio: Proptech Plus AI to Energize the Real Estate Sector

We recommend: LatAm startups raise only $406M in the first quarter of 2023

For detailed information, visit: Crunchbase

Por Israel Pantaleón

septiembre 11, 2025