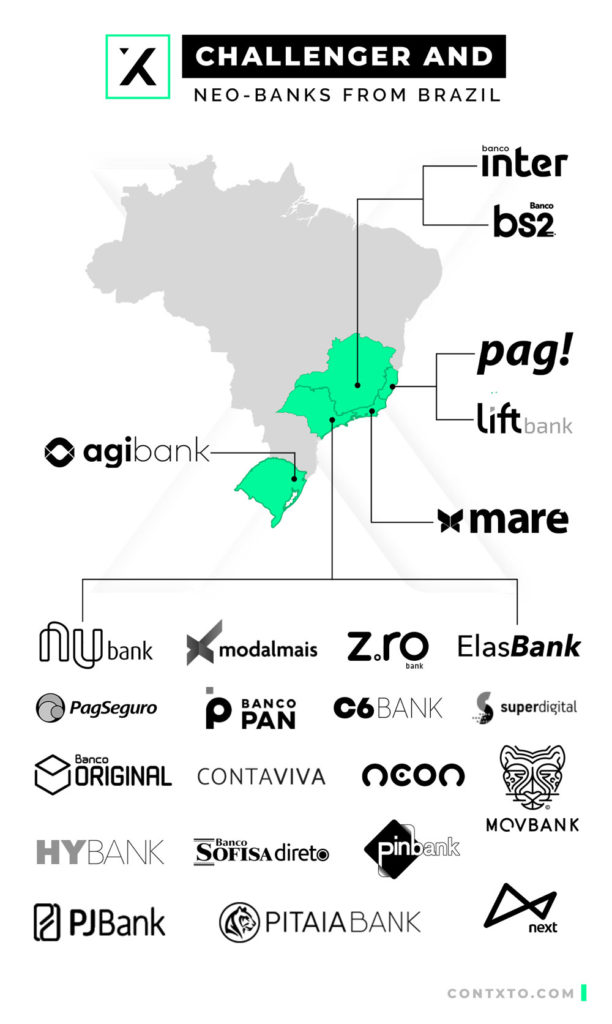

Contxto – Brazil is a giant, but when it comes to challenger and neo-banks is has become a titan amongst titans.

Not only is there a sizable number of contenders in this list—24 challenger and neo players to be precise—, Brazil also happens to be home to the undisputed world champion of neo-banking; Nu Bank.

(Full disclosure, this author is himself a (credit) card-carrying member of the Nu club all the way here in Mexico. I’m pretty happy with it, but tweet me to let me know if you’d like a full review.)

In spite, or perhaps because of this competition, Brazilian challengers and neos have had to up their game, and they have done it in creative and fascinating ways. Take a look, here are Brazil’s challenger and neo-banks:

Startup missing?

Challenger and neo-banks in Brazil

Fintech tends to concentrate around hubs, so it makes complete sense that Brazil’s financial capital, São Paulo, is at the heart of the country’s banking revolution.

But, don’t discard the rest of Brazil.

Indeed, it is so vast that regional and niche opportunities abound for those clever startups who know where to look. It is in these cases where you get Inter and BS2 from Minas Gerais, Pag! and Lift from Esírito Santo, Maré from Rio de Janeiro, and Agibank from Rio Grande do Sul.

Any article on neo-banks in Brazil (or anywhere in the world for that matter) would not be complete without Nu. Weighing in at over 20 million customers, this bank is the biggest neo on the face of the Earth and has a strong presence in both Mexico and Argentina.

What all these banks have in common is a desire to make finance easy in a region famous for unfriendly, inflexible, and sneaky traditional banking. I for one am not at all surprised by the exponential growth trend we’ve been seeing recently.

Related article: Fintech sees consumers as stupid—it needs to give them some credit

It’s a trend that has been boosted in Brazil by a recently instituted Fintech Law. Will it supercharge an already booming sector? We’ll no doubt find out soon.

Difference between challenger and neo-banks

Here’s a quick refresher for those of you who may have forgotten the difference between challenger banks and neo-banks. Remember, although there is some debate around the minutiae surrounding their definitions, the clearest cut, least debatable difference is a legal one:

- Neo-banks do not have a full banking license and so depend on other established financial institutions.

- Challenger banks do have a full banking license, allowing them to operate fully as a financial institution with the whole suite of banking operations available to them.

But wait, there’s more. We are in the midst of creating another publication of our instant-classic collection: The Ultimate Guide to challenger and neo-banks in Brazil. Be the first to know when it is published by dropping me a like at [email protected].

Related articles: Tech and startups from Brazil!

-AG, SB