In January 2012, ALLVP was founded with a clear goal: to finance exceptional entrepreneurs dedicated to addressing the most pressing problems in the region using technology as their main tool. Despite the venture capital firm not yet having its first fully constituted fund, they boldly decided to invest in Jimena Pardo, who was seeking seed capital to launch the first carsharing platform in Mexico City, an innovative solution to tackle the city’s mobility challenge. Federico Antoni played a fundamental role as chairman of the board of Carrot for the following six years until the investment was finally exited.

From that initial investment of their first fund, ALLVP has scaled to become one of the most influential VC firms in the region, forming one of the most promising early-stage portfolios, leading one of the most significant exits in the history of the region by selling Cornershop to Uber for USD$3 billion and delivering exceptional financial returns to a base of institutional LPs that include pension funds, multilateral and national development banks, corporations, and family offices.

In 2014, with the launch of their second fund, they welcomed two advisors who, to this day, play a fundamental role as members of the investment committee and the board of directors of ALLVP: Andrés Obregón Servitje, former partner at Carlyle, and who currently holds the position of managing partner in the Servitje Family office; and Murillo Tavares, who previously served as CEO of Submarino and Tiendas Extra, and is currently a partner at Spencer Stewart.

At the end of 2021, marked the beginning of a new phase for ALLVP, capitalizing on its track record of successes, philosophy, and unique position in the market. “We enter this new decade with an entrepreneurial ecosystem that is more mature and connected than ever,” explains Jimena Pardo, managing partner of ALLVP, exclusively for Contxto.

After a decade of dedication and collaboration with investors and entrepreneurs from across the region, managing four institutional VC funds and exceeding USD $350 million in assets under management, ALLVP has established itself as the leader in early-stage investment in Latin America.

Founders

Federico Antoni Loaeza

Managing Partner

Federico Antoni is a Founding Partner of ALLVP and has served as Managing Partner since its inception in 2012. He is a member of the Board of Directors for several companies in the portfolio, including Fintual, RobinFood, Flink, Flat, Clubbi, Cumplo, Wonder Brands, and Super. In the foodtech sector, Federico was a member of Cornershop’s committee from ALLVP’s first investment in 2015 until its acquisition by Uber. While Cornershop was part of ALLVP’s portfolio, he helped the team establish strategic partnerships with retailers in the region and assisted them in securing institutional funding rounds. He also supported Cornershop in M&A processes with Walmart and Uber.

Before ALLVP, Federico served as Director of Business Development and later as General Manager for Edoardos, a publicly traded Mexican clothing company. Between 2006 and 2012, he developed the company’s international expansion strategy in Latin America, launched new brands and product lines, and led its recovery efforts during the economic crisis.

Federico successfully developed and launched three new product lines in Europe while working at L’Oréal, a global leader in the cosmetics industry. Federico served as CMO for Mexico at B2W (formerly Submarino), the dominant e-commerce platform in Brazil, doubling the country’s sales before Televisa, the largest Spanish-speaking media company in the world, acquired the subsidiary. At Televisa, he took on the role of Vice President of E-commerce and restructured the division to reduce costs, increase sales, and launch new product offerings in Mexico. He regularly contributes to Techcrunch content and teaches Entrepreneurship and Management at the Stanford Graduate School of Business, where he earned his MBA. He holds a Bachelor’s and Master’s degree in Applied Economics from the University of Paris Dauphine. He has taught courses at ITAM (a leading educational institution in business and engineering in Mexico) and at CENTRO (a prominent Mexican school of design and liberal arts).

Managing Partner

Jimena brings over 10 years of entrepreneurial experience developed across multiple tech companies. Within ALLVP, she leads the relationships with Slang, Mendel, Nuvocargo, Fondeadora, Dentalia, and Nubity. Additionally, she currently serves as an advisor on the Mexican Private Equity Association (AMEXCAP), leading the Venture Capital committee. She began her career in the entrepreneurial ecosystem after co-founding Carrot, the largest P2P mobility and car-sharing marketplace in the region, which was ALLVP’s first investment in 2012. Her time as co-founder and CEO of Carrot led her to become an Endeavor entrepreneur.

Jimena continued her path as an operator at Meta (Facebook), where she served as a Product Growth Manager. During this time, she developed deep expertise in products, user experience, and monetization strategies, which she also shared with entrepreneurs through mentorships and angel investments. She returned to ALLVP in May 2022 and will become the portfolio companies’ best ally for operational guidance, founder-to-founder empathy, and product strategy.

Jimena holds an industrial engineering degree from Universidad Iberoamericana in Mexico. She has been recognized as one of Forbes Mexico’s 30-under-30 Promises, an Expansión Entrepreneur, and a TEDx speaker.

Types of Investors and Investment Thesis

At the heart of ALLVP lies a diverse community of investors ranging from family offices to pension funds, asset managers, development banks, and sovereign funds, all sharing a vision to support growth and innovation in Latin America.

Throughout its trajectory, ALLVP has forged a solid investment thesis that has proven successful in its three previous funds and, according to Jimena Pardo:

“This strategy focuses on early-stage companies with significant growth potential, especially those that base their business model on technology to expand their operations and have a significant regional impact.”

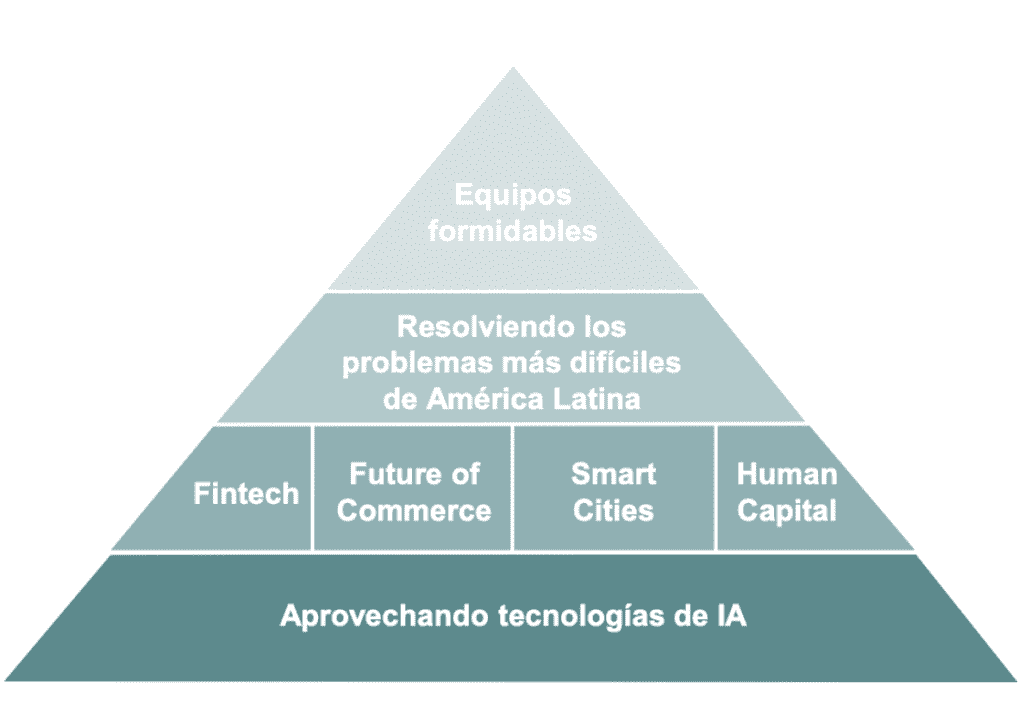

In line with its vision, ALLVP focuses on companies seeking financing in Pre-Seed, Seed, and Series A rounds, in sectors they consider crucial to address Latin America’s most pressing challenges: the future of commerce, fintech, climatech, smart cities, and human capital.

ALLVP aims for a multiple of invested capital greater than 3x and annual returns exceeding 25%. “This achievement is expected through a portfolio of companies founded by exceptional teams with technical experience and knowledge, providing them a clear exit strategy,” emphasizes Pardo.

The firm aims to raise USD $150 million for its fourth fund, destined to invest in a portfolio comprising approximately 18 companies that meet these characteristics. Their early engagement strategy in the companies’ development through operational, financial, and marketing advice allows for accelerated growth and improved operational efficiency.

In this fourth fund, ALLVP will continue to focus on companies seeking to raise rounds in early and early growth stages. Moreover, they will maintain their investment pace of between four and five investments per year, with a geographic focus that prioritizes Mexico (50%), followed by Brazil (20%), Chile, and Colombia (30%).

The first three funds are already fully invested, and ALLVP IV has already backed two companies: Sensai and Shinkansen. The investment period for this fund will be four years from the first closing, and they aim to maintain an average holding period of seven years per company. However, they will be open to strategic opportunities that may arise for a potential exit from any investment and seek to establish strategic alliances with significant players from the initial stages of growth and value creation.

As they deploy their fourth fund, ALLVP has updated its investment thesis to incorporate an even greater focus on artificial intelligence (AI). Despite this evolution, they remain committed to the key sectors they have backed since 2012: fintech, the future of commerce, human capital, and smart cities. “We will continue to bet on exceptional founders who are looking to address Latin America’s most complex challenges,” concludes Jimena Prado.

Investment Portfolio

|

ALLVP IV |

ALLVP III |

VIF II |

SIT I |

| Senzai | Slang Fintual Flat Robinfood Nuvocargo Flink Super Wonderbrands Kocomo Yana Reworth Mendel Clubbi Fondeadora |

Visor (Convalto) Alkanza Cumplo Aplazame Weex Cornershop Formafina Nubity Apli Enlight E3 Médica Santa Carmen Dentalia Farmacias Personalizadas Social Diabetes |

Carrot Aventones (BlablaCar) UHMA Cuídate Médica Santa Carmen Prestadero Salud Fácil Gaudena Petsy Click Voy al doc Viajamex |