In a significant advancement for Mexican consumers, Paymentology, the renowned card issuer-processor, has partnered with DolarApp, a Mexican startup that provides digital dollar accounts in Latin America.

The union between these two financial entities will allow millions of Mexicans access to a credit card denominated in dollars, without foreign exchange (FX) commissions, and with transparent market rates. Users can send and receive transfers from multiple countries, digitally dollarize their financial transactions, and pay with an international card issued by Mastercard at the best exchange rate.

Furthermore, DolarApp became the first organization in Mexico to offer its clients Google Pay and Apple Pay. Paymentology will provide DolarApp with a fast and scalable card payment program and top-notch tokenization and security services.

Álvaro Correa, co-founder and COO of DolarApp expressed his satisfaction in collaborating with Paymentology, highlighting its commitment to innovation and continuous improvement in customer experience in Latin America:

“Their exceptional experience and track record in the industry, coupled with their ability to offer agile and customized payment solutions, align perfectly with DolarApp’s vision and requirements. This alliance commits us to launch innovative and novel features to enhance our customers’ experience as we grow in Latin America.”

Alejandro del Río, Paymentology’s regional director for Latam, pointed out that the alliance with DolarApp represents an opportunity to make a tangible difference in people’s financial lives in Mexico, offering incredibly competitive exchange rates.

This agreement between Paymentology and DolarApp broadens the payment options available in Mexico and contributes to increasing financial inclusion and opening new possibilities for consumers.

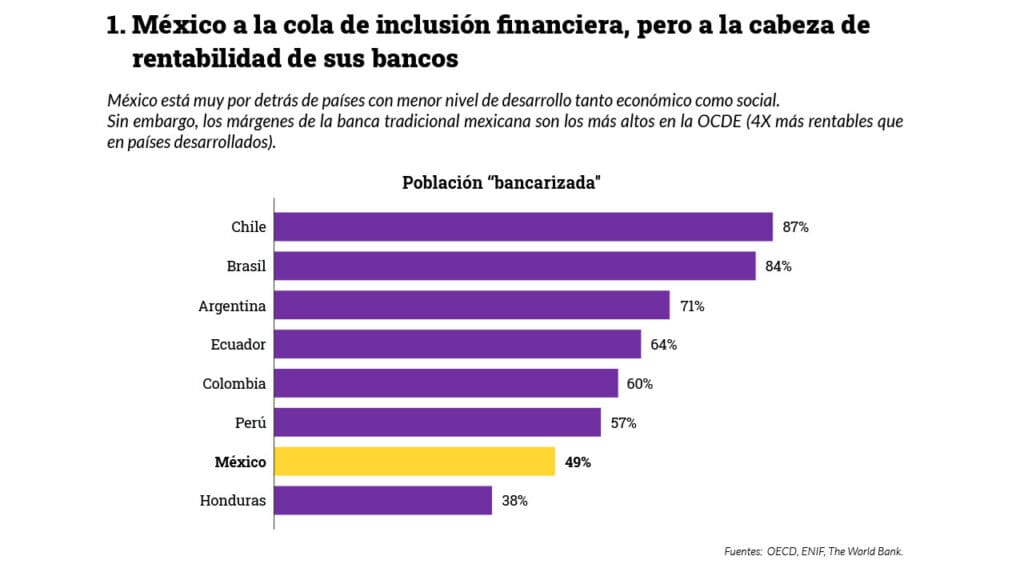

The Mexican economy received USD $24,666.7 million from its citizens residing abroad between January and May, a year-on-year increase of 10.26% compared to last year, reported the Bank of Mexico (Banxico) on Monday. However, Mexico is one of the countries with the most significant lag in financial inclusion in the region.

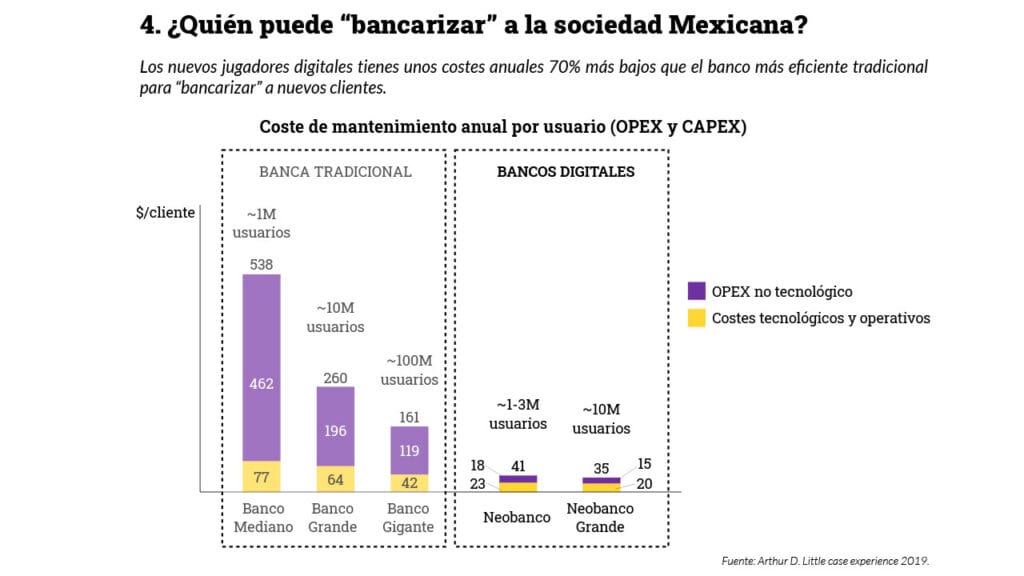

This is due, among other factors, to the cost of a traditional banking user not being viable. In other words, digital players like Paymentology and DolarApp, which maintain lower rates, become essential players in banking in the country, as 70% of these types of fintech have lower costs than any traditional bank.

The collaboration between Paymentology and DolarApp promises to continue growing and expanding in Latin America, providing novel and agile financial solutions for a constantly changing world.