To democratize access to financial products and improve financial education in Mexico, Fintual—a leading company in the Latin American fintech sector—introduces “Pregúntale a Fintual,” the innovative virtual financial advisor.

This artificial intelligence tool provides immediate, 24/7 answers to questions about money, economy, investments, and financial products, including those that challenge experts.

Addressing the Issue

Lack of knowledge and information are key factors contributing to poor economic habits and hindering the achievement of long-term goals like a dignified retirement or property acquisition. According to Mercer data, 67% of Mexican millennials have debts equivalent to 44% of their annual income.

To combat the lack of financial education and the resulting stress, “Pregúntale a Fintual” presents itself as a free virtual assistant available at all times, clarifying doubts about the economy, funds, and Fintual’s products, as well as other financial products in the Mexican market. Users can access this service anywhere in the country via a WhatsApp message and a local number starting with +52.

Salvador Rivero, Head of Investment Products Mexico at Fintual, exclusively explained to Contxto that:

“The virtual advisor aims to centralize and provide comparative information on financial products intuitively and accessibly, allowing users to make informed decisions and find the best products for their specific needs, when they need them, via WhatsApp, using OpenAI’s artificial intelligence.”

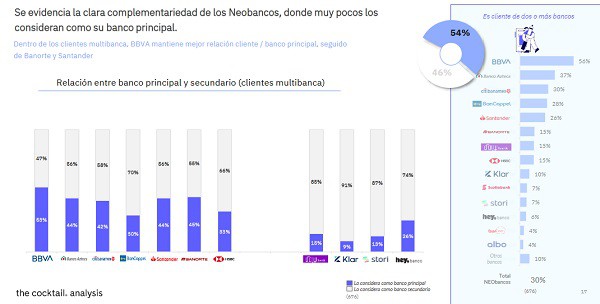

In a context where seven banks control 80% of the Mexican financial market, this innovation aspires to enhance competitiveness and empower citizens with tools to make informed decisions and optimize their finances. Rivero emphasizes that the service offers Mexicans crucial financial knowledge to select products and make decisions that affect their economic wealth.

Strategy and Technology: The Pillars of Financial Innovation

To achieve this, “Pregúntale a Fintual” is based on the company’s main objectives:

- Market Expansion. It aims not only to provide investment information but also to expand its reach to all aspects of personal finance, broadening its initial market and being a reference in the search for financial information in Mexico.

- Branding and Trust. This tool allows Fintual to increase brand recognition and build a trusting relationship with users, even those who are not initially Fintual customers.

- Consumer Empowerment. By providing relevant and accurate information at critical times, Fintual seeks to empower consumers on financial matters so they make better decisions.

Considering that Mexico remains one of the less developed countries in terms of banking (according to the World Bank, 65% of adults have no bank account, only 10% save via a financial institution, while 83% of adults do not have access to electronic payment systems), “Pregúntale a Fintual” emerges as a tool that, under the premise of using advanced technologies to create accessible and user-friendly solutions, “becomes the personal financial advisor of Mexicans,” states Rivero.

The tool addresses questions that seem basic but often do not find immediate, free answers in clear and understandable language.

“Fintual has developed this technology internally, using and training OpenAI’s APIs with its own data to focus on personal finance and provide relevant and specific financial information,” explains Salvador Rivero.

Fintual uses independent influencers as a communication channel to convey a solid message since they have built a strong trust bond with their followers. They are a reliable source of information on finance and money, especially when distrust prevails due to past experiences with financial fraud.

This virtual advisory service could mark a before and after in how Mexicans manage their finances, contributing to a more informed and economically healthy society. “Fintual, recognizing the need to improve access to financial information in Mexico, has introduced a virtual financial advisor to help consumers make more informed and empowered decisions, using advanced technology and effective communication strategies to expand its impact and presence in the market,” concludes Rivero.