Wonder Brands, a Mexican digital brand acquisition firm, has confirmed the completion of a Series A funding round amounting to USD $15.5 million.

This new investment will drive its expansion from Mexico City into South America. Nazca and BID Invest spearheaded the funding alongside other investors such as CoVenture and SilverCircle. The capital could potentially reach up to USD $20 million, accumulating approximately USD $40 million in funds for the company, as conveyed via email by Federico Malek, one of its co-founders, to TechCrunch.

Having been profiled in 2021, a few months post its inception, aimed at purchasing brands on platforms like MercadoLibre and Amazon, Wonder Brands had already secured USD $20 million in venture capital.

Malek emphasized that what sets them apart is the organic brand development, contrasting with the traditional aggregation model, which closely resembles a private equity scheme with minimal operational involvement. The company has adeptly tapped into brand development capabilities within the burgeoning e-commerce market of the region.

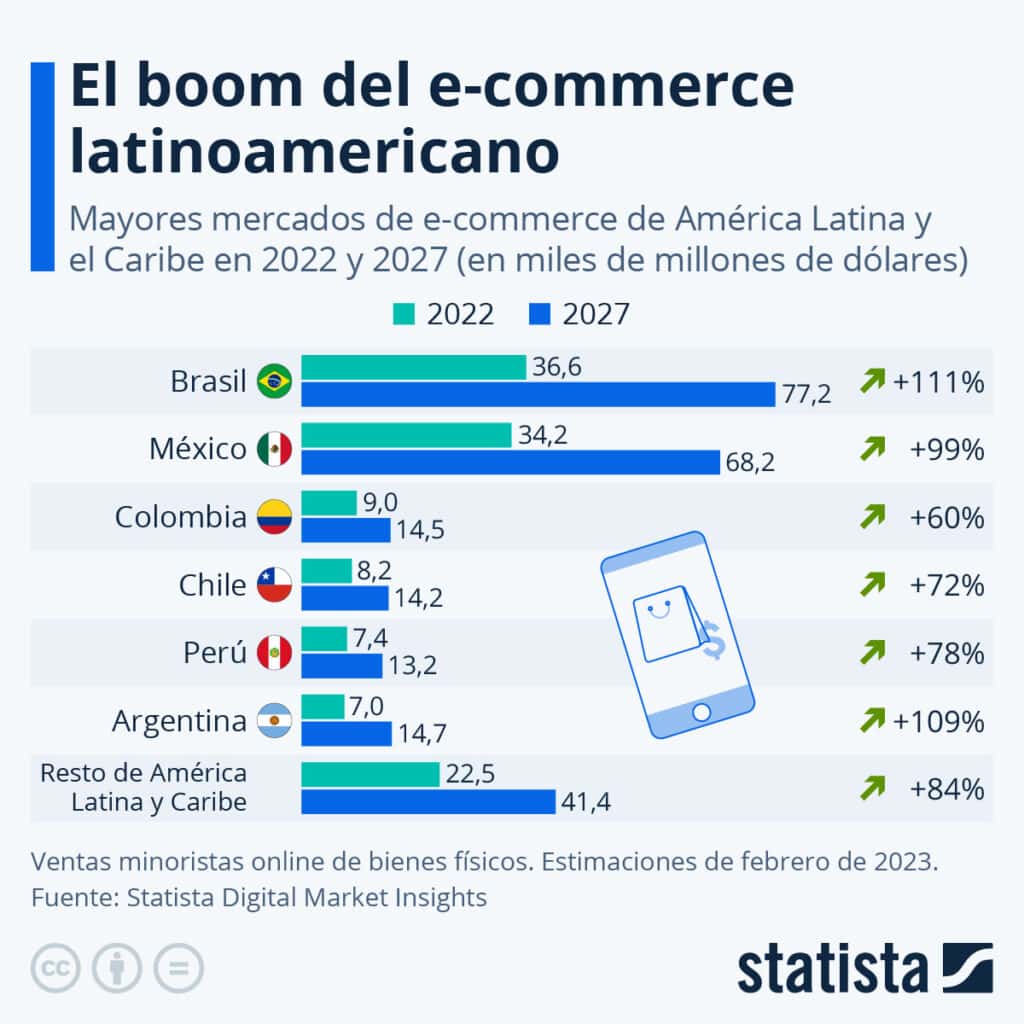

Latin America is home to nearly 300 million digital shoppers. This number will see an upward spike of over 20% by 2025. In contrast to other emerging regions, ecommerce penetration in Latin America still remains relatively subdued. Nonetheless, the forecast remains upbeat: online retail sales in the region are projected to hit USD $85 billion in 2021, which is expected to soar to around USD $160 billion by 2025, according to Statista.

In the Latin American e-commerce landscape, Brazil and Mexico emerge as the dominant economies, representing 31% and 28% of the market. Yet, countries like Argentina, Peru, and Colombia are rapidly gaining prominence thanks to their accelerated growth rates in this sector.

2020, shaped profoundly by the onset of COVID-19, revolutionized consumer behavior across Latin America. As restrictions kept people indoors, an increasing number turned to online shopping – a mode previously overlooked by a sizable segment of the populace. The data paints a clear picture: electronic sales in the region saw a staggering 230% surge in the weeks following the pandemic’s official declaration.

This surge in online shopping buoyed e-commerce at large and supercharged specific sectors. The food and beverage industry, which had been steadily growing before the pandemic, witnessed an unparalleled demand, particularly in terms of home delivery. Forecasts suggest that, through 2025, categories like food and personal care will spearhead ecommerce growth.

Beyond the immediate implications of COVID-19, this shift toward digital purchases seems to have found a permanent place in daily routines. A survey conducted at the end of 2020 backs this up: eight out of ten Latin Americans stated they would continue shopping online even post the health crisis.

The rapid evolution of the e-commerce landscape in Latin America, catalyzed by external factors like the COVID-19 pandemic, signals a profound shift in consumer behavior. Companies like Wonder Brands are astutely positioned to leverage this momentum, exemplifying the region’s growing digital appetite. As traditional barriers to online shopping recede, Latin America stands on the precipice of a digital commerce revolution, with its future trajectory looking promisingly upward.