Por Ayax Bellido

November 8, 2023

Visa has made a strategic investment in the field of Real-World Asset (RWA) tokens in Brazil, leading a funding round for Agrotoken, a Brazilian company specializing in the tokenization of agricultural products. This investment marks a significant milestone, as it will be used to boost Agrotoken’s growth and the development of new products. It will also facilitate the expansion of the Agrotoken Visa card internationally.

Agrotoken, in a communication to Cointelegraph, emphasized that the collaboration with Visa focuses on creating more opportunities in the agricultural sector and promoting financial inclusion of small producers through monetary tokens. Eduardo Novillo Astrada, CEO and co-founder of Agrotoken noted that the relationship with Visa, which began in 2022, has been strengthened with this investment. It expands Agrotoken’s goals and offerings and allows it to focus on future challenges, moving towards a new era of financial solutions and payment options for the agro-industrial industry.

Eduardo Coello, Regional President of Visa for Latin America and the Caribbean, stated that agriculture is a crucial regional pillar. Visa is committed to helping farmers and entrepreneurs grow through digital payment solutions. These solutions are based on blockchain technology and tokenization, which are critical for advancing digital currencies. Visa is dedicated to facilitating the integration of stablecoins and traditional currencies to promote economic prosperity.

In expanding their services, Agrotoken also recently announced a partnership with Banco de Brasil on the bank’s digital platform, Broto, aimed at agribusiness. This collaboration allows farmers to purchase machinery, fertilizers, and other inputs directly on Broto, paying with their tokenized production.

The process is simple yet innovative: producers access the Broto platform, select what they want to buy, and choose to pay with grains. They receive a valuation of their products in sacks of corn or soybeans, and once they accept, tokenization is carried out through Agrotoken. The producer gets the equivalent in tokens, and the distributor generates a payment link through the Agrotoken app. Upon authorizing the payment, the transaction is completed, and it’s important to note that the distributor does not retain the tokens; Agrotoken handles the conversion into cash.

This investment and collaboration between Visa, Agrotoken, and Banco de Brasil represent a significant advancement in the digitalization and modernization of transactions in the agricultural sector, offering practical and economical solutions to producers and strengthening the financial ecosystem through blockchain technology and tokenization.

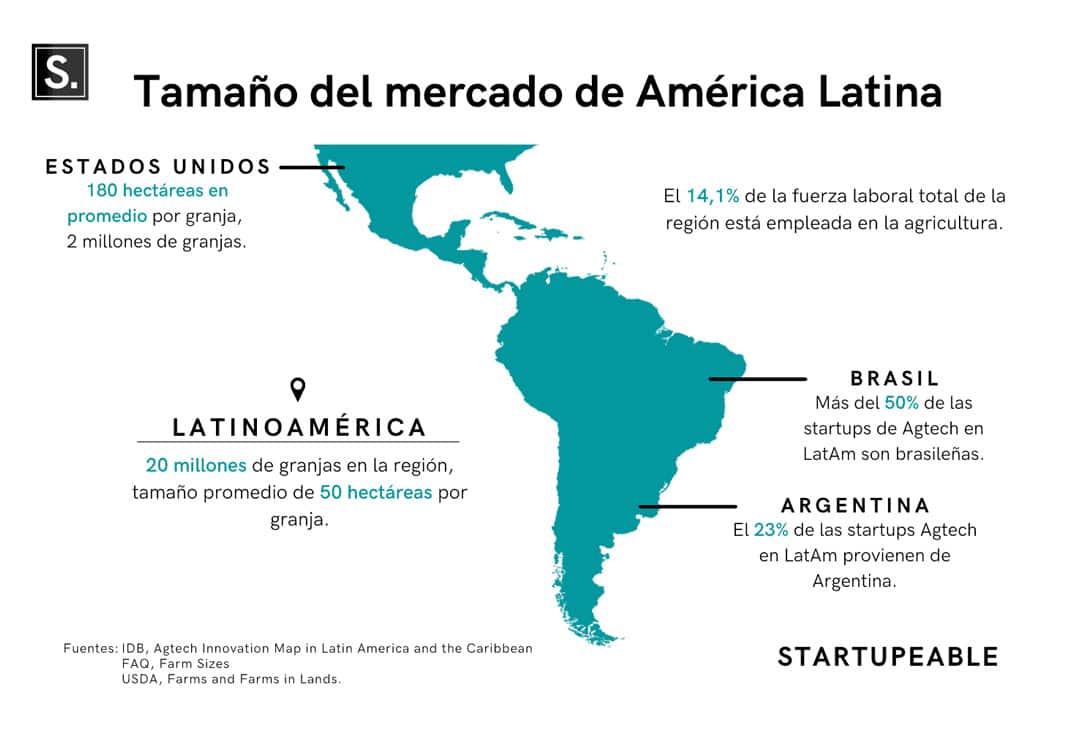

According to a study by the IDB titled Agtech Innovation Map in Latin America and the Caribbean, Argentina accounts for 23% of agtech-focused startups in the region, while Brazil accounts for 50%, thus establishing themselves as the two agricultural giants in an area where 14.1% of the workforce is employed in agriculture.

December 4, 2024

November 20, 2024