Por Jose Pulido

August 30, 2023

Mercado Pago, known as the most prominent fintech in Latin America and a subsidiary of Mercado Libre—often likened to Amazon in Latin America due to its millions of users—has begun to offer support for USDC, choosing Chile as the first market for its roll-out through Circle.

Circle’s CEO, Jeremy Allaire, likened Mercado Libre to the Latin American counterpart of Amazon, boasting a user base of 200 million. He announced the inclusion of USDC into Mercado Pago, Mercado Libre’s payment solution, through a series of posts on X.

1/ The largest fintech in LATAM, @mercadopago, part of Mercado Libre, the Amazon of LATAM with 200M users, is rolling out support for USDC in key markets, starting with Chile. Momentum for USDC and digital dollars building around the world! https://t.co/3mNQxXvNUC

— Jeremy Allaire (@jerallaire) August 29, 2023

USDC is a stable coin tied to the value of the U.S. dollar and is one of the most widely adopted stable cryptocurrencies. Its introduction to the Chilean platform signifies the increasing importance of cryptocurrencies and the U.S. dollar in Chile. This is especially noteworthy, considering the U.S. dollar is not as commonly accepted as a direct payment method in Chile compared to other Latin American countries.

Mattias Spagui, Senior Director of Mercado Pago, stated:

“The U.S. dollar is globally recognized as a stable currency and reliable means to safeguard value in uncertain times. By introducing this stablecoin, we aim to broaden cryptocurrency options and provide our over two million users with an alternative aligned with the dollar’s value.”

In 2021, Mercado Libre expressed its interest in accepting cryptocurrencies. Since that announcement, significant progress has been made, such as the recent incorporation of USDC in Chile and a partnership with Paxos to integrate the stablecoin USDP in Mexico.

On another note, Circle has been making headlines due to Coinbase’s recent decision to acquire a stake in the company following the dissolution of the governing body Centre. As pointed out by Cointelegraph, this positions Circle with more significant responsibilities as USDC expands across multiple blockchain platforms.

Before this restructuring, Circle had announced preparations for the impending entry of traditional financial institutions and major tech corporations into the realms of cryptocurrencies and stablecoins, amassing resources for that purpose.

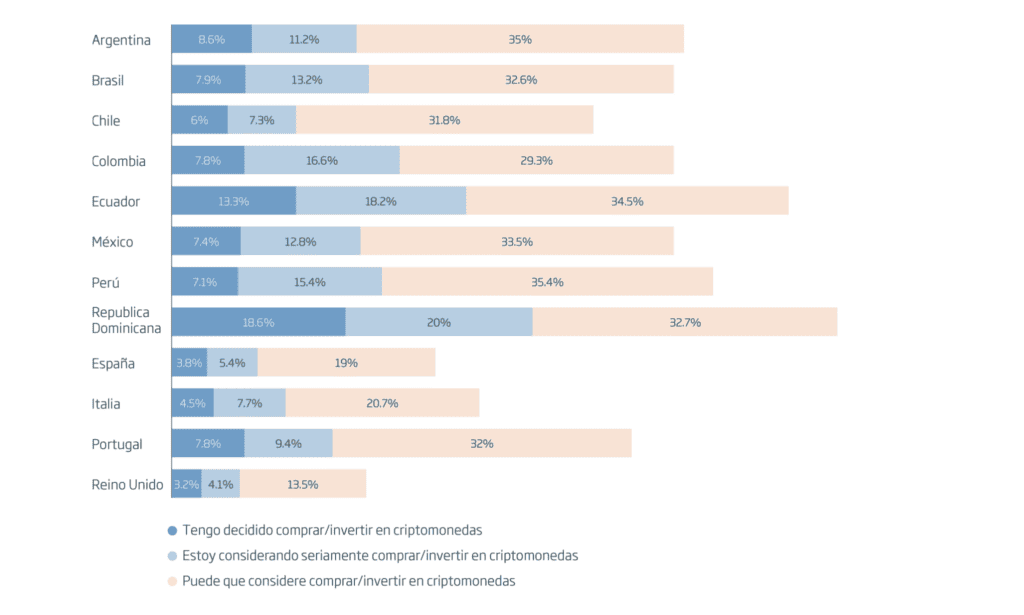

Cryptocurrencies are gaining momentum, although it is still a minority sector in the financial world. According to a study by Minsait Payments in collaboration with International Financial Analysts (AFI), a significant portion of the banked population is considering getting involved with crypto-assets at some level: 14% have already bought, 7% plan to do so, and 39% are considering it.

Percentage of the banked population considering buying or investing in cryptocurrencies shortly. (Source: Afi and Afi and The Cocktail Analysis).

This growing trend is particularly noticeable in Latin America compared to Europe. In the Latin American region, there is a higher inclination to buy or plan to buy cryptocurrencies, which could be linked to the perception that digital assets offer protection against the devaluation of fiat currencies, a problem commonly more acute in these countries.

Regarding willingness to use cryptocurrencies, the Dominican Republic and Ecuador lead the way, followed by Colombia, Brazil, and Argentina. In contrast, countries like Chile have been more cautious in their approach to digital assets, evidenced by a relatively lower adoption rate.

Por Israel Pantaleón

January 20, 2026

Por Israel Pantaleón

December 17, 2025