Por Ayax Bellido

October 9, 2023

The emerging Mexican fintech Bravo, recognized for its innovative solution in debt settlement, arrives in Colombia, promising its users a new financial opportunity and access to credit.

With great aspirations, Bravo introduces itself in Colombian territory to advise more than 600,000 individuals, aiming to reincorporate at least COP $193 billion of overdue debts into the financial system before the end of 2024.

The plan includes an investment exceeding COP $179 billion. Its main goal over the next 15 months is to integrate approximately 27,000 users, settle over 24,000 debts, and grant around 7,500 loans. This is to reintegrate its customers into the financial system. However, it’s crucial to highlight that “only those who join Bravo’s program and comply with their initial savings plan for at least seven months will be eligible for the credit option.”

Daniel González, co-country manager of Bravo, shares his vision:

“We identified a significant opportunity for consumers to cover their overdue debts and for creditors to recover significant amounts from expired portfolios in a unique way where both parties benefit. In addition to using innovative technological developments, we aim to have a team of over 600 people in Colombia to achieve all our goals by the end of 2024”.

From its inception, Bravo has sought to deepen the understanding of its products in every country where it operates: Mexico, Colombia, Spain, Portugal, Italy, and Brazil. This experience has enabled them to identify how to support and guide their customers.

Bravo offers financial solutions and a second chance to those who have faced adverse economic circumstances. Despite their challenges, these individuals remain committed to settling their debts and achieving financial stability.

Camilo Quiñones, also co-country manager of Bravo, notes:

“Colombia is a key market for the brand. For this reason, it’s one of the first regions where we’re offering new solutions that will soon be implemented in the other five countries where we have a presence. With our services and our credit model, we hope to benefit many more people in less time and for Colombia to continue being a breeding ground for initiatives that can be exported to other geographies”.

Bravo’s process begins by evaluating the client’s financial situation. Candidates must have debts exceeding COP $5 million and show evidence of delinquency. But the essential requirement is the willingness to pay.

The first step is to create a detailed savings plan, ranging from 16 to 60 months. This plan aims to help users settle their debts, consolidating multiple commitments into a single reduced payment. After seven months in the program, the client’s behavior is assessed. If they meet the criteria, they are offered a loan to settle their debts, intended solely for that purpose and for the obligations in the rehabilitation plan.

If the client does not comply or declines the loan, they continue with their original savings plan to settle their outstanding commitments. While the client remains with Bravo and meets their obligations, the company issues positive reports to risk centers, facilitating the gradual improvement of their credit rating.

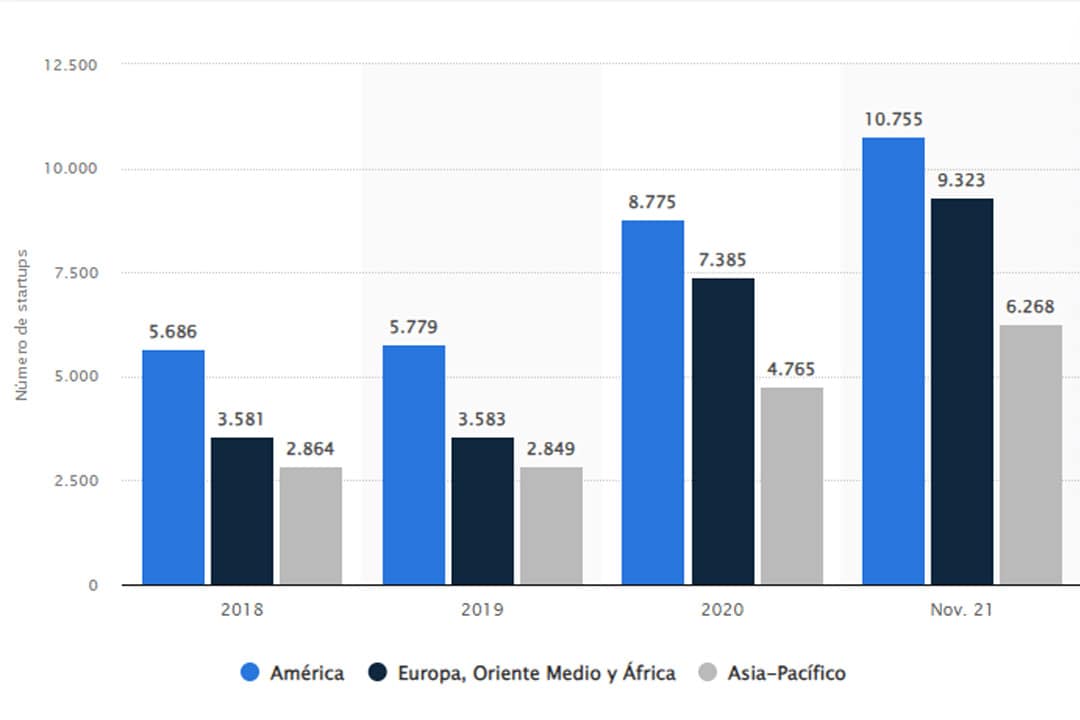

Lastly, Fintech continues to consolidate as one of the most important sectors for the region’s startups. According to data collected by Statista, there was a significant increase in fintech startups in America between 2018 and 2021, going from 5,686 to 10,755, surpassing other global markets.

Por Israel Pantaleón

January 20, 2026