Grupo Security has a four-year digital investment strategy amounting to USD$50 million, implementing various actions to strengthen its operations and improve operational efficiency in the context of business digitalization.

In this line of action, Banco Security, a subsidiary of the financial group, entered into an agreement with Backbase, a prominent fintech globally, specializing in solutions for digital banking.

The goal of this partnership is to boost the digital experience, strengthen the marketing of additional products, and increase business efficiency.

Through the integration of Backbase’s Retail Banking solution, Banco Security is renewing its digital platforms to provide personalized experiences to its clients.

“In a rapidly advancing and increasingly digital world, we want our customer experiences to be simple, secure, and seamless.”

“Therefore, this alliance with Backbase will allow us to innovate quickly, scale our operations, and offer an integrated banking experience, enhancing and strengthening our products and services, with a focus always on the customer,” highlighted Matías Morales, Digital Manager of Banco Security.

A notable example is ‘Security up!’, a digital current account obtained in minutes, including essential services such as personalized assistance, credit line, and credit card, all managed entirely online.

Furthermore, through the implementation of Backbase for Business Banking, Banco Security positions itself as the preferred partner for businesses by simplifying and optimizing banking experiences to manage their operations quickly and easily.

With the introduction of Wealth Management by Backbase, the entity redefines wealth management by combining digital conveniences with personalized attention, empowering its advisors to provide a distinctive service, characteristic of Banco Security and its subsidiaries.

“We are excited to embark on this journey of digitization with Banco Security, an entity that not only has significant growth potential in Chile but is also driving innovation efforts in the country’s financial sector.”

“Together, we hope to set new standards in the banking industry, putting the customer at the center of everything we do,” explained Nicolás Perdomo, Regional Sales Director of Backbase for Latin America and the Caribbean.

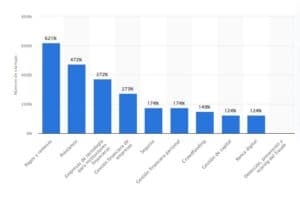

Data indicates a growth in demand for digital banking services in Latin America, especially in Chile, where digital payments represent a significant percentage of the Gross Domestic Product (GDP), and 68% of these payments are made through electronic fund transfers.

In this scenario, Banco Security, recognizing this trend and committing to its vision of providing exceptional services, has taken significant steps to move in line with the current transformation.

With this strategic collaboration, Banco Security strengthens its product and service offerings, improving the customer experience by streamlining digital processes according to the individual needs of each one.