November 12, 2024

Cobre, a Colombian company specializing in interoperable financial systems technology, has taken a crucial step in its regional expansion by entering the Mexican market.

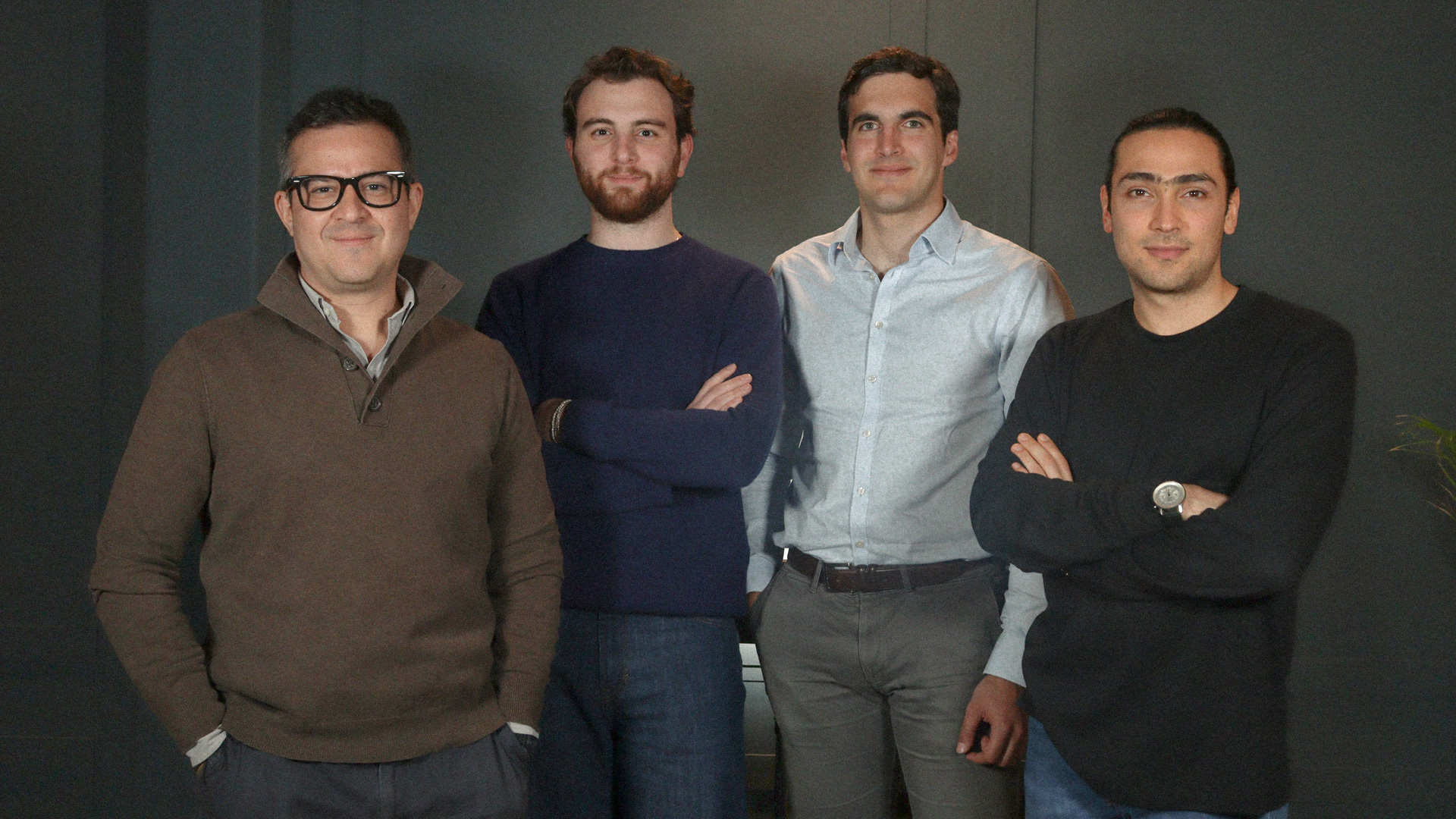

Founded in 2020 by José Vicente Gedeón and Felipe Gedeón, Alberto Chejne and José Donato, and with nearly five years of experience in Colombia as a platform that has transformed treasury and payment management for more than 200 companies, Cobre seeks to replicate its success in a market five times larger, adapting its technology to the unique needs and challenges of Mexico’s financial ecosystem.

The company has built a proprietary infrastructure that has enabled companies to centralize and optimize their financial operations through three key products: Movimientos Real Time, Cobre Connect and Pagos Internacionales Inmediatos; an infrastructure that has processed more than $12 billion Colombian pesos in transactions during the first half of the year and reduced manual processing times by 90% for its partners, according to the company.

Since its founding, Cobre has focused its mission on solving money movement challenges in the enterprise environment. “Our mission is clear: to solve the most complex problems in the movement of money by developing proprietary interoperable technology that enables businesses to grow and thrive. We believe that by reducing barriers in the movement of money, we boost the economic potential of the entire region,” co-founder Felipe Gedeón told Contxto.

The idea for Cobre began to be forged almost 10 years ago, during José Vicente’s first year at university he read a whitepaper about M-PESA, a Vodafone subsidiary company launched in Kenya with Safaricom, the country’s mobile operator, which allowed millions of people to send money in real time via text messages, thus revolutionizing the Kenyan economy. “The impact of the platform in facilitating secure and accessible transfers was fascinating,” Felipe explained.

After trying to replicate a sort of “M-PESA in Colombia,” he soon identified even greater potential: solving money movement problems for businesses. “Thus, our focus at Cobre was consolidated on facilitating payments and collections with proprietary technology that solves three major pains: lack of speed, excessive [manual processes] and data inconsistency in payments,” he said.

The Mexican market represents a significant opportunity for Cobre due to its size, growth in financial innovation and international economic integration. Despite having real-time public payment protocols in place, many Mexican companies face the same problems Cobre identified in Colombia: lack of speed in the movement of money, excessive use of manual processes and inconsistent financial data.

“In a larger, more modern market with better financial infrastructure, companies suffer from the same problems in the movement of money (lack of speed in payments, a high burden of manual tasks and inconsistent financial data). We are obsessed with solving them with technology on an even larger scale than in Colombia,” explained Gedeón, underlining the company’s specific preparation to face the challenges of the Mexican ecosystem.

Cobre’s offering in Mexico focuses on two key products. Through Cobre Connect, companies can centralize and automate their treasury, optimizing the management of payments and collections in real time. This system allows Mexican companies to reduce up to 50 hours a month in administrative processes, which increases efficiency and ensures consistency in their financial data.

On the other hand, with Immediate International Payments, companies can carry out global transactions in real time, overcoming traditional cost and time barriers. This solution ensures that international transactions reach their destination smoothly, providing visibility at every stage of the process and significantly improving transaction times, while optimizing companies’ liquidity.

“At Cobre, we have been thinking about the challenges of the Mexican market for more than two years. In that time we have prepared ourselves to comply with a business regulatory framework that is very different from Colombia (in Mexico we already have a Money Transmitter License) and we have built new money movement rails designed to be compatible with the Mexican financial and banking infrastructure (SPEI, CODI, SPID),” said Gedeón.

Cobre’s arrival in Mexico comes against a backdrop of rapid growth in the country’s fintech sector, which has experienced a 340% increase in the last six years. Mexico, as the second largest market for financial innovation in Latin America, offers fertile ground for Cobre to not only consolidate its presence, but also boost the financial ecosystem by offering advanced payments and treasury infrastructure for companies of all sizes.

In beta mode, Cobre has already partnered with a dozen Mexican companies since the beginning of 2024, and expects to close the year with 50 clients. In addition, the company is in the process of establishing partnerships with key financial institutions in Mexico to have more companies adopt its solutions over the next 12 months.

“We told the market the news a month ago after being absolutely convinced that the product is ready to add differential value to the companies that use it, and that the Cobre team in Mexico is ready to serve their needs,” Felipe explained.

Cobre has raised $65 million in total, with a recent $35 million Series B led by Oak HC/FT, which has provided a significant boost to its expansion in Mexico.

The resources will be used to further strengthen its technology, expand its team in Mexico and consolidate its infrastructure, ensuring that its platform is robust enough to meet the demands of Mexico’s dynamic financial ecosystem.

Felipe Gedeón also indicated that the funds will be used to both improve the technology infrastructure and strengthen Cobre’s presence in the Mexican market: “We will focus on developing our interoperable technology and strengthening our infrastructure to ensure that our clients have an increasingly robust and efficient platform.”

Por Stiven Cartagena

January 21, 2026