Por Sandra Pérez

June 20, 2022

In 2021, no expense was spared in the Latin American startup ecosystem. It was a record-breaking year for venture capital (VC) investment, with more than US$15 billion, the equivalent of the cumulative capital invested in 10 years in this sector. This was revealed in the recently released study Ecosystem of Venture Capital and Growth Equity in Latin America by Endeavor and Glisco Partners.

Vincent Speranza, general director of Endeavor Mexico, told Contxto that the boom is explained by LatAm being a region with a lot of market to conquer with many problems to solve. Also, it would be the result of the fact that there is entrepreneurial talent, sophisticated and experienced, with people who have been in the ecosystem for more than a decade, with more than one venture.

Endeavor and Glisco Partners analyzed the vast majority of investments made in 2021, and some conclusions of the report were:

An increase in mega-rounds (above US$50 million) of 4x compared to the previous year, which accounted for 70% of the total capital invested.

Approximately 63% of the total capital was concentrated in fintech and e-commerce. And about 52% of the total investment was allocated to more emerging companies in the ecosystem, up to five years of operation.

Sectors that used to have a shortage of capital grew: edtech, foodtech, healtech, and proptech (at the end of last year, several VC funds foresaw Contxto this trend). Also, compared to 2020, 3.5 more startups reached a private valuation of US$100 million.

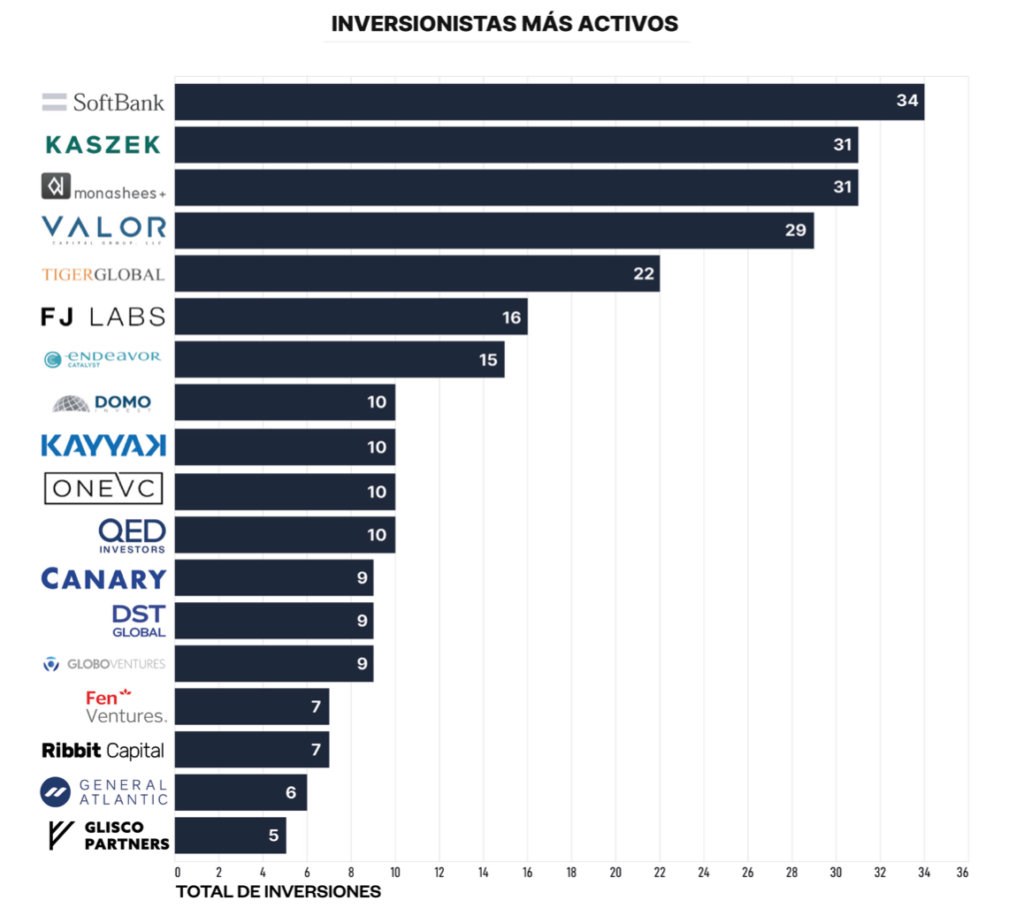

Of these, most of the investments (62%) came from foreign funds such as SoftBank, Kaszek, Monashees, Valor Capital Group, Tiger Global Management, FJ Labs, and Endeavor Catalyst. The other share (38%) came from local funds.

In fact, Japanese firm SoftBank has been one of the most generous funds to the region, creating Latin American Fund I in 2019 with US$5 billion and Latin American Fund II in 2021, which added US$3 billion of venture capital.

During that record year, every day, one or even two different companies were heard of raising a new round of investment, and unicorns abounded. In December 2021 alone, JOKR, Clara, Incode, Merama, and Olist achieved that status with a US$1 billion or more valuation.

In the region, there were 31 unicorns out of the 1,000 in the world as of last year, representing 3% of the total number of companies that have raised a round of capital and less than 0.0001% of the total number of companies in LatAm.

Of these unicorns, 59% are concentrated in Brazil and 20% in Mexico, with those in the fintech, e-commerce, transportation, and logistics sectors gaining ground. It should be noted that LatAm unicorns have an average valuation six times higher than the investment they have attracted.

But in this roller coaster, after a rise comes a decline, and the ecosystem has begun to see difficulties in 2022.

A complicated outlook for startups in the next 18 months

While this 2022 follows the great uprisings and some new unicorns so far this year, such as Jeeves, Betterfly, Habi, Dock, Nowports or Kushki, and the arrival of new funds such as Gilgamesh Ventures, Nido Ventures, and SoftBank’s Upload Ventures, the crisis has begun to live. One of the first symptoms was that large companies such as VTEX, Creditas, Loft, Buenbit, and Bitso had made significant layoffs.

The report mentions that the outlook for 2022 is based on “a significant drop in the stock of companies in the technology sector, rising inflation, an increase in interest rates, and a war”.

It says that this decline is being seen globally. In the face of the new conditions, large funds like SoftBank, Tiger Global, a16z, and others will be much more selective and cautious in their investment. To see this, just look at the pay cuts that SoftBank’s top global executives took this year, as well as its US$26.2 billion worldwide loss.

Despite the difficult times, Vincent Speranza says the “party is not over” for big investments. He says there will still be money, but capital will go to those with a clear path to profitability and entrepreneurs with a degree in scarring, i.e., those who know how to attract talent and course-correct.

The report points out that what will follow is that VC funds will focus on unit economics; that is, efficiency will be prioritized versus growth at all costs. This will lead to startups seeing a slowdown in investments, hiring freezes, layoffs, market capture strategies versus international expansions, and less favorable conditions for valuations.

However, those who will benefit will be the more established startups with clear fundamentals that have been well-capitalized by the boom of the previous years.

The challenges we are seeing in this first half of the year are just a sample of what will come in the next 12 and 18 months. As Martin Escobari, head of General Atlantic’s LatAm business, states in the study, “a more complicated panorama is expected.”

“This is an opportunity for the strong to become stronger,” he adds. So the most consolidated startups will have adjustments and challenges to stay afloat and keep moving forward.

According to Endeavor and Glisco Partners’ work, the most accentuated slowdown effects could be reflected in the second half of 2022.

As for IPOs, they continue to be a challenge for startups. Only 18% of IPOs on NYSE, NASDAQ, and B3 of Latin American companies are of technological origin. The new scenario for 2022 makes it even more complicated. Speranza foresees that not much will be heard about IPOs, since the public markets, which have fallen sharply, will have to be rebalanced.

Changing the rules of the game

The director of Endeavor in Mexico sees a vast market opportunity. Local funds still have money they will not leave untouched in their accounts. Although the traditional economy will have a recession, entrepreneurship is counter-cyclical, so there will be an opportunity to obtain resources in a more controlled manner. Now that a readjustment with new rules is coming, something that has been working for a decade cannot be dropped, and a crisis also represents opportunities, he added.

According to Speranza, the rules must change, as startups must focus on unit economics and healthy growth. He says these metrics allow startups to evaluate their profitability, sustainability, and the effectiveness of their strategies. And they are not only functional indicators for technology companies. They are also functional indicators for VC fund evaluations.

(Main image: Adobe Stock)

You May Also Be Interested In: What Latin American Startups Can Do To Overcome This Difficult Time

Por Yanin Alfaro

February 17, 2026

Por Israel Pantaleón

February 17, 2026

Por Stiven Cartagena

February 13, 2026