The Economic Commission for Latin America and the Caribbean (ECLAC) revealed that Foreign Direct Investment (FDI) in Latin America and the Caribbean saw a significant increase of 55.2% in 2022, reaching a historic record of USD $224,579 million. This represents the highest since records began and is mainly attributable to the increase in all investment components, particularly the reinvestment of profits and the growth in the services sector.

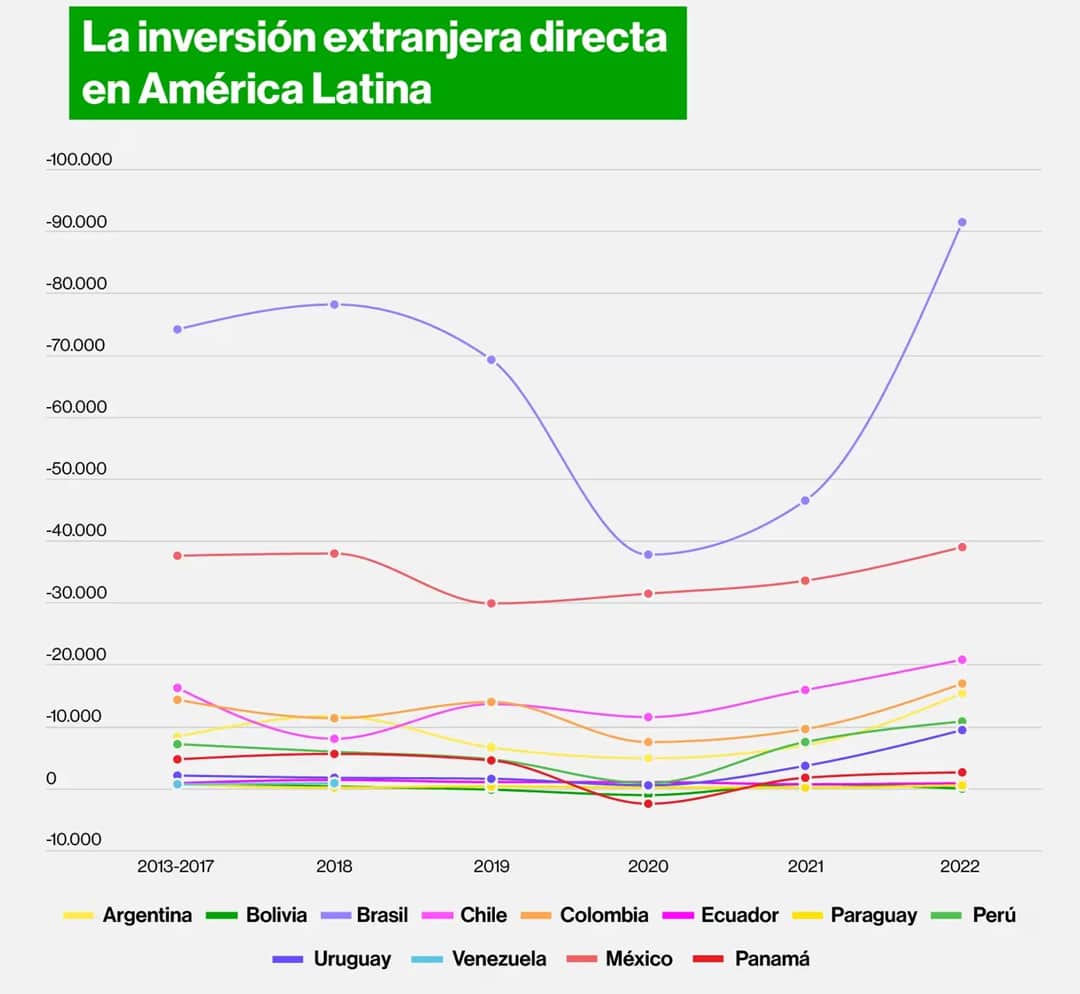

Since 2013, FDI has remained within the USD $200,000 million barrier. While this increase aligns with the post-pandemic economic recovery, the report warns that it may not be sustained in 2023. However, in 2022, FDI accounted for 4.0% of the regional GDP.

José Manuel Salazar-Xirinachs, Executive Secretary of ECLAC, emphasized that while attracting and retaining FDI is crucial for the sustainable and productive development of the region, nations must seize new opportunities. These arise due to changes in global value chains and the relocation of production. To maximize FDI’s contribution to development, Salazar-Xirinachs urged the implementation of robust policies focused on value addition, human resource development, infrastructure, and building local capacities.

In data compiled and published by Bloomberg, Brazil led in FDI reception in 2022 with 41% of the regional total, followed by Mexico, Chile, Colombia, Argentina, and Peru. Costa Rica was the primary recipient in Central America, although Guatemala experienced a drop after an unusual spike in 2021. In the Caribbean, the Dominican Republic and Guyana were the primary beneficiaries.

It’s crucial to highlight that 54% of FDI was directed to the services sector regionally. However, an increase was also observed in the manufacturing and natural resources sectors. The leading investors were the United States and the European Union, excluding the Netherlands and Luxembourg. Additionally, there was a noticeable increase in FDI from countries within the Latin America and Caribbean region, rising from 9% to 14% of the total.

Regarding investments abroad by Latin American transnational companies, known as “translatinas”, 2022 recorded a historic USD $74,677 million. Additionally, FDI project announcements in the region increased by 93%, totaling approximately 100,000 million dollars. Surprisingly, the hydrocarbons sector led these announcements, followed by the automotive and renewable energy sectors.

ECLAC recognized the energy transition as a pillar of future economic growth. It urged governments to prioritize it, highlighting that FDI is essential to accelerate the transition, transfer technology, and enable emerging technologies. ECLAC argues that a vital role of governments is to develop policies promoting investments in renewable energies, ensuring a fast, safe, and competitive transition.

Despite the importance of renewable energy, ECLAC also pointed out the relevance of the non-renewable energy sector for specific countries in the region, especially regarding revenue generation, productive development, and energy security. This consideration is crucial to ensure that the energy transition does not leave any nation in the region behind.

In conclusion, although 2022 was a record year for FDI in Latin America and the Caribbean, ensuring these investments contribute to the region’s sustainable development is the challenge. Governments must adopt efficient policies to maximize the positive impact of FDI, especially in areas such as the energy transition.

What do you think about the growth of foreign investment in the region?