Por Daniela Dib

January 26, 2022

Vest, a company created by entrepreneurs from Mexico and the U.S., has launched a Latam-focused app for commission-free trading in US stock markets; specifically, on the Nasdaq and the New York Stock Exchange (NYSE).

The launch follows a US$6 million seed round raised by Vest in 2021 led by Founders Fund. Other investors included Nazca, Class 5 Global, FJLabs, Tamarack Global, and individual investors like Carlos García Otatti, founder and CEO of Kavak; Scott Shleifer of Tiger Global; Nico Barawid, founder of Casai, Gerry Giacomán Colyer, founder of Clara, and the founders of Moons.

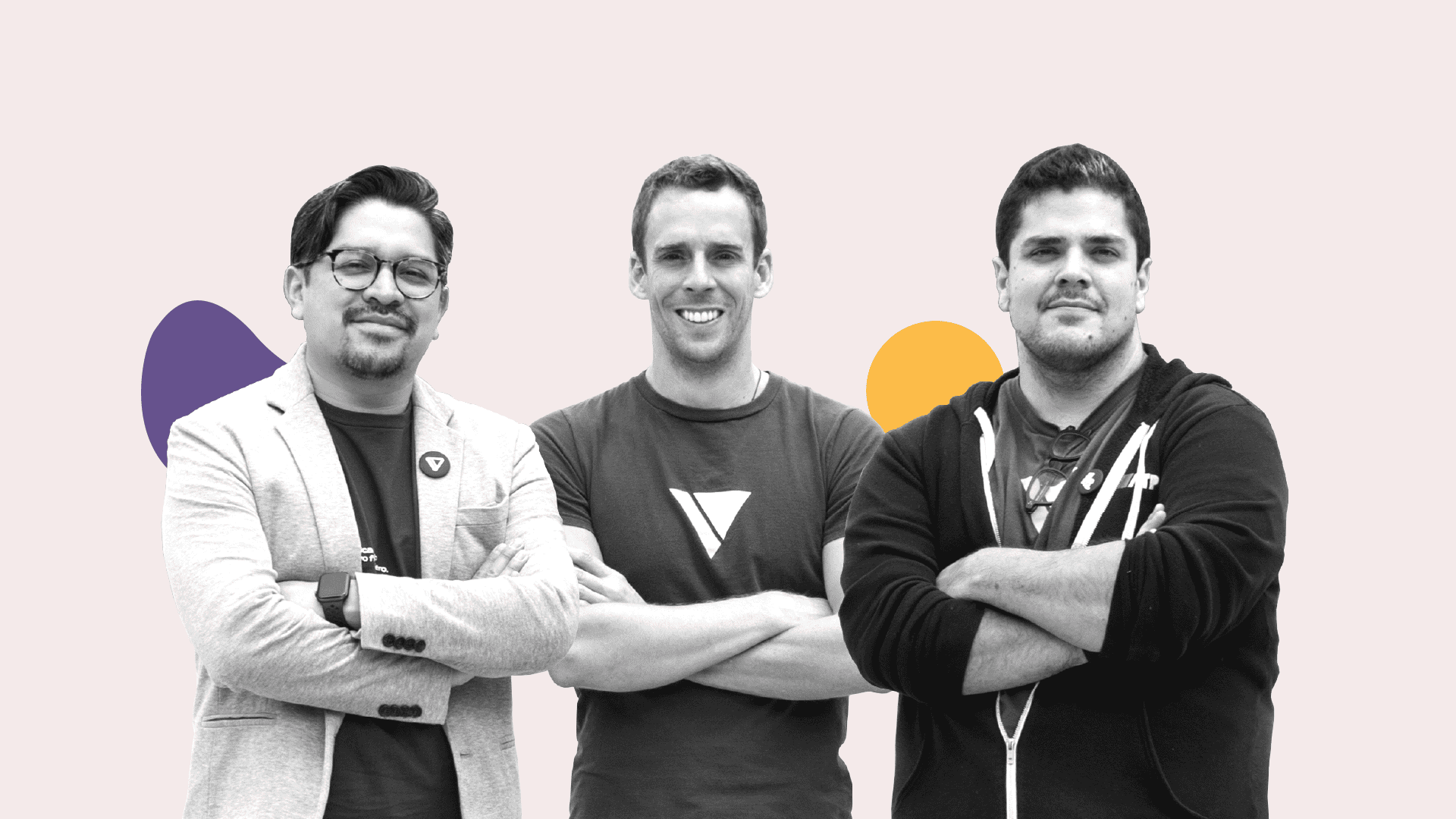

Vest’s founders Aaron Polhamus, Jaime Rodas, and Miguel Arroyo are veterans of the fintech ecosystem in Mexico. Polhamus was CTO of Credijusto before co-founding and leading Vest as CEO. Rodas, who serves as COO, was part of Resuelve Tu Deuda, where he directed the accounting platform Enconta.

Arroyo is Vest’s CPO. He previously co-founded Mazing Shop, a software development company that worked with Credijusto. His expertise as a designer has been key for Vest to have a very careful approach in terms of a seamless and intuitive user experience.

Now available for download on iOS and Android, Vest offers a platform to invest with local currencies in public stocks trading in U.S. dollars, including ETFs. The platform will eventually include more products such as advised portfolios, investment simulators, and educational content for users who are just entering the world of investments. “We also have crypto on the map,” Polhamus mentioned during an interview with Contxto.

The app is designed to eventually work throughout Latam and even among Latino investors in the U.S. However, Mexico and Brasil are key markets. Vest will allow users’ accounts in these countries to be funded through local transfer systems. Plus, the company is applying for an investment adviser license with the Mexican regulatory authorities. If they get it, Vest would also offer investment portfolios listed in Mexican pesos.

“Mexico and Brasil interest us for two reasons: they are the largest markets in the entire region, and their inhabitants do save money, but invest very little of it,” said Polhamus. In Mexico, for example, 80% of the population with a constant income saves some amount, but only 15% of it interacts with some type investment asset. The market could benefit from apps like Vest, since younger generations do not face a good outlook for their retirement funds.

Polhamus stressed that Vest is quite serious in terms of financial education to attract and retain new investors. The app comes with several sections. One, called Bites, informs the user what is happening worldwide. Another one called Moments offers the news of the week. Though it’s in an initial stage, a third one will include content that “is part of the user’s financial life”.

Vest seeks to be a “financial ally” of its users through the different investment stages they go through during their lifetime. “We’d rather have them build wealth on our platform with long-term compounded earnings rather than play casino to get rich overnight,” explained the CEO.

Vest is clearly inspired by the American app Robinhood, created in 2015 and a pioneer in offering an investment tool without commissions. After the pandemic, Robihnood has had extraordinary growth: it went from 12 million users in 2020 to 22 million in the last quarter of 2021. Plus, it went public last year and has played an important role in the stock market by helping to democratize investments, making them accessible to individual investors.

You may also be interested: Women tend to be better investors, but “they don’t believe it”: Mario Valle Reyes

Por Santiago Cardona

March 4, 2026

Por Yanin Alfaro

February 17, 2026

Por Israel Pantaleón

February 17, 2026

Por Stiven Cartagena

February 13, 2026