A few days ago, Colombian fintech RapiCredit secured a USD$7 million debt investment from the U.S. fund Almavest. This company acquired part of the debt accumulated by the startup.

RapiCredit specializes in providing microcredits to individuals without access to banking services.

The fintech has provided credit opportunities to over 550,000 unbanked Colombians, and 36% of them become eligible to enter the traditional financial system after obtaining a loan from the company.

This type of fintech and its business model has been successful throughout Latin America, becoming a real opportunity for people without bank credit through these startups.

Similar fintech companies started emerging in various countries, such as Mexico, Brazil, or Colombia, offering loans or credit cards without checking banking histories, backgrounds, or current financial situations.

This proved very attractive to people who didn’t fit into the traditional banking system. It allowed them to ‘start anew’ in the financial environment or begin a credit history when other institutions or banks denied them products due to lack of history.

Other examples of startups that have revolutionized the fintech ecosystem in Latin America include Nu Bank and Stori, offering innovative products like credit cards for users to build a credit history from scratch.

Their business model propelled them to exponential growth, turning them into unicorns. They remain among the most valued startups in the region, offering a reliable option for individuals.

Recently, Nu Mexico officially requested authorization from the National Banking and Securities Commission (CNBV) to become a bank in the country.

Nu Mexico’s strategy aims to expand its product and benefit offerings for its customers and investors. This includes the possibility of offering payroll portability and higher deposit limits.

Nu Mexico, a subsidiary of Nubank originating from Brazil with 90 million customers, currently operates locally as a Popular Financial Society (Sofipo), characterized by its focus on transparent, simple, and customer-oriented digital finances.

This strategic step naturally follows Nu becoming the largest Sofipo in Mexico, one of the leading credit card issuers in the country, and after the successful launch of savings accounts and debit cards, attracting one million customers in just one month.

On the other hand, Mexican unicorn Stori also started by providing credit cards to unbanked individuals or those rejected by traditional banks, with a product that quickly gained consolidation.

Stori also became a real option for people who still need credit card access and those wishing to start their credit history but are not authorized by any institution.

In 2022, Stori reached two million customers, currently exceeding 2.2 million. It was also the year it achieved a valuation of USD$1.2 billion, attaining unicorn status.

This fintech, born in 2018, aims to provide 80 million Mexicans with access to a credit card. For this reason, Stori has continued to raise investment rounds to authorize more credit cards.

There are many success stories of fintech startups that have established their products among people seeking financial options not found in traditional banks.

Companies like Tala or Baubap are just examples of other startups offering online loans with very accessible requirements for users in need of cash and looking to build a credit history.

These applications have been a lifeline for many people starting their financial lives or not qualifying for products from traditional banks due to their backgrounds.

Like several fintech companies, these have secured million-dollar investment rounds to boost their growth and expansion in Latin America. They have established themselves in the region, and their customer base has grown due to the trust their operations offer to users and investors.

Undoubtedly, these online loan models have proliferated throughout Latin America, more in some countries than others. However, amid the success of these fintech applications, other companies emerged to copy the model but to defraud their clients through attractive but harmful ‘products.’

The Dark Side of Fintech

Despite having nothing to do with legally established startups, their innovative operating mode has encouraged ‘ghost’ companies, including criminal groups, to offer financial products, mainly microcredits, with completely illegal conditions and against users.

These illegal applications took advantage of the momentum of digital banking operations to reach out to ‘customers’ in need of credit.

The COVID-19 pandemic caused many businesses to close, exponential increases in unemployment, and the lives of millions of people suddenly affected.

Money from settlements or businesses began to disappear, so many people needed to obtain money to provide for their homes.

Simple requirements, accessible to any user without a banking backgrounds and without checking credit history, were the perfect bait to lure users into their networks of deception, fraud, and corruption.

These illegal ‘fintech’ companies invested in designing their interface, platform, logo, and image to appear established entirely and legitimate. However, it was all a facade, as they acted and continued to act with premeditation, malice, and advantage.

Indeed, the online loans they offer are approved in record time, sometimes in just a few minutes, and the money is transferred to their customers’ accounts immediately or within a few hours, even when it takes much longer.

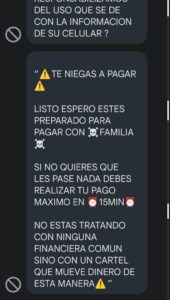

The nightmare begins when the collection from these companies occurs, using intimidation, extortion, psychological violence, and downright illegal methods or methods prohibited by the laws of the countries where they operate.

Since they are not legally registered with the institutions that control financial and banking entities, authorities need more elements to counteract or stop their operations.

It is urgent to legislate these applications throughout the region, as they also operate without issues in the app stores of the operating systems used by mobile devices where they can be downloaded.

Cases in which one of these illegal applications has ‘disappeared’ from online stores have been known to reappear in just a few days, changing image, name, and logo. Authorities have been unable to stop this.

Authorities have even declared that it is a method used by criminal groups to launder money for the organization.

If users ever fall into the networks of these applications or ‘fintech,’ the recommendation is to contact the cyber police in their home country, file a complaint, and primarily review all the backgrounds and the origin of the company they plan to use.

Indeed, financial applications, which have democratized access to financial services and expanded their reach, also face the challenge of ensuring user safety against the risks of fraud and cybercrimes.

User security is paramount, and effective regulation is required to mitigate the risks of rapid technological advancement. Authorities, investors, developers, and entrepreneurs must work together to eliminate scams, deceptions, and extortions to which users are exposed in the digital world.