500 Global (formerly 500 Startups) is a fund and business accelerator focused on early stage companies. In 2012 it opened offices in Mexico, after acquiring the firm Mexican VC, beginning its Latin American operation. In its first decade, they have invested in more than 240 startups in the continent, including Konfío, Clip, Ayenda, 99Minutos, Conekta, Jüsto, Terapify and Graviti. René Lomelí is a 500 Global LatAm partner and wrote for Contxto about what they have learned during this time.

Latin America is a region that is full of opportunities for the growth and consolidation of startups and, up until now, it has presented only a small part of its potential.

Last year we experienced a watershed moment in the history of venture capital due to the closing of investment rounds and the consolidation of several Latin American startups as “unicorns”. In contrast, this year the region is seeing a more cautious economic climate in which investment is not as abundant as it was just a year earlier.

But beyond the ups and downs typical of this ecosystem, we are convinced that Latin America is a vibrant region with immense opportunities, no matter what period it is living through.

This month, 500 Global celebrates 10 years of having its base of operations in Latin America. Over this time, we have accumulated multiple lessons after becoming partners to more than 240 Latin American businesses and accompanying them on their exciting paths of growth.

For all this, we share 10 lessons from investing in the region over a decade.

1. The people are more important than the business model

In 2013 we had to evaluate around 100 companies; today, we evaluate about two thousand in each batch. In all this time, we have learned that investing in a startup implies investing in a person or group rather than a business model.

For example, Alexis from 99minutos initially presented us with an e-commerce, not a logistics business as it turned out to be in the end; Andrés from Ayenda introduced us to a hotel management system, not a virtual hotel chain as it is now. Business models may change, but what matters is the people’s ability to grow and scale their businesses.

2. It is not possible to compare startups or founders

Each company is different, and each industry is different, its type of client and its pricing as well. We have learned that we cannot compare companies with each other, nor take for granted that what worked for one company will work for another.

There is not even a founder that is the same as another. It is not the same thing to live in Mexico City, where many entrepreneurial events are held, as it is to live in a smaller city where there is no talk of innovation or entrepreneurship. However, both still have an equal chance of making a successful company.

Each founder is different and each company is different; we take this into account both when evaluating a company and throughout our partnership with them. We analyze each case and guide them based on their unique variables.

3. Processes matter

During these 10 years, the ecosystem has changed, as has the volume we receive from startups. For this reason, the way in which we evaluate companies has also transformed.

We have understood that to be able to respond to companies in less than 30 days, as we do today, and to obtain the results we expect, it is essential to adhere to our process, an important part of which includes due diligence that allows us to ensure that the company meets specific standards.

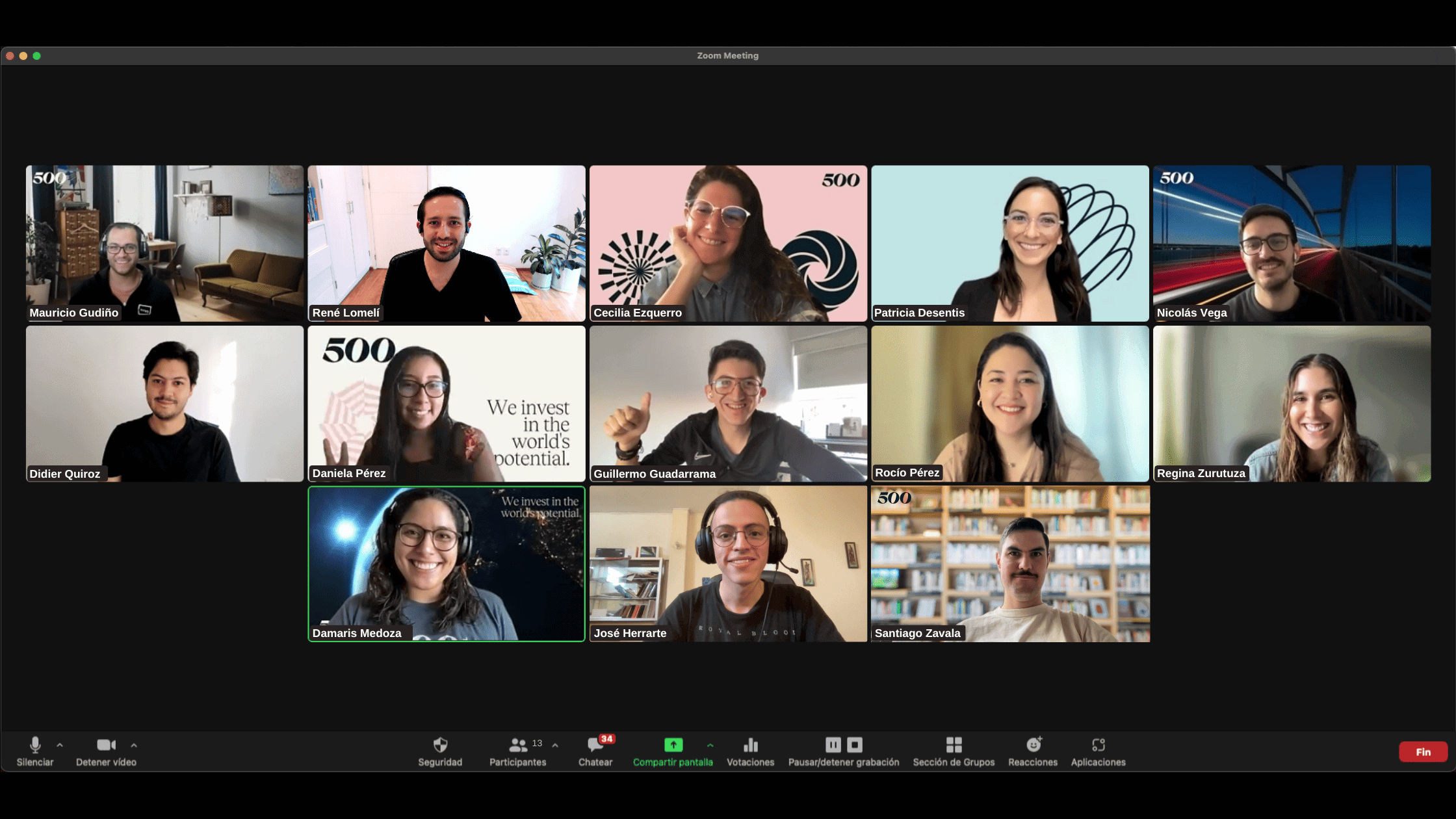

4. Our team is one of our most valuable assets

The formation of our team has been essential to achieving everything we have done at 500 Global in LatAm. The construction of our internal culture directly impacts the performance of our investment fund, both in our selection of startups and in the services we offer to our companies.

5. Working in venture capital requires “loving the jersey”

In other words, you need to be willing to generate an impact on startups and create value within the ecosystem. That’s why when we hire, we don’t care so much about the person’s experience in our industry; we focus more on their passion for the world of investments, and this has become a part of our DNA.

We need people who feel the same emotion we do, for example: seeing how David Arana of Konfío turned his company into a unicorn, remembering that he came to our program when 500 Global had just started operations in Mexico.

6. Where there is a vibrant ecosystem, there is a great opportunity

There will always be ups and downs in an ecosystem like this, but there will also always be opportunities to invest because it is a region full of talent. Therefore, being consistent with our strategy generates long-term results.

Another important aspect that this ecosystem requires in order to take advantage of its opportunities is that there is a collaboration between all its players. Therefore, even though there is competition in the industry, it is essential to understand the balance between cooperation and competition so that we can all be successful.

7. Capital is available for good opportunities

A company that is a good investment opportunity, and a professional founder with great follow-up and diligence, will always have a better chance of attracting capital.

However, capital demands respect and responsibility. It is crucial that the founders value this capital because it is not only money but also a tool that allows growth.

In addition, behind the capital, there are an effort, a team, and objectives to meet. It is not easy to obtain, neither for the investment fund nor for the founder who receives it to grow their company.

8. Adapting to the speed of change is essential

Over time, the manner and expectations of the founders regarding the investment funds to which they present opportunities have become more demanding. As a fund, it is essential to adapt. If not, you stay out.

Today, what a founder values most is his time. Raising capital fills your gas tank to extend the life of your startup. Saving time allows you to prioritize and focus on what your company needs.

That is why we can make decisions—from the moment a startup is presented to us until we decide to invest—in seven days or a maximum of one month.

9. Being a partner is much more than just investing

Executing an investment entails support, services, and added value; it does not only imply depositing the money into the company’s account. It consists of supporting their needs, getting your hands “dirty,” and really bringing value to the table.

We pay close attention to how much the founders value us as partners throughout our relationships with them because investments have no expiration date. Once you become a partner to a company, you are there for the life of that company.

We make a partnership commitment in which we build long-term relationships, which allows us to have, for example, the possibility of investing in the next round of a company.

10. Developing strong relationships with investors is essential

Whether or not you have invested in 500 Global, it is very important for us to follow up on our relationships with investors because building an investment fund like ours is only possible with their help.

In this sense, relationships with active investors in the region are very valuable to us because they have the potential to become our future investors, to invest directly in the companies in our portfolio, or recommend a startup in which they have already invested. By nurturing these relationships, what comes back can only be positive.

In summary

We feel very privileged to have participated in the growth of the Latin American ecosystem during these 10 years. We are aware that this is just the beginning of developing our region and we are very excited about what the future holds.

The next decade is a challenge, in which more and more players will be added to the ecosystem; where decision-making will become faster and faster; and in which problems related to areas such as health, education, financial inclusion or food need improved, technology-enabled solutions.

We will continue to invest in the most talented entrepreneurs of the region in order to generate a positive impact on the economic development of Latin America.

Main image: Adobe Stock