Por Jose Pulido

July 17, 2023

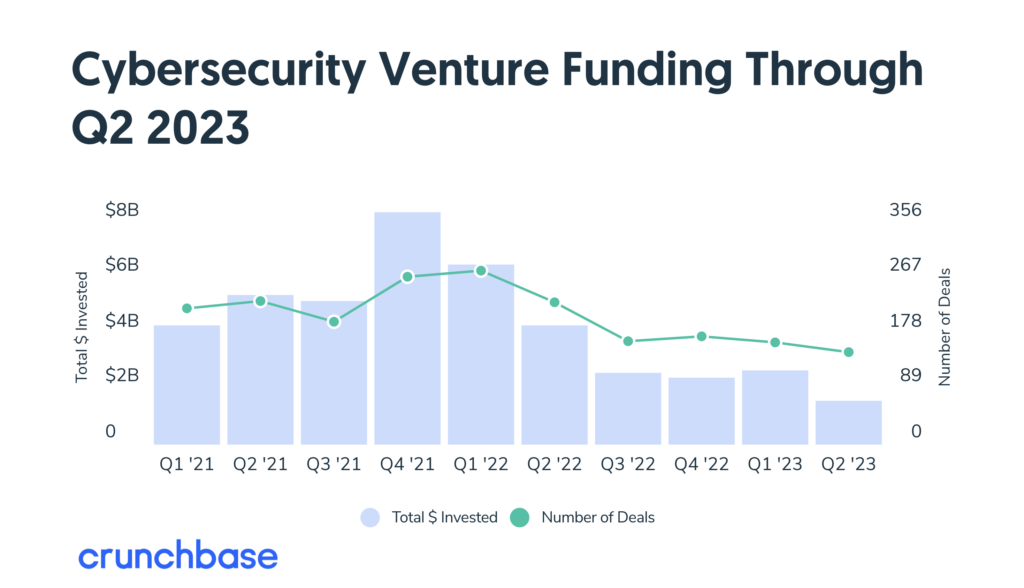

Venture capital funding for cybersecurity reduced to just over $1.6 billion in the second quarter of 2023, marking a 63% drop compared to the same quarter last year, when startups secured nearly $4.3 billion, according to data from Crunchbase.

The report highlights that the figures for the first half of the year also contrast with those of the first six months of 2022, where companies had raised $10.8 billion in the first half of the previous year, whereas this year they only managed to raise $4.3 billion, representing a 60% decline. Thus, two years after raising $23 billion (in 2021), “it seems that a startup will only be able to raise a third of that.”

But it’s not just about venture capital; Crunchbase points out that there has also been a drastic decrease in deal volume. In the second quarter, there were 148 funding deals in the cybersecurity field, a 35% decline compared to the 228 deals completed in the same period the previous year, marking the lowest level in years.

Cybersecurity Venture Funding Through Q2 2023. (Source: Crunchbase)

Additionally, throughout the first half of the year, only 312 deals were announced, representing a 38% decrease compared to the 507 deals announced in the first half of the previous year.

A clear example of this decline both in the amount of money and the number of transactions can be seen when looking at “large rounds,” those of $100 million or more.

During the first six months of the previous year, there were 33 of these rounds in the cybersecurity field. However, in the first half of this year, only 11 were carried out, representing a 67% decrease.

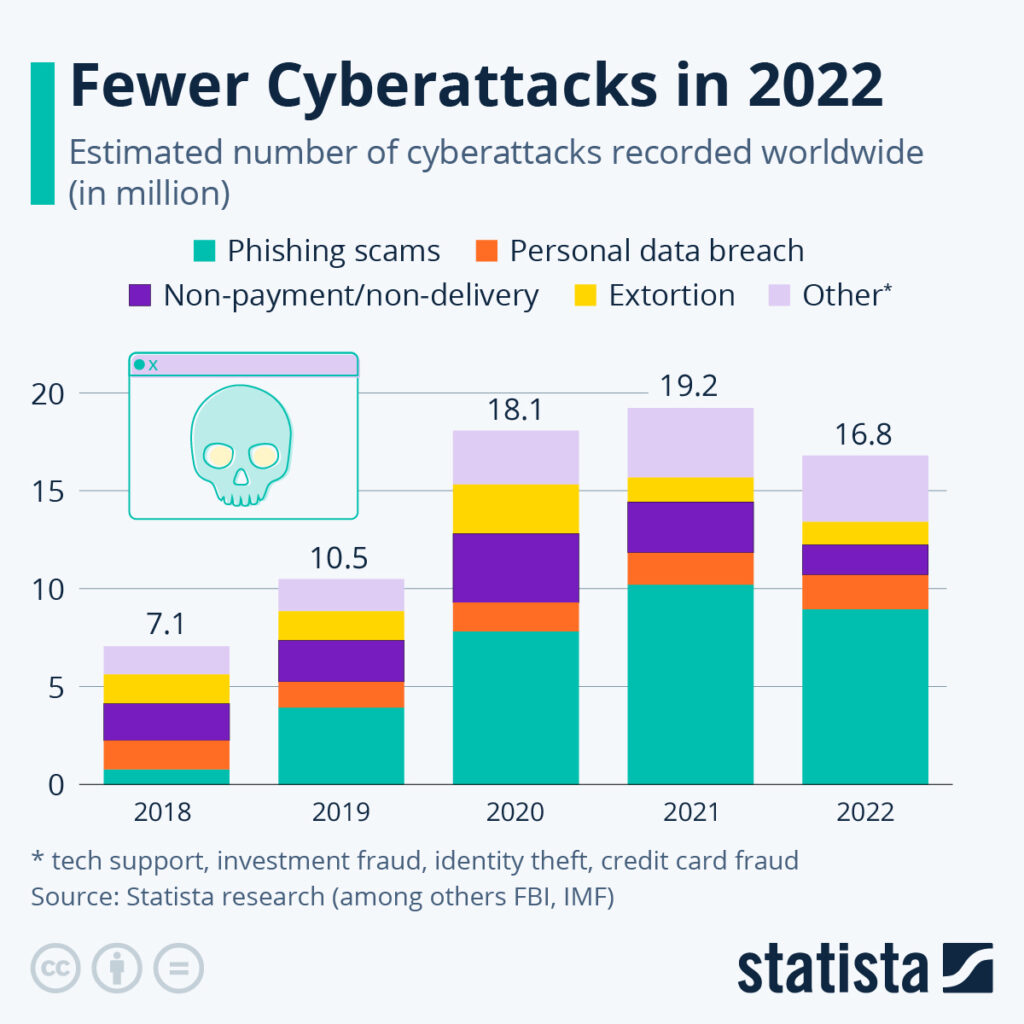

One of the major challenges facing the cybersecurity market is cyberattacks. Spyware, malware, and phishing have grown exponentially during 2021; according to Statista, 50% of cyberattacks were concentrated on phishing practices two years ago.

The graph shows the major incidences of cyber-attacks. (Source: Statista)

In 2021, SoftBank Group announced the launch of SoftBank Latin America Fund II, its second private investment fund focused on Latin American tech companies, with an initial commitment of $3 billion. Among its hub companies are startups like incode or unico, bitso, or Kavak. Meanwhile, Ocean Report forecasts that the Latin American cybersecurity market will have a general Compound Annual Growth Rate (CAGR) of 12.3%, with a value of $20.65 billon by 2023.

You may be interested: Great Expectations: Latin American fintechs’ unfinished business according to VCs

We recommend: Use of fintech apps grows 54% in Latin America

To read the information in detail, visit: Crunchbase

Por Stiven Cartagena

September 15, 2025

December 4, 2024

November 20, 2024