Por Contxto

April 10, 2024

– Pago Confiado, based in Guanajuato, joins a group of 76 firms already authorized under the terms of the Law to Regulate Financial Technology Institutions, also known as the Fintech Law.

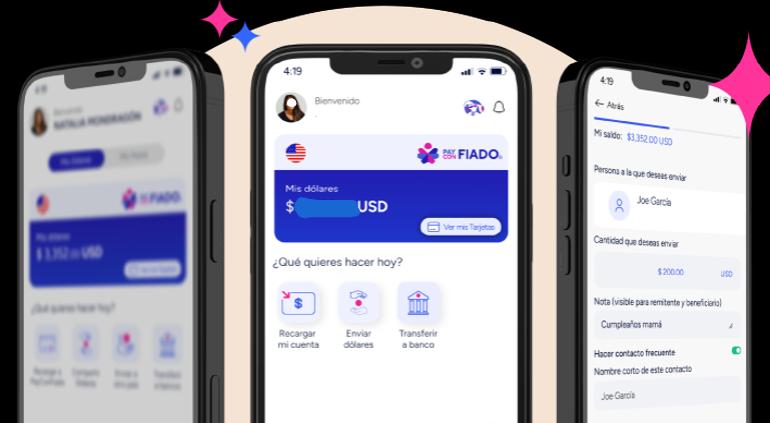

– Pago Confiado is part of the Fiado conglomerate, which offers financial services to Mexican migrants in the United States and their families in Mexico.

—

Pago Confiado joins a universe of 76 firms already authorized under the terms of the Law to Regulate Financial Technology Institutions, also known as the Fintech Law. The official letter states that “the members of the Interinstitutional Committee, in accordance with Articles 11 and 35 of the Law to Regulate Financial Technology Institutions, unanimously agreed to grant authorization for the organization and operation of an Electronic Payment Funds Institution to be named Pago Confiado.”

Pago Confiado, registered in the Public Registry of Commerce since September 2022, has Deirdre García Cienfuegos and the company Fiado as its main shareholders. Fiado is part of a homonymous conglomerate that offers financial services to Mexican migrants in the United States and their families in Mexico.

In addition, the Collective Financing Institution (IFC) Lendera is now listed in the Financial System Catalog, although its official letter has not yet been published in the DOF. Lendera’s status in the catalog is authorized, meaning it has not yet started operations. There are currently 54 institutions in operation.

If Lendera’s authorization is published in the coming days, the regulated universe would rise to 77 Financial Technology Institutions, with 52 IFPEs and 24 IFCs. The average time for the regulatory process, from application to the publication of the official letter in the DOF, is 796 days.

Por Israel Pantaleón

January 20, 2026

Por Israel Pantaleón

December 17, 2025