Por Sandra Pérez

September 27, 2021

The insurance startup Súper was founded 2019 with one mission: to ensure properties against damages caused by earthquakes. However, this year it has expanded its offering to life insurance and is seeking to provide insurance against hurricanes in 2022.

Súper is a Mexican insurtech that seeks to make insurance payments simpler and faster, without intermediaries, coinsurance, or deductibles. According to its website, the company uses data to help it determine claims. It also relies on acceleration models developed by seismic energy company ERN, Bloomberg noted.

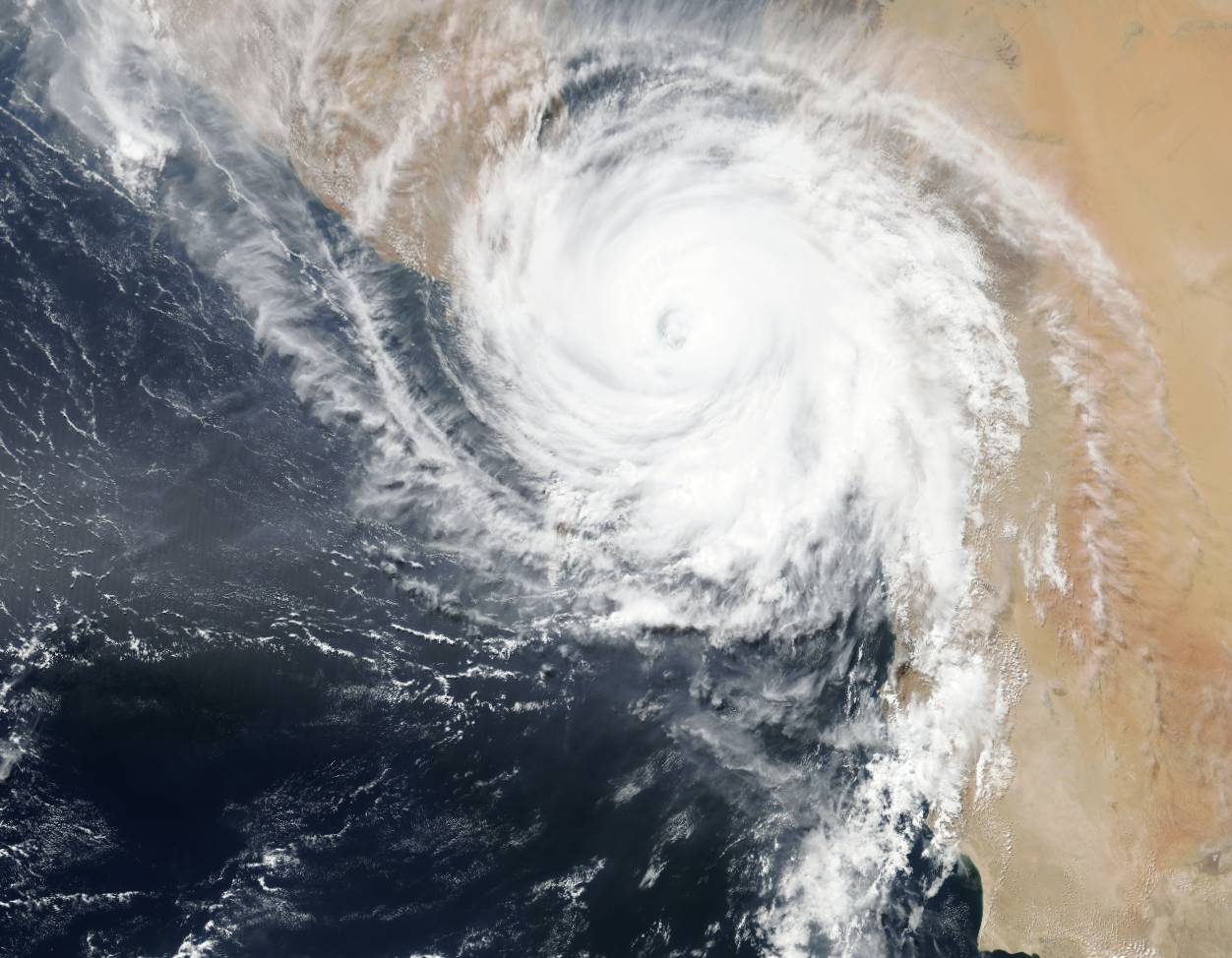

The Insurtech sector is booming in Mexico, a country that’s vulnerable to several natural phenomena like hurricanes, earthquakes, and heavy rainfall, said the Mexican Institute of Water Technology.

Mexico is located between the Pacific and Atlantic Oceans, as well as on the edge of the highly seismic region of Ring of Fire in the Pacific. The country is also surrounded by five tectonic plates, which increases its chances of severe earthquakes.

Due to these conditions, the Mexican Association of Insurance Institutions (AMIS) said that around 41% of the population is exposed to a natural disaster. However, it points out that only around 25% of the country’s households have insurance to cover such damage.

The low number of insured properties may be due to a cultural problem, Sebastian Villarreal, CEO of Súper, told Techcrunch. The existing products on the insurance market are not the best because the policies are “expensive, difficult to buy, and don’t pay much”.

These circumstances are making Súper look into offering more services. In a country that is hit by multiple hurricanes every year, the company plans to expand its services to offer insurance against potential damages to private property, especially in the states of Quintana Roo, Campeche, Veracruz, Jalisco, and the Baja California Peninsula, its CEO told Bloomberg.

Villarreal also mentioned that there is the possibility of raising a new round of financing (Series B) of $30 million.

So far, Súper’s founders David Luna, Sebastián Villarreal, and Marco Antonio Ahedo) –who are also industry experts– have raised $9.4 million since the company was founded in 2019. Of that capital, $2.4 million were raised in a seed round in which investors like 500 Startups Mexico, Broadhaven Ventures, and Village Global, invested.

According to Crunchbase, Súper’s last funding round was in July. Latin American VC firm ALLVP invested $7.2 million in a Series A.

Súper is one of the 80 Insurtechs operating in Mexico. Together, they generated around $1.37 billion pesos in revenues in 2020, according to Endeavor’s Whitepaper Panorama Insurtech in Mexico.

The report also revealed that the industry is still at an early stage, but is experiencing tremendous growth: in 2020 alone, the year-on-year rate of startups increased by 46%.

The document also mentioned that improved insurance costs and access to insurance through technology creates a safety net, critical for rural communities.

Por Yanin Alfaro

February 17, 2026

Por Israel Pantaleón

February 17, 2026

Por Stiven Cartagena

February 13, 2026