Por Ayax Bellido

December 11, 2023

In the dynamic business environment of Latin America, small and medium-sized enterprises (SMEs) are a fundamental pillar of the economy. According to the KoreFusion report “LATAM SME-Focused Fintechs,” 98% of businesses in LATAM are SMEs, equating to approximately 65 million companies.This landscape offers vast fertile ground for fintech intervention and growth, which have started to play a crucial role in these businesses’ digital and financial transformation.

SMEs in Latin America make up most of the business fabric and are a crucial driver for employment and production. Despite their importance, these businesses face a significant challenge: a financing deficit estimated at USD $1 trillion. This gap has created a unique opportunity for fintechs, emerging as innovative solutions to overcome traditional barriers to accessing financial services.

Currently, around 24 million SMEs in LATAM use at least one fintech solution, with digital payment acceptance being the most prevalent. This data reveals a growing trend towards financial digitalization, though there is still a long way to go. The latent demand for fintech services is significant, with an estimated 46.4 million SMEs susceptible to adopting these technologies.

Digital transformation in the SME sector manifests in various ways. Brazil and Chile lead this change, showing advanced adoption of digital payments and Software as a Service (SaaS)-based solutions. On the other hand, countries like Mexico and Colombia are making progress, primarily supported by mandatory electronic invoicing, while other regions are still in the early stages of their digital capacity.

The role of fintechs in this context is multidimensional. On the one hand, they facilitate access to financial services that were previously inaccessible to many SMEs due to barriers like bureaucracy, high collateral requirements, or the need for more suitable products. On the other hand, fintechs are playing a crucial role in modernizing business processes through automated solutions for payments, accounts receivable and payable management, and financial administration.

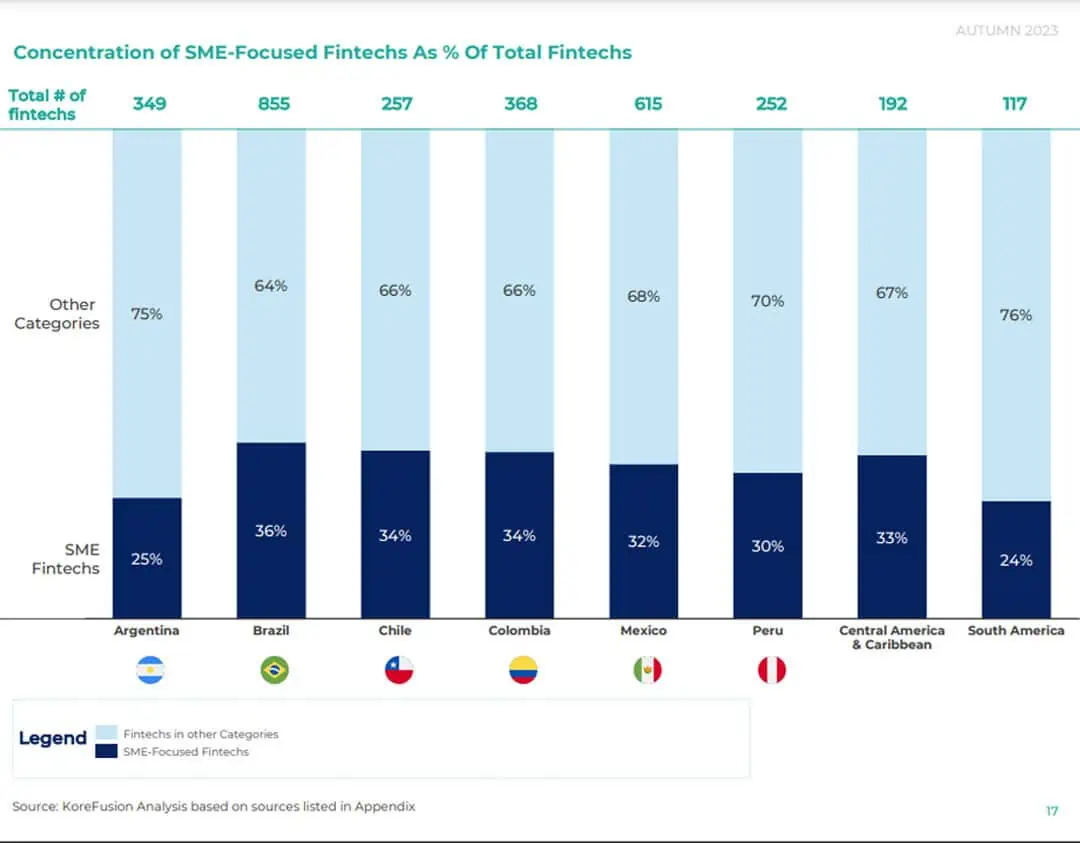

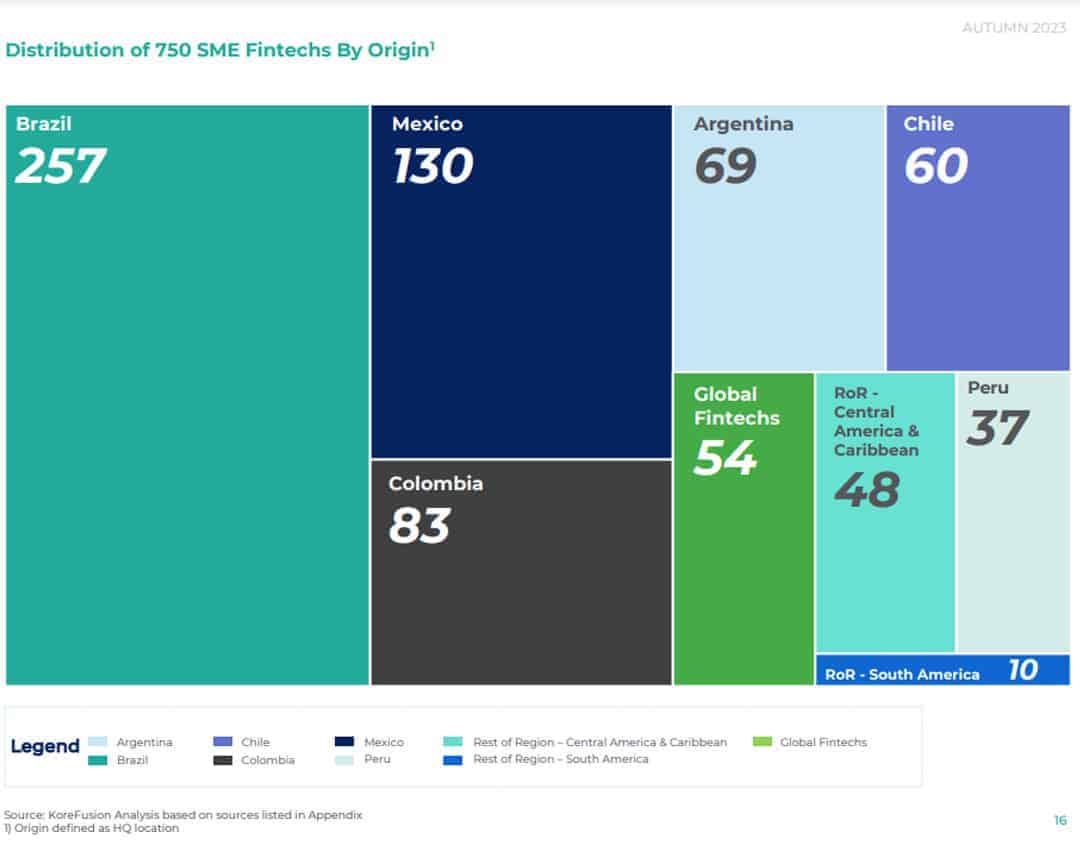

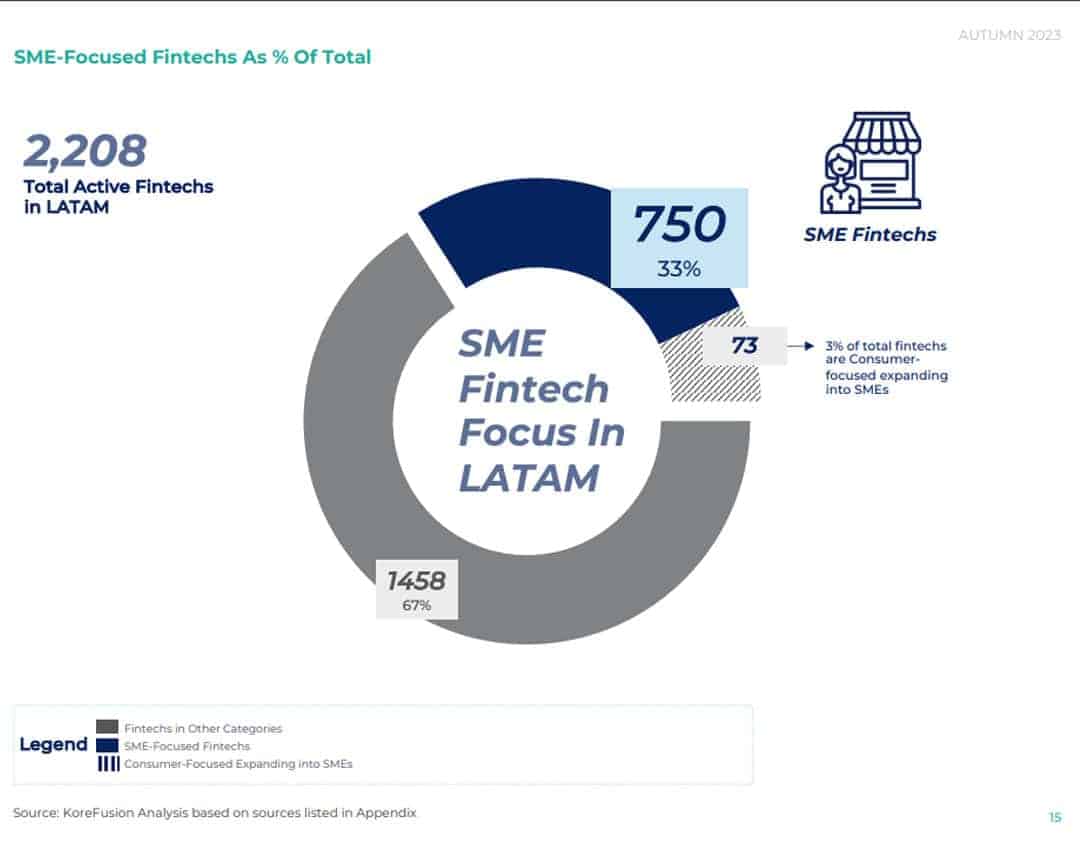

The report highlights that 33% of fintechs in LATAM focus on serving SMEs. These companies are mainly concentrated in four areas: payments, lending, enterprise financial management, and comprehensive digital banking platforms. However, financing in this sector is highly concentrated, with 85% of the total in the hands of only 23 fintechs. This concentration suggests that a few companies dominate the market despite diversity in service offerings.

Despite advancements, significant challenges still exist. Many SMEs continue to rely on personal financial products for their business needs. Additionally, there’s a general perception that current banking products need to justify their cost for SMEs, leading these businesses to depend on personal financial solutions.

Another crucial aspect is user experience. More than two-thirds of SMEs consider current financial service offerings inadequate due to usability, customer service, and user experience (UX) issues. These challenges represent significant opportunities for fintechs, which can design user-centered solutions to meet these needs better.

The future of fintechs in LATAM is oriented towards diversified business models and comprehensive platforms. While younger and less funded companies tend to focus on mono-products, more mature and better-funded ones are diversifying their offerings. This shift towards comprehensive platforms suggests a move towards more complete and interconnected services, which could significantly improve the efficiency and effectiveness of financial services for SMEs.

In conclusion, the report “LATAM SME-Focused Fintechs” sheds light on the significant role fintechs play in transforming SMEs in Latin America. Although challenges remain, the trend towards fintech solution adoption is clear and growing. With the evolution towards comprehensive platforms and diversified business models, the future of fintechs in LATAM looks promising, with the potential to drive broader economic transformation in the region.

Por Israel Pantaleón

January 20, 2026

Por Israel Pantaleón

December 17, 2025