Investment in startups in Latin America has experienced notable fluctuations throughout 2023. According to recent data from Crunchbase, although the third quarter saw a slight rebound in funding, there was a marked contrast in how funds were distributed among the different stages of startups.

The data shows that the third quarter of 2023 witnessed an 8% increase in funding compared to the second quarter, totaling approximately USD $699 million. However, compared to the same period of the previous year, 2022, there was a significant decrease of 46%. This gives us insight into the shifting investment climate.

For a broader perspective, it’s essential to look back at 2021, which stood as a benchmark for investment in Latin America, with a record USD $13 billion invested in startups. In contrast, the first three quarters of 2023 saw only a USD $2 billion investment in the region.

Where is the money going?

The third quarter of 2023 was especially prominent for late-stage investments. A total of USD $365 million was invested in these stages, showing a notable recovery from the previous quarter, which saw only USD $47 million. This trend was driven by significant funding rounds, such as the São Paulo-based real estate platform Loft, which secured USD $100 million. Other examples include the Brazilian startup Mottu, which received 50 million dollars, and Gringo, securing USD $30 million.

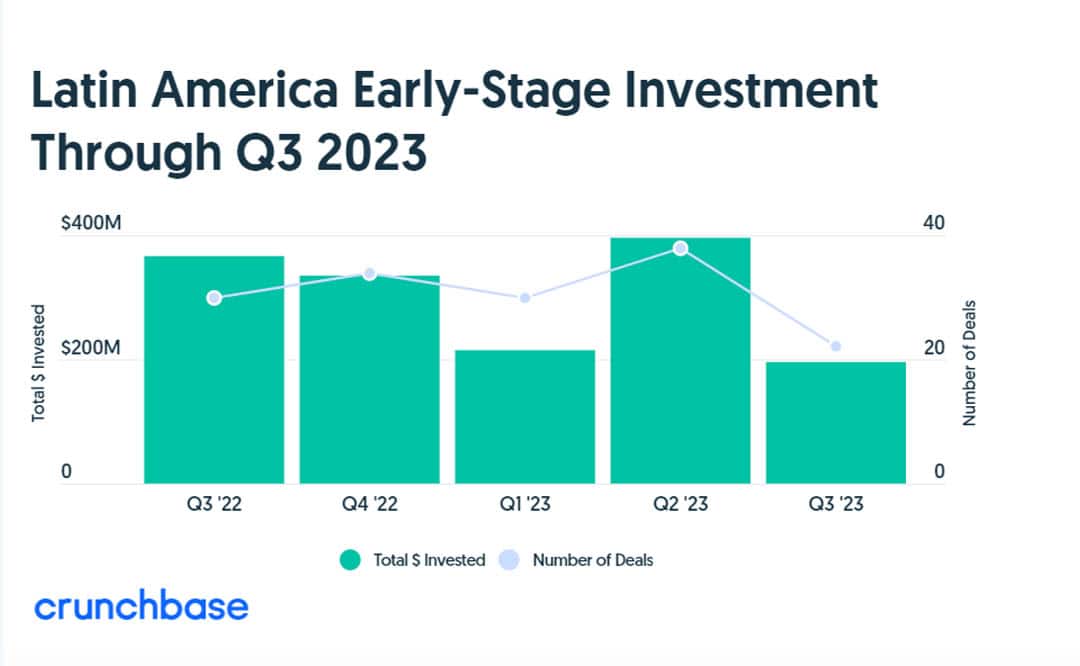

On the flip side, early-stage and seed-stage investments showed a sharp decline. In the third quarter, they witnessed an initial investment of USD $196 million, marking a 50% drop compared to the second quarter and a 46% decrease from the same period of the previous year, as per data provided by Crunchbase.

Beyond the numbers, it’s essential to consider the underlying trends shaping the startup ecosystem in Latin America. The past months have seen significant shifts. On one hand, many well-known companies, such as Loft, Neon, and Rappi, have had to adjust, including layoffs, to adapt to a tighter financial environment. Furthermore, IPOs have dwindled, and high-value mergers and acquisitions have stalled.

However, the resurgence of late-stage investments in the last quarter is promising. It indicates that while investors are cautious, they are still willing to back companies showing potential, even if current valuations might be lower than in previous years.

Founders and investors must remain vigilant about how these trends evolve and adapt accordingly. The following stages will determine if Latin America can reach (or surpass) the funding levels seen in 2021.