Por Cristóbal Fredes

June 17, 2022

Although it was only born last December, Mono has a lot to tell in its brief history. They took part in the recent Y Combinator winter batch. They then raised US$6 million in San Francisco in a seed round led by Tiger Global, where they were valued at US$50 million. It was in March, but the news is being released today.

Mono, which offers bank accounts for startups and SMEs, emerged mainly from the frustration that its founders experienced before with traditional banks in Latin America. Something happened to Colombians Salomón Zarruk (CEO) and Sebastián Ortiz (CTO) in TPaga, the startup they founded years before. To Juan Camilo Poveda (CPO) diagnosing these problems in Brazil when he worked at Nubank. And it happened to Chilean José Tomás Lobo (COO) when he was country manager of the local startup Laboratoria.

“I went through all the operational bullshit of dealing with the bank, of going once a month every month to sign an item, a lot of manual paperwork,” the latter says in a conversation with Contxto.

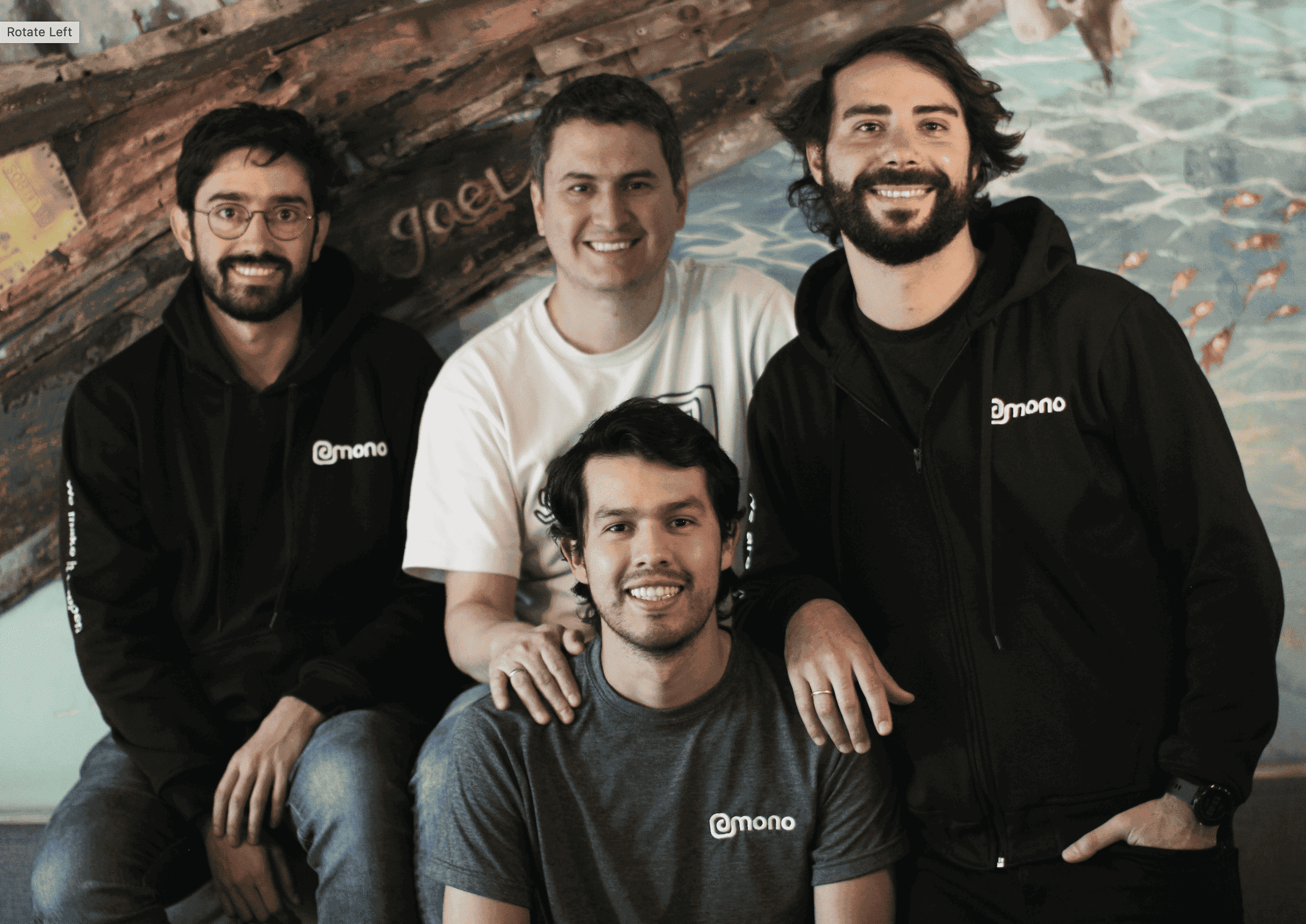

Top: Salomón Zarruk (CEO), Sebastián Ortiz (CTO), José Tomás Lobo (COO). Bottom: Juan Camilo Poveda (CPO) (Photo: Mono)

Lobo met Zarruk when they were both doing a master’s degree at the London School of Economics. There Zarruk told him about the idea that they later polished and would end up taking the current form of Mono: a bank account for companies that are opened in 15 minutes, which allows interbank transfers, payments with physical and virtual cards “and various things where you can do everything you need to move your business forward.”

“Our motto is that companies can focus on their business and not their bank.”

The COO emphasizes the importance of a fast pace: “Our differential here is speed. We have an account that opens in 15 minutes, different from the two weeks it takes for a traditional bank in Colombia. The only chance we startups have to win in the business world is to use speed to our advantage.”

In a challenging year for raising capital, they want to be able to give this quality to other startups. “They can focus on growing their business, talking to customers, selling, and not wasting time doing stupid things at their bank,” he says.

In addition to the bureaucracy of opening a bank account, Mono rebels against other inefficiencies of traditional banking for businesses: those related to credit approval, customer services, outdated technology, and unclear charges among them.

Focusing on Colombia, for now

Despite operating in Colombia, Mono employs people from all over LatAm, many of whom work remotely from their home countries. In Colombia, they have more than 300 clients, and, at the moment, they are focused on continuing to grow in that market, allocating the new capital, especially to product development. “We are a technology and product company, obsessed with creating excellent products. We use our product; when we fall, we fall with our product. We are very obsessive that what we make is something we also want to use,” Lobo explains.

This does not mean they do not intend to reach other countries in the future. They perceive their service as a need for the whole region: “Luckily, we have very good friends in other startups in all parts of LatAm, and we see this happening at a regional level. Something that was also, in fact, happening in the US until players like Brex and others came along to try to solve it”.