Nubank, the digital bank that offers credit cards, transfers, and digital payments, surpassed 80 million customers in Brazil, becoming the country’s fourth-largest bank in terms of customer base and surpassing Banco do Brasil in the ranking.

At the beginning of this year, Nubank had 73.1 million customers in Brazil, as reported by the company. And David Vélez, founder, and CEO of Nubank stated in a statement that:

“The successive growth of our customer base continues to reinforce the efficiency and potential of our digital business model. This allows us to grow at scale, providing high-quality and low-cost financial services. We have solid levels of activity, above 82%, and increasing cross-selling possibilities, which have driven the company’s revenues.”

According to data from the Central Bank (BC), Caixa Econômica Federal remains the largest bank in the country, based on data from the end of the second quarter.

The customer numbers are as follows:

- Caixa: 150.4 million customers

- Bradesco: 104.5 million customers

- Itaú: 99.9 million customers

- Nubank: 77.7 million customers

- Banco do Brasil: 74.6 million customers

- Santander: 64.4 million customers

Additionally, according to the statement, almost 60% of active SMEs (small and medium-sized enterprises) have Nubank as their main account, and among the company’s customer base, there are 10 million entrepreneurs, representing great potential for further growth in the segment.

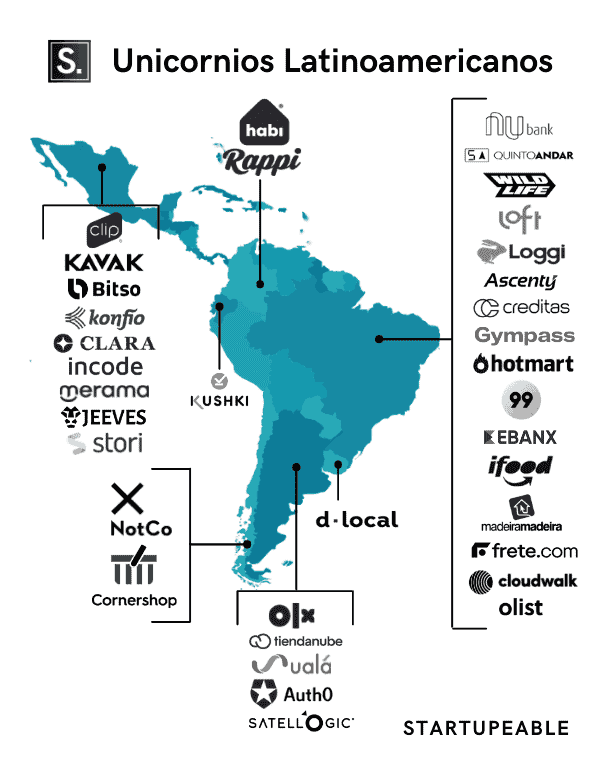

The Brazilian unicorn has been investing in the growth of its customer base in Mexico and Colombia, expanding its presence in Latin America. Combined with the customer volume in Brazil, Nubank now has more than 85 million customers in Latin America.

Nubank has also been investing in new products for other countries, with digital accounts and credit cards already available in Mexico. In Colombia, the account is expected to be launched later this year.

Why is it relevant for fintech startups?

- The success of Nubank and its growth in the Brazilian market reinforces the viability and acceptance of the digital business model in the financial sector.

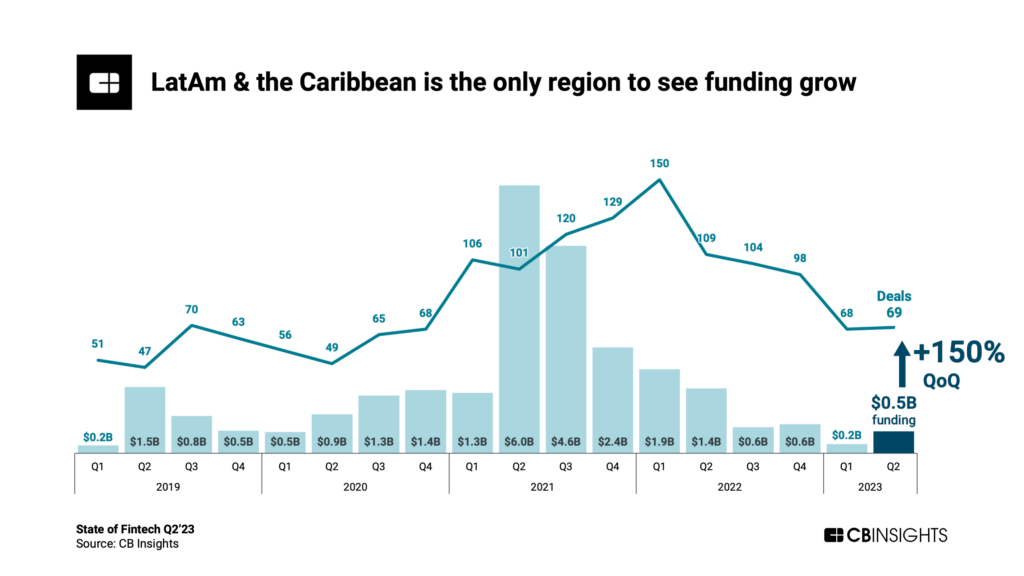

- According to a report by CB Insights’ State of Fintech Q2 report, fintech companies in Latin America and the Caribbean raised US$500 million, a 150% increase compared to the previous quarter, while the number of deals (69) remained almost the same as the previous quarter.

- Brazil is the country with the highest growth in the fintech industry, followed by Mexico, Chile, and Colombia.