ZoomAgri, a global Argentine agricultural technology company that uses AI and machine learning for grain variety recognition, has just raised US$ 6 million in an investment round led by GrainCorp and GrainInnovate, along with venture capital funds like the Grain Research Corporation (GRDC) and Artesian, and a larger participation from existing investors SP Ventures.

ZoomAgri, which already participates in the barley testing market in Australia, reached the Series A investment round to improve and expand its commodity coverage.

According to Robert Spurway, CEO of GrainCorp:

“We have been testing two ZoomAgri units at our reception sites on the east coast of Australia for the past few years, to detect sieving defects and quality in barley. They have developed advanced prototypes over the past three years for variety testing and determination of physical quality, and our investment will support further product development in new commodities, such as wheat”.

Recently, ZoomAgri received official approval from Mitteleuropäische Brautechnische Analysenkommission eV (MEBAK), the Central European Commission for Beer Analysis, as an authorized method to use their technology in the analysis of barley varietal purity at all stages of the supply chain.

With the capital raised, ZoomAgri will continue investing in the development of new technology to consolidate its expansion and to improve its AI technology to enable them to complement, evaluate, or replace current quality assessment methods.

The Agtech sector in Latin America

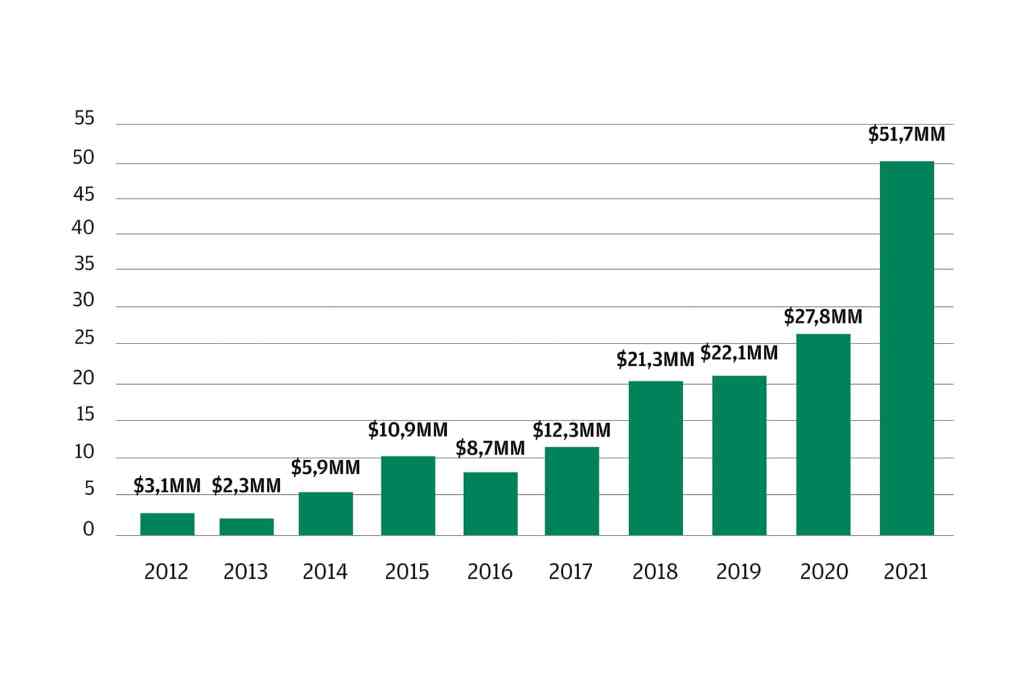

In 2021, global investments exceeded US$ 51,000 million, with the United States as the market with the largest agtech investments in the world, with companies that raised 41% of the capital and represented 34% of the transactions that same year, according to a report by J. P. Morgan.

This graph depicts Agtech’s annual financings from 2012 to 2021. (Source: J. P Morgan)

This graph depicts Agtech’s annual financings from 2012 to 2021. (Source: J. P Morgan)

This graph depicts Agtech’s annual financings from 2012 to 2021. (Source: J. P Morgan)

" data-medium-file="https://i0.wp.com/contxto.com/wp-content/uploads/2023/07/JPM-AgriFoodTechESP-04.jpg?fit=300%2C200&ssl=1" data-large-file="https://i0.wp.com/contxto.com/wp-content/uploads/2023/07/JPM-AgriFoodTechESP-04.jpg?fit=1024%2C683&ssl=1" decoding="async" >While the Private Capital that was invested in agtech in Latin America during the same period was US$ 35,400 million of venture capital in 15 disclosed rounds, with Colombia being the only country in the region that appeared occupying the eighth place among the first fifteen countries in the world. In Brazil, another of the main players in the industry, US$ 70 million were also raised in 2021.

In 2022, agrifood startups in the region raised a total of US$ 1.7 billion, representing 5% of global investment in the sector. As more capital flows into these startups, which are mostly in early stages of growth, we are likely to see greater diversification among countries, addressing different points in the supply chain.

AgFunder_Map_agritech

AgFunder_Map_agritech

Deals by region in the agtech sector to 2022. (Source: AgFunder)

" data-medium-file="https://i0.wp.com/contxto.com/wp-content/uploads/2023/06/Screenshot-2023-06-19-at-18.38.50.png?fit=300%2C216&ssl=1" data-large-file="https://i0.wp.com/contxto.com/wp-content/uploads/2023/06/Screenshot-2023-06-19-at-18.38.50.png?fit=1024%2C738&ssl=1" decoding="async" >Additionally, the country is starting to diversify its innovation and investment in agrifood technology, particularly in the field of bioenergy. With the overall increase in investment in agri-food technology, we are likely to see more deals, both in companies related to agricultural production and in the laboratory setting.

Why is it relevant for venture capital funds in the region?

- Investment in agtech in Latin America represents 5% of global investment and the region is one of the most important agricultural markets in the world. Supporting a sector that is growing and increasingly leaning towards the integration of new technologies can be a spicy offer for venture capital.

- Receiving official approval from a regulatory body (MEBAK) enhances the credibility of ZoomAgri’s technology. This validation can be a critical factor for venture capital funds.

- ZoomAgri’s focus on expanding its product coverage is a sign of market diversification, and in a situation where funds need to consider where to put their money, this option may offer lucrative returns.