Por Jose Pulido

July 27, 2023

Polymath Ventures was born in 2012 as a venture studio with the purpose of bridging the gap of inequality and the paradox of middle-income in Latin America. It has offices in Bogotá and Mexico City. It has raised USD$70 million in capital and debt across the group.

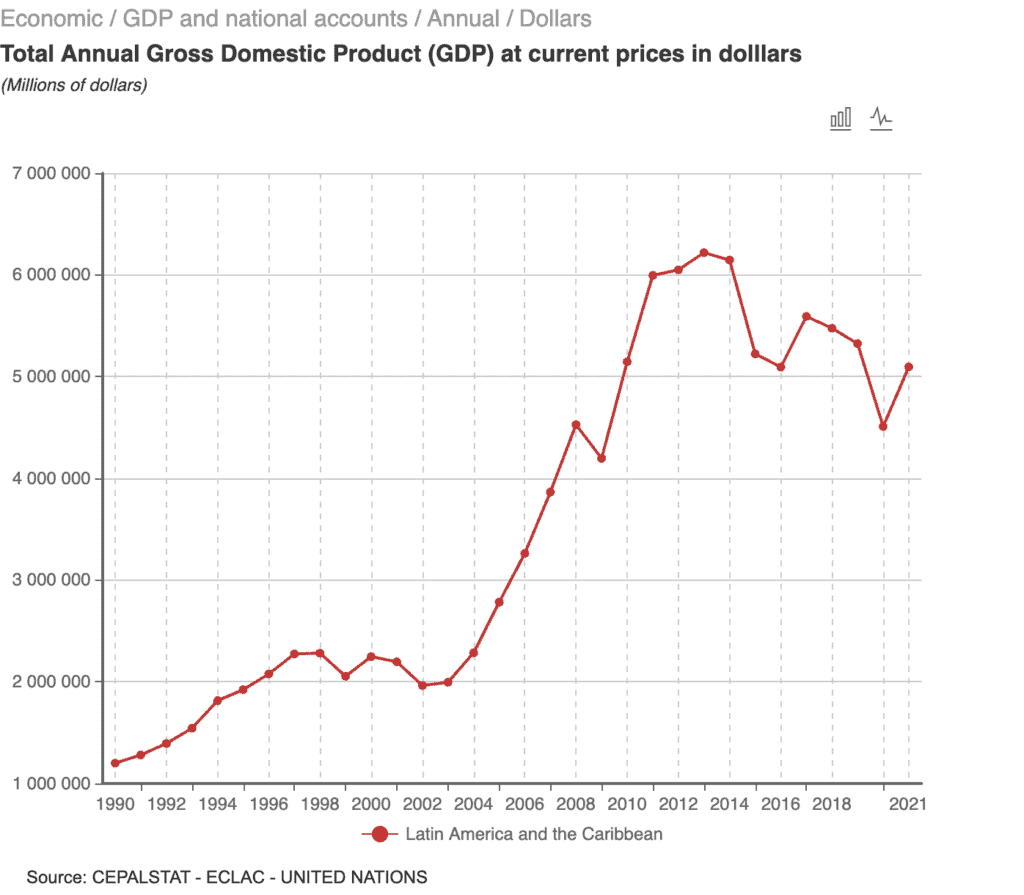

According to the United Nations Economic Commission for Latin America and the Caribbean (CEPAL), the average economic growth rate of Latin America and the Caribbean will be 1.3% in 2023, as a result of a structural trap of low growth, high inequality, and weak institutions.

To address this, Polymath conceived its studio with the aim of creating technology companies designed to increase the population integrated into the middle class in the region, which accounted for around 311 million in 2019, including both lower-middle and upper-middle class individuals with a per capita income between USD$10 and USD$50 daily, according to the International Monetary Fund, Trading Economics, LAVCA, The Information, World Bank, and Pew Research Center.

The definition of the middle class referred to by Polymath must possess three essential factors:

“The emerging middle class is the second-largest in the world in Latin America after China. With that in mind, Wenyi Cai came to Colombia to found this venture studio and contribute to consolidating technological startups. Their goal: to build and invest in companies that can scale massively while making an impact in the region,” explains Peter Ostroske, Managing Partner of Polymath for Contxto.

Wenyi Cai

Co-founder and CEO

Before founding Polymath, Wenyi was an entrepreneur in Silicon Valley. As COO of Milo.com, an internet startup for consumers that was sold to eBay in 2010, Wenyi led business development efforts with major technology companies such as Microsoft and eBay and supervised product and engineering teams. Earlier in her career, Wenyi was a consultant at McKinsey & Company in the Middle East, Africa, and South Asia. Before her entrepreneurial career, Wenyi helped build a quantitative trading hedge fund and was a published researcher in applied physics. Wenyi graduated cum laude from Harvard College, studying philosophy and physics. Wenyi was born in China and grew up between China and the United States.

Damián Alcedo

Director of Growth

Before joining Polymath Ventures, Damián was CEO and co-founder of Carmatch.mx, an online vehicle marketplace that was sold in late 2018. Damián has an MBA from the Carlos III University of Madrid, a Master’s in Architecture, Construction, and Planning from the Eindhoven University of Technology, and a Bachelor’s in Urban Planning from the University of Applied Sciences of Breda.

Peter Ostroske

Managing Partner

An American entrepreneur selected as Endeavor Colombia’s entrepreneur of the year in 2017. Peter has twelve years of operational experience in Latin America and was previously CEO of Ofi. He is a candidate for an MBA from the University of Pennsylvania Wharton with a bachelor’s degree from the University of Chicago.

At Polymath, startups are internally designed using a methodology of ideation, validation, and product-market-fit. Business designers are then promoted or founding teams are recruited from the venture studio to lead them.

Polymath “remains involved in our companies throughout their life cycles, providing strategy and support in some areas of operation, such as human talent selection,” highlights Ostroske.

After over a decade of exploration and development, Polymath has created a portfolio of ventures that include:

In the new fund, Polymath allocates 30% to building companies from scratch and 70% to investing in early-stage companies external to the fund – that is, investments in projects that technological entrepreneurs bring as investment opportunities to the fund.

This second case is not how Polymath Ventures was born eleven years ago, but the founding partners understand how it fits into their value proposition. It represents a new approach that allows them to grow by aligning with other ideas that share their philosophy.

As a venture studio – a model of incubation that was born in 1996 with IdeaLab – Polymath tests the ideas of startups that approach them. They accept companies with traction, in the seed stage, that are already generating revenue and seeking Product Market Fit, companies that speak Spanish, and companies that have an impact on the middle class in the region. They provide funding and resources to launch and turn these startups into scalable ventures.

Over the past eleven years, they have invested through their venture studio – their independent division that builds and launches digital ventures for the emerging middle class in Latin America. Now, they have a new vehicle to grow startups. It is the Pollymath Ventures Seed Fund, through which they invested in Pacto.

An analysis by Crunchbase highlights that early-stage startup financing decreased during the first quarter of this year below the USD$1.5 billion from the same quarter of the previous year.

The premise of this fund goes against the trend in that regard: the good businesses are where others do not venture due to fear of unexplored territory.

Ostroske, like the Polymath team, believes that to reimagine the future, startups need to decentralize their structures and prioritize agility and experimentation. To achieve this, it is essential to partner with the private capital investment ecosystem.

Now, Polymath is looking for Limited Partners (LPs) with whom they hope to raise USD$25 million. They are also seeking investors with experience in venture capital.

“We are in talks with Family Offices, foundations, institutions, investment funds, and Development Financial Institutions (DFI). We evaluate investors based on their profile and investment platforms,” explains Peter Ostroske.

Their latest success came from their investment in Pacto, which raised USD$4 million in an investment round involving 500 Global, among other investors.

For Ostroske, venture capitalists investing in a volatile region like Latin America “must maintain discipline as investors, establish the baseline, understand the true value of a company, and begin investing to generate a factor of change that contributes to improving the global economy in the next ten years,” he concludes.

Por Stiven Cartagena

September 15, 2025

December 4, 2024

November 20, 2024