Tenpo has fully launched an aggressive strategy against Walmart, accusing the American chain of not allowing the use of prepaid cards in its physical stores and e-commerce.

The digital platform, with over 2.3 million users, accuses the American chain of causing unjustified disruption in the payment industry in Chile, affecting financial inclusion in the South American country.

So far, Walmart and Falabella.com are the only major retailers that do not accept this type of cards.

The refusal of these businesses is causing harm to consumers and hindering the development of the payment industry, leading to the closure of some major players in this field.

“The blockage by Walmart and Falabella.com of prepaid cards is serious and reveals that they are prioritizing their commercial interests over those of consumers.

“If we want to advance financial inclusion and fairly develop the payment industry in the country, we need to ensure the interoperability of this ecosystem that allows consumers the freedom to choose the technology they want to use to pay at any store,” said Tenpo’s CEO and co-founder, Fernando Araya.

Currently, there are more than seven million prepaid cards in circulation, representing approximately 15% of all active cards in the country.

There are 10 issuers of these types of cards, and their transactions have experienced an average annual growth of 233%.

Through their social media platforms, the fintech has expressed dissatisfaction with Walmart, emphasizing that it is the only supermarket chain in Chile rejecting prepaid cards and has urged others to join in defending the free choice of payment methods in the country.

Since 2016, prepaid cards have been regulated in Chile by the Financial Market Commission and the Central Bank of Chile.

Thanks to the regulation of interchange fees, the acceptance of these cards by businesses does not imply, in any case, higher costs compared to credit cards.

“It’s hard to understand why a card that meets all the standards required by law cannot be used to pay at the largest supermarket in the country.

“The central goal of Tenpo is to accelerate financial inclusion in the country and improve the quality of life for individuals, entrepreneurs, and businesses, and this type of obstacle only prevents us from offering innovative solutions and bringing people closer to payment methods,” said the fintech’s CEO.

According to Tenpo’s representative, Araya, the obstacles faced by prepaid cards have already had consequences in the country, evidenced by the exit of three major players. This is perceived as a negative impact on financial innovation in Chile.

Walmart opposes high commissions

Walmart Chile has expressed disagreement with the fees proposed by Transbank for debit cards, considering them too high.

They indicate that they will only consider the prepaid option if they are allowed to negotiate commissions that align with their policy of maintaining low prices, especially for lower-income segments.

The chain claims that the commissions they pay to Transbank are so high that it is more economical for Walmart Chile to receive cash payments than debit card payments.

According to Mónica Aravena, CFO of Walmart Chile, cash transactions cost the chain only 1/3 of what debit card transactions involve, considering the fees set by Transbank.

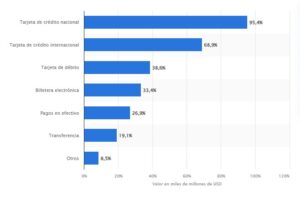

Although they recognize the importance of debit as a mass payment method, they point out that prepaid card transactions in general commerce are still very low, representing only 1% of all transactions.

Additionally, Aravena denies that the promotion of Walmart’s credit card is the reason for restricting the use of prepaid cards.