Por Alejandro González Ormerod

February 12, 2020

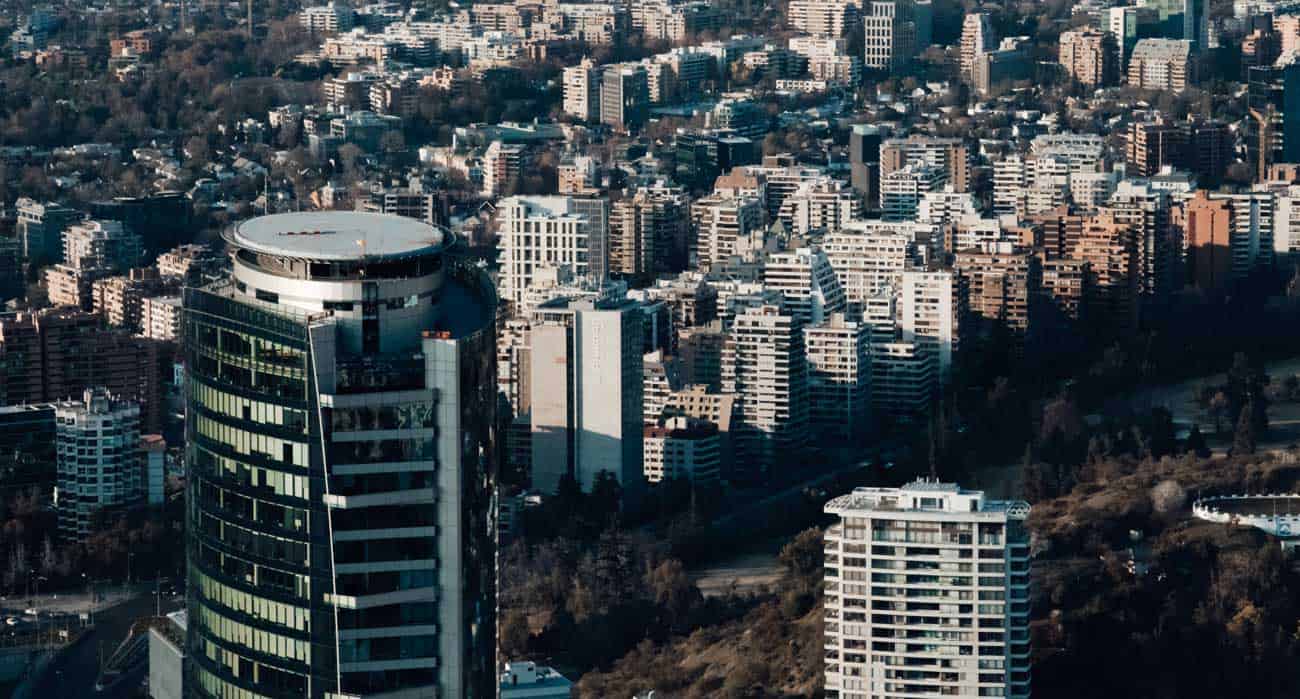

Contxto – You loved our Mexico venture capital (VC) ranking so now we’re back with more. Behold! Our list of top funds of Venture Capital in Chile, the perennial startup overachiever!

You got my whole schpeel on what makes a VC tick in that past article (and if you haven’t, look above and click that first), but now I must turn to another important matter.

How on Earth are we coming up with the criteria for these rankings?

Well, first of all, we don’t number them because, as I’ve detailed before, each VC has its own methods and approaches to investment. Some startups may well come to appreciate a small “mom ’n’ pop” fund that gives them just the right amount of cash to keep them streamlined and independent. Others may be looking for the big spenders.

However, we do have to choose our VC based on something, so here goes:

Often, when contemplating “the best” of anything, size matters. Of course, the question “the size of what?” quickly springs to mind. Are we talking average ticket size (aka, the amount of money each startup normally gets)? Or is portfolio diversity what matters most—both in terms of distribution across markets and/or sectors? Or is it simply just the raw number of startups the VC has invested in which makes it the best?

Well, interestingly enough, it turns out that most of these criteria combine once an investment fund has reached a critical mass of capital.

Indeed, as you will find below, more often than not, the more outstanding VCs tend to have it all—high levels of total amassed capital and average ticket size, market and sectoral diversity, and a sizable portfolio. Obviously there are exceptions, but I try to explain their incorporation to this ranking below.

So, without further ado, we give to you…

This Chilean venture capital firm is one of the hardest-hitting funds. Not because of its moderately well endowed average ticket size—set at a cool US$50,000—, but rather due to its range. Startups going to this investor will not become instant millionaires, but they may get lucky nonetheless.

Just looking at Magma’s portfolio you can see why; over 65 investments (the largest in this ranking) with startups ranging from the United States, Mexico, Puerto Rico, Peru, Ecuador, Colombia, Argentina… an impressive diversity of markets indeed.

This VC takes no prisoners when it banks on a startup. It goes all-in, featuring ticket sizes of between US$3 to US$5 million—one of the biggest upper limits in this ranking.

Even though Austral focuses on early growth in healthcare, biofuel, digital media, mobile, and agriculture, it has an arsenal with around US$200 million with which it is able to liberally play around with and invest generously.

Manutara plays it safe, but is daring enough to get on this list. Its smallish portfolio, its Chile-exclusive investment, and its up-to-US$1 million ticket limit, on paper make it seem like it barely makes the cut. But that’s the point of looking into the minutiae of these VCs.

A closer look shows that, as a sub-.organization of the Draper Venture Network, its hands-on, local approach makes it one of the more coveted tickets in the ecosystem.

Genesis looks like an al-Chile outfit until you peer right to the bottom of its investment list to find a successful Swedish company, Quality Pharma. Clearly, this fund of venture capital in Chile has its sights set for wider investment horizons.

Indeed, they have a very healthy triple-digit fund as of 2017, and what seems to be some of the heftiest ticket size-ranges on the market; from US$1 million to US$20 million reserved for clean energy.

The diversity of this VC’s portfolio is rather interesting. There’s the usual spread of Latin American investments beyond venture capital in Chile, there’s their strong presence in the United States, but what I did not expect was the fact that a quarter of this fund’s chosen startups are based in Jamaica. They’ve even got offices in Kingston.

Their regional diversity and their specialty in software, energy, and agri-business make for a powerful trans-continental combo.

This is a bit of a cheat selection considering our million-plus ticket size criteria for the selection of contenders for this ranking. You see, Chile Global gives up to US$300,000 to its chosen startups, mostly focused on early-stage B2B (business to business) startups. But, with a portfolio of over 100 separate investments, this VC had to be on our list.

It is also notable that, despite toting the word “Global” in the title, this fund is really betting on Chile-based startups aiming to take over the world—and boy there are quite a few of them. As the oft misattributed quote says: “Quantity has a quality of its own.”

This is the VC you go two when you are ready to take off as a startup. Dadneo has its eye on those about to enter their first Series-category rounds; the peculiarly named post-seed investment, working its way up through Series A and B with an upper ticket limit of US$1.2 million.

Related articles: Tech and startups in Chile!

-AG, SB

Researched by Salvador Betancourt-Ramírez with material cited from the funds’ websites, ACVC, ACAFI, and Contxto. Source material was obtained through correspondence with the VCs or, upon non-response, cited from the funds’ websites.

Por Stiven Cartagena

September 15, 2025

December 4, 2024

November 20, 2024