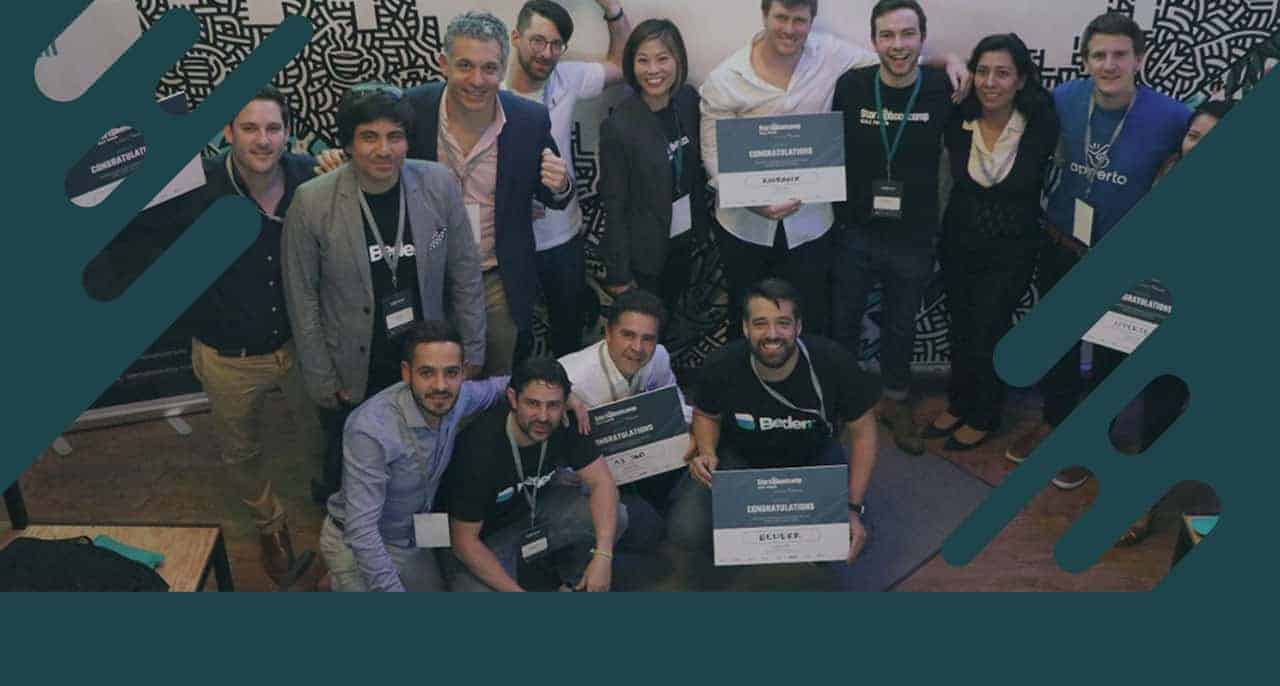

Contxto – Finnovista has been busy, and they’ve been keeping others busy too. This showed particularly last week, when they held their Startupbootcamp Scale Fintech Digital Demo Day.

Wow… That was exhausting to just say, now imagine how much work the five chosen fintech startups had to put in over the course of their six month acceleration.

The results show as one Peruvian, one Mexican, and three Argentinian fintechs paraded their progress remotely. Take a look at what startups Bederr, ai360, Apperto, Koibanx, and Siembro had to show here.

A big benchmark for four of them was to penetrate the growing Mexican market in the midst of a pandemic. However, in an interview with Fermín Bueno—co-Founder and Managing Partner of Finnovista—I wondered out loud if having scaled during a pandemic could have actually benefited these fintechs.

This unprecedented situation has forced us all to double-down on digitalization, and in the past three months, we’ve done what we would have managed to do in years.

Fermín Bueno, co-Founder and Managing Partner of Finnovista

Latam fintech battle for the ages

Fermín Bueno is of Spanish origin, but is based in Mexico, so he perhaps has a horse in this race, but his thoughts on what country will end up queen of fintech in the region is still fascinating.

“Argentina, Brazil, Mexico, all these countries are the birthplaces of fintech in Latam,” he told me in our post-Demo Day interview. He believes that Mexico has been playing catchup for a while, but it now has momentum on its side.

This is because, compared to Mexico, Argentina has a longer “fintech tradition” and Brazil… Well, Brazil not only has a massive financial sector, it is also the most developed in the region, according to Mr Bueno.

However, this lagging may have turned out to be the kick in the caboose Mexican fintech needed to get ahead. Mr Bueno says that, at a regional level, there is generally more openness towards fintech on all fronts: Banks look to form alliances with fintechs, startups are really gathering steam, and the government has provided a Fintech Law before other Latam countries.

- Related article: Brazil to embrace open banking regulations in November 2020

Now, Brazil is playing catchup on this front, only just recently announcing the eminent rollout of its own Fintech Law. So, the race is really on, and Mexican fintech should really be feeling the pressure.

[wd_hustle id=”InArticleOptin” type=”embedded”/]

The death of nice to have

One thing is clear. Latin American fintechs, wherever they come from in the region, are collectively winning and here to stay.

The finalist startups that reached Demo Day had to work hard to get there. Five out of 300 original contenders. But all of the winners–apart from being fintechs with a good Minimum Viable Product (MVP)—had to have one crucial feature in common above all others.

We want to enable startups to bridge the gap with industrial actors and help them innovate in the most efficient way possible. To help, what we call, their innovation journey by driving serious cultural change amongst the big traditional actors.

Fermín Bueno, co-Founder and Managing Partner of Finnovista

I asked Mr Bueno if this meant that if they were looking to invest all their energy into hard-hitting, systemic change, then there’d be no time to spare on the gizmos and flashy extras that have been part of the entrepreneurial tool kit.

“Yes,” he said. “It is the end of nice-to-have.”

Related articles: Tech and startups from Mexico!

-AG