In 2023, Colombia saw a significant 0.9% increase in its financial inclusion indicators, according to the Financial Inclusion Index (IIF) by Grupo Credicorp. This uptick is largely attributed to fintech companies, which have been instrumental in expanding online financial services to previously inaccessible populations.

Historically, the financial inclusion score for Colombia was 44.7 out of 100 in 2022, which climbed to 45.6 in 2023. This increase signifies more people gaining access to digital banking services. Despite the progress, there remains a need to extend these services to more regions and demographics within the country.

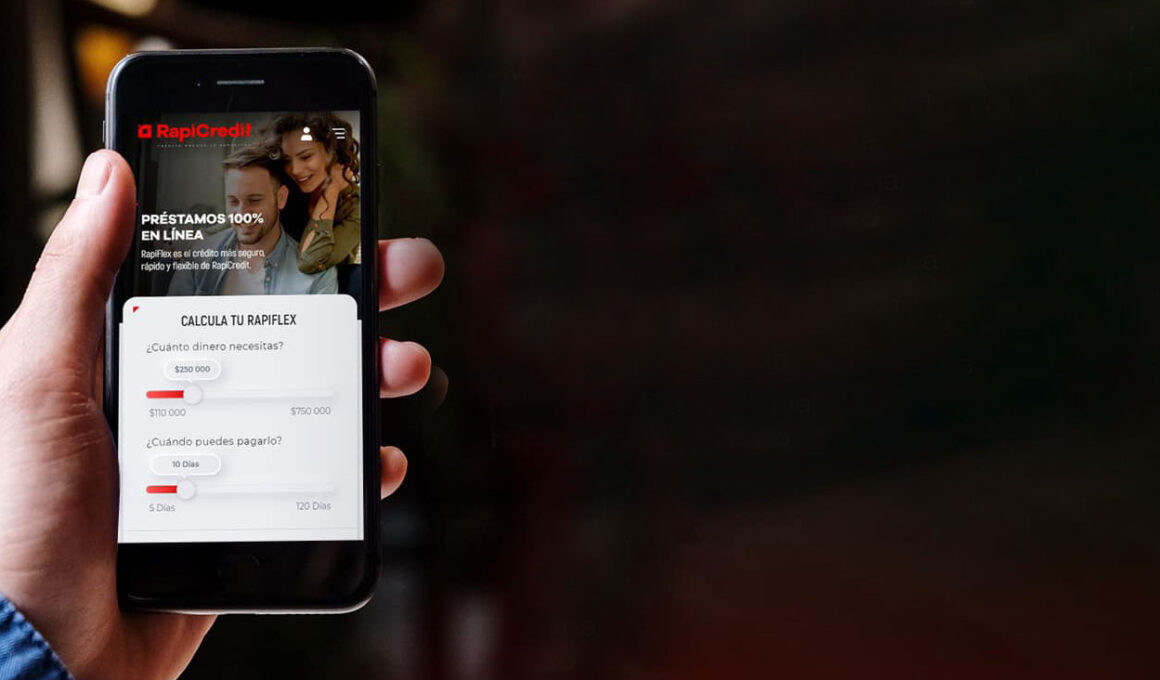

Fintech innovations have led to the development of products and platforms that cater to the unique financial needs of Colombians, particularly in areas where traditional banking previously had no reach. For instance, RapiCredit, a local company offering microcredits in socio-economic strata 2 and 3, is addressing critical financial needs of the underserved. CEO Daniel Materón emphasized the importance of their digital credits that are quickly approved and accessible without physical bank visits, targeting those traditionally distrusted by conventional banking due to credit history and informal economic activities.

Such fintech initiatives have played a pivotal role in narrowing economic disparities in Colombia. The percentage of adults owning at least one financial product rose from 91.2% in 2022 to 92.3% in 2023. This growth is primarily due to improved access to savings accounts, credit cards, and insurance products.

Moreover, according to Colombia Fintech, 76% of the financially active population in Colombia engages with fintech solutions, equating to approximately 28 million people utilizing these technological financial services.

While considerable progress has been made in financial inclusion, much work remains, particularly in reducing gender gaps in credit access and extending efficient solutions to rural areas. The advancements in fintech are not only closing traditional banking gaps but are also setting a transformative path for financial inclusion in Colombia.